Results of Sam Altman’s 2015 “Bubble Talk” Bet

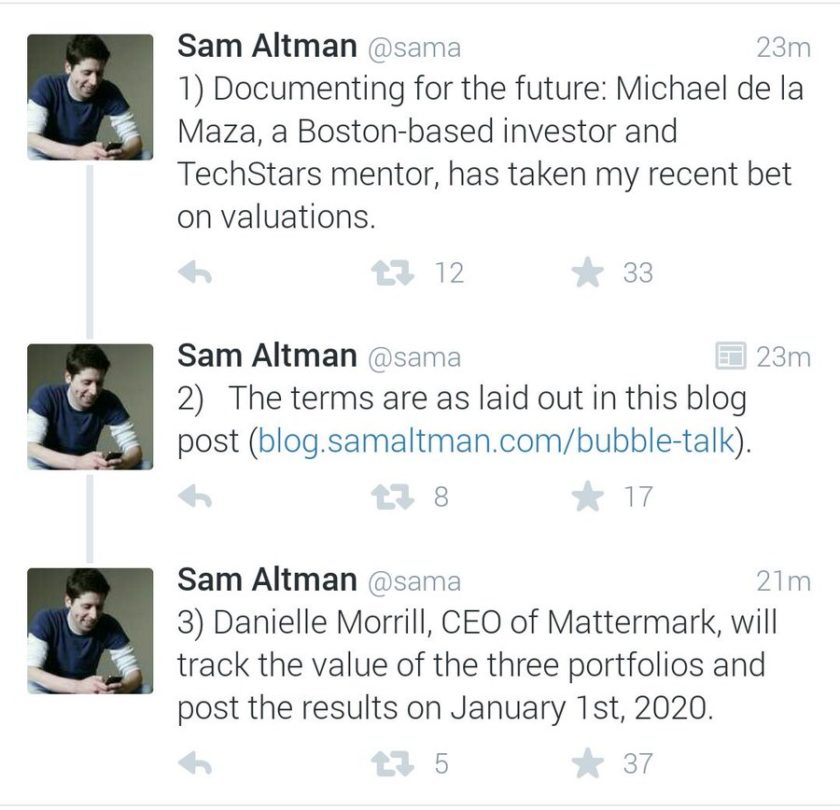

In 2015, Sam Altman wrote a post titled “Bubble Talk” which lamented the “boring reading” of ongoing press coverage of a bubble in tech valuations, and laid out 3 scenarios he believed would be true by January 1, 2020. To win, Sam has to be right on all three propositions laid out in the post and reviewed in detail below. Sam also invited a VC to take the other side of the bet and Michael de la Maza obliged. The loser will donate $100,000 to a charity of the winner’s choice.

Proposition 1: On January 1st, 2020, the top 6 US companies at http://fortune.com/2015/01/22/the-age-of-unicorns/ (Uber, Palantir, Airbnb, Dropbox, Pinterest, and SpaceX) s will be worth at least $200B in aggregate (from just over $100B in 2015).

Outcome: Not true. The group is collectively worth $30-40B less than $200B, based on publicly reported valuations of private companies and market caps of publicly traded companies.

- Uber = $50.73B Market Cap on Jan. 1, 2020

- Pinterest = $10.41B Market Cap on Jan. 1, 2020

- Dropbox = $7.44B Market Cap on Jan. 1, 2020

- SpaceX = $33.3B private valuation as of May 31, 2019

- Palantir = $20-30B private valuation as of September 2019

- Airbnb = $35B private valuation as of March 2019

Proposition 2: On January 1st, 2020, Stripe, Zenefits, Instacart, Mixpanel, Teespring, Optimizely, Coinbase, Docker, and Weebly will be worth at least $27B in aggregate (from just under $9B in 2015).

Outcome: True.

- Stripe alone is valued at $35B as of September 2019

Proposition 3: The current YC Winter 2015 batch—currently worth something that rounds down to $0—will be worth at least $3B on Jan 1st, 2020.

Outcome: True.

- GitLab* = $2.75B private valuation as of September 2019

- Razorpay = $450M private valuation as of June 2019

- Atomwise = $150M private valuation as of March 2018

- Chariot = acquired by Ford for $65M

*Disclosure: I work for GitLab.

2 Comments

Danielle Morrill

Test

Pingback: