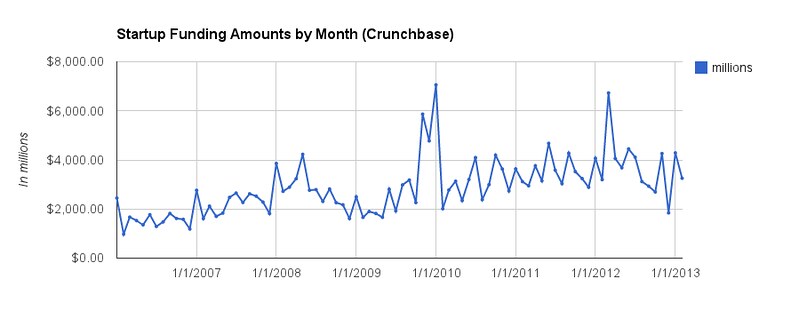

According to investments reported in the Crunchbase database, this winter investment dollars flowing to startup companies reached low point not seen since May 2009.

Even more concerning, on Monday the National Venture Capital Association reported that venture-backed IPO exits fell to a 3 year low in the first quarter of 2013, while M&A was at its lowest point since 1995.

According to the article:

The number of venture-backed IPO exits during the first quarter of 2013 fell 58 percent compared to the first quarter of last year. For the first quarter of 2013, 77 venture-backed M&A deals were reported, 10 of which had an aggregate deal value of $984.3 million, a 73 percent decrease from the first quarter of 2012. This marks the slowest quarter for number of disclosed deals since the first quarter of 1995*, when eight disclosed deals were completed.

“First quarter IPO and acquisitions activity is often subdued as year-end reporting and forward planning take priority, but this year political, taxation, and sequestration concerns weighed even more heavily on the exit market for emerging growth companies. Therefore, activity was especially slow,” said John Taylor, head of research for NVCA. “That said, public market valuations have been up recently, 2012 financial statements are being finalized now, and quality companies tell us they are starting the process toward an exit later in the year. Despite having waited for the right opportunity to move forward, the 2013 class of companies that goes public or gets acquired will have to be solid. Barring significantly adverse events, we expect stronger volume in the second and third quarters.”

*emphasis added

I’m unclear why the tech press did not report on this, and can only speculate they were too busy curating lists of April Fools Day pranks to notice. Or maybe they thought this was a bad joke from the NVCA?

Other possible explanation: people aren’t using Crunchbase as religiously as they used to. We didn’t put our round on Crunchbase. Everyone we care about uses AngelList.

Even if AngelList data were added I don’t think it would account for more than 25,000,000 in a month…. which is a comparably small amount. The bulk of the money comes from Series A, B, C deals from VCs and I think TechCrunch keeps those updated themselves.

Could I recommend a read-along song to accompany this ominous post? https://soundcloud.com/bbc-radio-3/carmina-burana-oh-fortuna

Was thinking the same thing as Nicholas. Early-stage rounds especially seem to be underreported on Crunchbase. TechCrunch writers don’t seem to be updating Crunchbase as much recently, and AngelList is where the action is.

Agreeing with both commenters above about AngelList, the best analysis for the number investments would probably be analyzing SEC filings.

The IPO numbers are interesting but the numbers are so low that I’m not really surprised we’re seeing such varience. Several high profile tech companies have hinted that they’ll IPO this year so maybe we’ll see the action pick up as the weather gets warmer.

It is significantly than just getting the Sunday paper and considering you will save a lot of cash.

You have to know exactly where to obtain carrabba s coupons are and

how to use them. The write-up beneath will help you do so.

Thanks, Elsie Hayward for daniellemorrill.com