Through the startups indexes I’ve been creating in the past month I’ve developed a database of over 1,000 companies with dozens of signals each. This list includes ALL the startups in my database, across all the portfolios that have been indexed so far, ranked by momentum.

Through the startups indexes I’ve been creating in the past month I’ve developed a database of over 1,000 companies with dozens of signals each. This list includes ALL the startups in my database, across all the portfolios that have been indexed so far, ranked by momentum.

Why I’m Writing These Posts

Many commenters and friends have asked why I’m doing this and not working on my startup. In case it wasn’t obvious, this is our startup and these posts are our MVP. I’d like to publicly acknowledge the tremendous effort by my team that make this possible. Kevin Morrill, our CTO and cofounder, who has taken a process managed in dozens on unwieldly spreadsheets and a ridiculous number of browser tabs and automated it with code. Andy Sparks, our Technology Editor, has undertaken the incredible schlep work of hand building new indices and researching startups, cleaning, curating and organizing our data.

Momentum measures a quantity of motion, measured as a product of its mass and velocity. In case we want to measure the momentum of a startup (the “body”) where mass is the company’s share of web traffic (as measured by Alexa rank) and velocity is the growth trajectory of several different signals. Unlike previous indexes growth trajectory is now heavily weighted toward sustained growth, versus small spurts of growth from press coverage or a burst of paid traffic or Twitter/Facebook followers.

The Bigger They Come, the Harder They Fall

You will find companies in the top portion of the list that you’ve probably never heard of, and companies near the bottom who are big names you recognize right away. Because of this, you might be tempted to immediately discredit the entire index – but let’s walk through a few examples first so you can see what we are measuring. Since this measures momentum, the bigger the company the more it is impacted when it fails to grow.

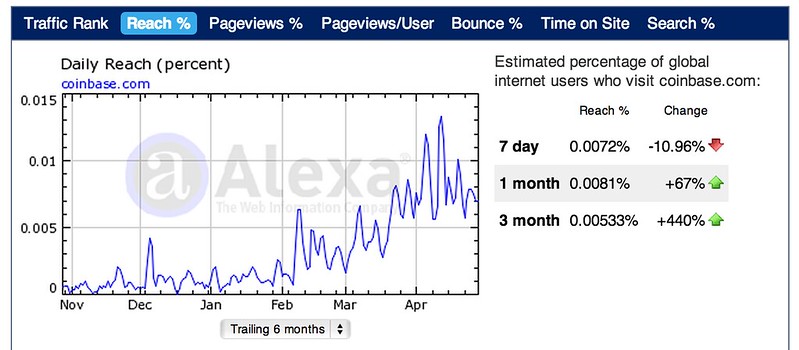

#2 – Coinbase, a service for storing and selling Bitcoin e-currency, has been gaining a lot of momentum alongside the popularity of trading the online currency – averaging 11% growth week-over-week in web traffic by our estimates. This growth also shows in Coinbase’s social media following. They grew Facebook Likes 35% from 452 to 614 during April. On Twitter they grew from 1375 followers to 1876, a 36% growth rate. We’ll be watching to see if Coinbase can sustain this growth in May.

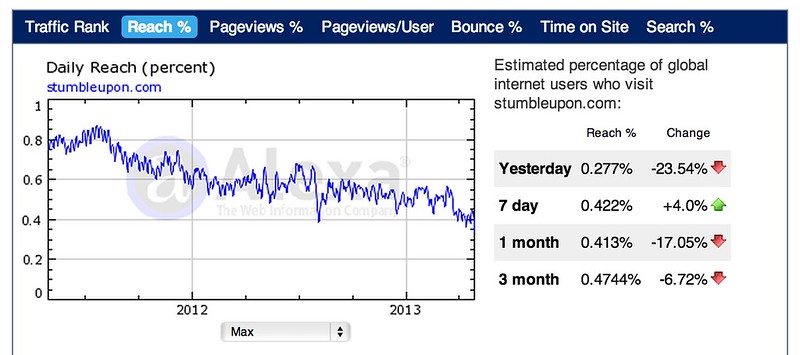

#1179 – StumbleUpon, the popular social content discovery service, appears just 6 positions from the bottom of the list and upon closer inspection we see this is because the mass of the company has declined as it dropped from 176 to 179 in Alexa rank during April. Based on our analysis this drop is representative of a loss of around 10,000 unique visitors per day, and a look at the companies Alexa graph reveals their traffic has been in steady decline for over a year.

Also of note in this list are some of the younger startups that have already shot to the top. YC Winter 13 companies such as Strikingly, Teespring and Thalmic Labs made an impressive showing.

Biggest Winners & Losers

Keep scrolling and you will find the entire list of startups, but for those of you who don’t like scrolling through 1000+ rows in a spreadsheet I’ve got the highlights for you.

20 Startup Who Gained the Most Momentum

- BuzzFeed

- News Blur

- Coinbase

- Dropbox

- Codecademy

- Disqus

- Rap Genius

- Weebly

- ROBLOX

- Priceonomics

- Strikingly

- Teespring

- Creative Market

- Aereo

- Virool

- BuildZoom

- Thalmic Labs

- Bitnami

- Perfect Audience

- Tapas Media

20 Startup Who Lost the Most Momentum

- ChirpMe

- Causes

- Payvment

- Udemy

- StumbleUpon

- Lockitron

- Svbtle

- Crowdbooster

- Grubwithus

- Kaleidoscope

- Oh Life

- SplashUp

- Tumult

- LaunchRock

- Ecomom

- FamilyLeaf

- Imgfave

- LeanMarket

- OpenX

- Iconfinder

This is extremely interesting! I’ve been following your blog for some time because you write such insightful, smart, and honest stuff. I really have been wondering what these new posts are about (and what the new startup will be).

So from what I can tell the new service is:

(a) tracking startup traction using objective measures

(b) getting real first scoops on funding by tracking the SEC website

Are you out to kill techcrunch? Because that would be great!

Alternatively, I imagine vcs might be very interested in this, and if a wider market for funding through individual investors really grows through funders club, second market etc, seems like this could become the yahoo finance of the startup market.

Either way, thanks for the great content and good luck to you and your team.

VoiceGem was acquired

Boingo Wireless is a public company

Hey, I like this list! Nice to see a focus on data as opposed to hype.

I’m excited to see how this idea evolves.

Why aren’t you honest about your experience at Expeditors ? You worked at a single, medium-sized branch out of like 200. You make it sound like you “turned around a department” for the entire company. You know that isn’t true. It hurts your cred….

That’s a good point, and not what I intended at all. I’ll update (I’m assuming you mean my bio) to be more specific.

Great list, please please hyperlink!

That’s great data Danielle. Keep it coming. Congrats on the funding announcement.

btw- any chance you might consider switching to Disqus for comments? they were #6 on your momentum list after all 🙂

Why are not you sincere about your encounter at Expeditors ? You proved helpful at only one, medium-sized division out of like 200. You create it audio like you “turned around a department” for the whole organization. You know that isn’t real. It affects your cred….

Spybubble Free