-

Good Technology Raises $50M Equity Round

According to an SEC filing today, enterprise software company Good Technology has raised $50,000,005 from undisclosed investors in a equity round of financing.

Crunchbase data appears to be out of date, showing its most recent funding event in 2005. However, according to the EDGAR database prior funding events not listed on Crunchbase include $51.3M raised in October 2006. The company was founded in 1996 and is estimated to have raised a total of $223.3M to date.

I will update this post as I learn more.

-

CrunchFund Backed LikeIt.com Will Shut Down April 30th

According to a banner across the top of the company’s website, interest-based people discovery service LikeIt will shut down tomorrow. Originally called TheComplete.me, the company relaunched as LikeIt.com in late January of this year. Its Facebook app and shows ~1,000 monthly active users, and the website doesn’t appear to have ever had enough traffic to produce a traffic graph on Alexa.

According to Crunchbase, the company raised $1.22M from Intel Capital, CrunchFund, and Plentyofish 1 year ago and received an additional $500,000 in January from Western Technology Investment.

From my own experience it’s pretty difficult to burn through nearly $2M in a year with such a small team, so it wouldn’t surprise me if the company was changing course to fight another day with a new project. The company is lead by CEO and Cofounder Brian Bowman and I have reached out to him for comment.

-

Mis-Management & Incompetence at Ecomom

We benefit from a startup culture where it’s okay to fail, but that doesn’t mean we should avoid examining the mistakes that lead to the loss of capital, jobs, and the opportunity cost when increasingly limited venture capital dollars go to the wrong companies.

It’s time for Silicon Valley to take doing business as seriously as we take writing code.Ecomom controller Philip Prentiss wrote a post-mortem of the company’s financial and managerial situation, chronicling how things fell apart in the months leading up to shutting down. His analysis ultimately points to Ecomom CEO Jody Sherman’s lack of business acumen:

“He was not a numbers guy. I would bring the financial statements to Jody who would glance at them so cursorily and wave me away with “no one can understand this without extensive analysis.” Critically, he did not understand margin. At the end of December when things were getting truly desperate, he said to me “Phil, just bring me a forecast that shows how much we need to sell to break even.” He did not understand, after three years of negative margin, that increased sales resulted in increased losses.” – Prentiss

Accountability Starts with Transparency

It really is remarkable just how easy it is to digitally disassociate yourself from having held an important role at a failed company. The senior management team of Ecomom, who go unnamed in Prentiss’ post mortem, should be held accountable for the company failing as well. It is too convenient to hide behind the tragic ending of Jody’s life, or to simply remove any relationship with the company from your LinkedIn profile as several employees have done.

Ecomom’s VP of Marketing Leslie Langford ran a marketing program with aggressive discounting that played a substantial role in driving the company into the ground.

“You don’t need the company’s financials to get a glimpse of what was going on. If you Google “Ecomom†and “coupon†you find 73,000 results. Many were run through daily deals sites. This one on PlumDistrict is one of the more egregious. It offers $100 of product for just $40, with free shipping, and when you consider the healthy 50 percent that most deal sites take, the economics are even worse. As one investor characterized it to me, it’s like selling a dollar for $0.20 — venture capital dollars at that, which aren’t limitless in today’s era and can come with a steep cost.” — Sarah Lacy, PandoDaily

Ecomom’s VP of Sales, who I believe is the same person as Alex Sayyah – VP of eCommerce, was paid on revenue before discounts – leading to a mis-aligned and expensive compensation package.

“the VP of Sales was compensated according to sales before discounts, not according to margin or profit. Our discount strategy resulted in enormous losses, but for the VP of sales the strategy optimized his bonus” – Prentiss

He appears to have removed all record of himself working at the company from his LinkedIn profile, although his past tweets indicate he worked there at some point and Zoominfo captured his old profile. I have reached out to him to confirm whether he is the VP of Sales who received this misguided compensation package:

Also critical to the team was Ecomom cofounder and “Chief Mom Officer” Emily Blakeny, who now lists herself simply as VP of Merchandising for the past 5 years.

Reality Distortion Field Gone Wrong

Investors don’t get the luxury of hoping the Internet will forget, as Ecomom has one of the most surprising Crunchbase pages I’ve ever seen with ~$10M in total raised from a huge slew of investors, many of them quite high profile angels, in a series of party rounds.

At first I thought it seemed unlikely that Ecomom’s CEO could trick these people into investing in broken company, however popular Los Angeles VC Mark Suster clearly felt Jody’s grasp on the numbers was strong:

“Ok. I have to admit something to you. With your persona I always expected to ask you tough financial questions about your business and expect you to say, “let me check with my CFO.†You didn’t. You always had the most precise mastery of your numbers. The way no CEO from Harvard does.“ – Mark Suster, Goodbye Jody (emphasis added)

This doesn’t add up with the controller’s account of Jody not being “a numbers guy”.

The startup ecosystem can’t afford to turn a blind eye to this blatant example of mis-management and lack of understanding of fundamental business concepts and math. Startups need to stop trying to re-invent good business practices, evidenced by the litany of self-helpish posts rising to the top of Hacker News, and focus on building real businesses that leverage the skills, knowledge and experience of skilled operators.

Investors who say their value-add is operational experience you are on warning – the expectation is that you break through the reality distortion field to help founders see around these corners. For hired senior management this should go without saying but I’ll say it anyway: operating the business in a way that will ensure its survival is your #1 priority. Sexy top line numbers might get you a pat on the head or line the pockets of the sales guy, but strategic long term thinking by professional managements wins every time (even when it fails).

Image credit: Tripletsisters on Flickr

-

Hunter Walk & Satya Patel

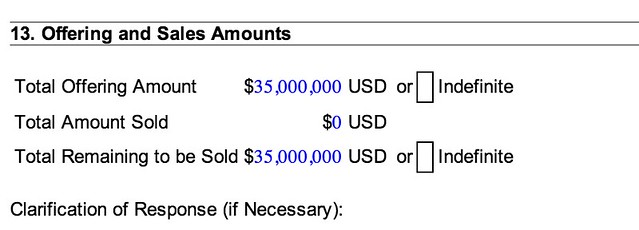

CloseRaising $35M for Homebrew Ventures First Fund It was reported in early February that the two product managers, hailing from Google (Walk) and Twitter (Patel) would raise a $25M first fund. It appears fundraising has gone so well that the two

It was reported in early February that the two product managers, hailing from Google (Walk) and Twitter (Patel) would raise a $25M first fund. It appears fundraising has gone so well that the two have closedare raising and additional $10M, bringing the total to $35M according to their Form D filing posted on Friday.Hunter Walk was formerly a product manager for YouTube at Google, and has been an angel investor for awhile now with investments in Schematic Labs, GreenGoose, Karma, Seesaw, Lever, Tugboat Yards, and Path 101 according to his AngelList profile. He also has a profile for his infant daughter on the site but notes he “will not be entertaining M&A offers until she’s at least 18”.

Satya Patel was formerly VP of product at Twitter and is also ex-Google and ex-Battery Ventures where he was a partner, so I am going to guess he brings a bit more of the post-investment VC know-how to the partnership. He is also an active angel investor with investments in Viddy, Wealthfront, STELLAService, BoostCTR, Clever, DNA Games, Blockboard, Adku, AdNectar, Loosecubes, BlueKai, eduFire, YieldMo, Safetyweb, ProsperWorks, Adisn, Umami, Brightedge, J.hilburn, FashionStake, and Slime Sandwich.

Both have been added to the List of Popular VC & Angel Blogs.

Image credit: Giant Fire Breathing Robot

Correction, I originally said they’ve closed the round but the filing actually indicates $0 raised so far, with the option to take up to $35M.

While they’ve probably got some soft commitments (these filings are generally a lagging indicator), no word yet on the fund being closed and ready to start making investments. The founders are also unable to discuss current fundraising activity public due to SEC regulations that don’t allow public solicitation for private investment by the company. The good news: if you’re an accredited investor you might still be able to invest. The fact that they’ve set a total raise amount that is higher than originally announced might indicate prospects for raising are looking good. Time will tell. (HT: Ryan Lawler)

-

Thoughts On YC Interview Prep

Companies currently interviewing for Y Combinator have taken the Internet’s advice to reach out to alumni to practice before they present, but unfortunately we don’t scale very well. I’ve prepped with a dozen teams so far and will probably talk to a dozen more before the weekend ends, but that will hardly scratch the surface. I am asking them all the same questions, so I thought I’d sum it up here for people I won’t have time to chat with.

My phone number is 425-698-7497. Call me for a 10 minute prep session. If I don’t answer just try again (or you could build a Twilio app to keep trying me, just sayin’). I won’t promise to return voicemails or texts – imagine I’m one of those people in the 90s with a landline phone and no voicemail machine who says, “if it was important they’ll call back”.

Rule #0: Read the Official Y Combinator “How to Prepare for the Interview” Guide

The Conversation

At the end of the interview, which is quite short, the people you’ve spoken to should know what you’re making (ideally because you actually showed it to them), believe you are the best team to make it, and think you are rational/determined/resourceful enough that if it doesn’t work out you’ll figure ouut what to do next.

“There’s one type of question your practice investors probably won’t ask, and we probably will: whether you’ve considered various mutations of your idea. We spend all our time dealing with startup ideas, so we’ll often see potential variations of yours that might be interesting. Your idea is almost certain to change as you work on your startup, and while it’s not necessarily going to change into something that comes up in the interview (though it has happened), we’re very interested to see how good you are at traversing idea space.” – Official YC Interview Prep Guide

Here are my 5 bullet points for this blog post

- Write down 3 to 5 key points you want to be sure to communicate

- Walk in ready to present the most important information first

- If you have a product, walk in with laptop in hand and show it

- Answer questions quickly using as few words as possible

- Make sure you bring the conversation back to cover your key points

Practice with people who are critical of you, your idea, and the way you present your ideas. When you prep helpers become yes men, giving you a metaphorical pat on the head, it’s time to dismiss them and move on.

The Demo

You should practice your demo as much as you practice answering questions. Practice walking in, open laptop in hand, placing it on the table and immediately showing what you’ve made so far. Do whatever you have to do to make this a smooth process… if you product is half done have all the important pages open in different tabs already. Be logged in. Have plenty of battery life, and make sure you’re connected to YC wifi.

The reason we like demos so much is that they reduce the amount of guessing we have to do. A startup needs to have (a) good ideas (b) implemented energetically. And while it’s fairly easy to tell from talking to someone how smart they are, it’s much harder to tell how good they are at getting things done. On that dimension we’re practically reduced to guessing. So anything you can do to show us how good you are at getting things done will make us much more sure of you. A good demo multiplies the effect of however well you answer our questions.” – Official YC Interview Prep Guide

If you feel like the conversation or questions about the product are going in a different direction than you want take control of the meeting and gently direct the conversation back to what matters, using trigger words like, “What’s really important to understand is…”

If stuff goes wrong in the demo just keep going, exhplain, visualize, use the whiteboard, whatever – but don’t spend (waste) 2 minutes trying to fix something or start over. Imagine it is a piano recital – the audience doesn’t know how the piece is supposed to go so just keep going and they probably won’t even notice that you screwed up, or at least it won’t matter that much.

Beware the Curse of Knowledge

The Curse of Knowledge is a cognitive bias, and the number one thing I worry about for teams I prep with. Are you explaining things which is very detailed way that and requires inside knowledge which the interviewer may or may not have? You might be suffering from this cognitive bias. “But PG and RTM are interviewing me, surely they’ll understand!” you argue. They might. But they’re also going to be left wondering if you’re going to be helpless in communicating with and marketing to mere mortals. This behavior of dumping a deluge of information on the interviewer instead of essentializing and breaking it down into understandable chunks seems to be a natural fallback for coping with stress for many founders.

Buzzword bingo might be another flavor of the curse of knowledge, and tends to be spawned from the business guy mindset. This meeting is not the time to brag about what an awesome growth hacker you are, or drop names (well drop maybe one, and make sure that person is an investor or some other meaningful part of the company), or come off like an MBA douchebag. The only marketing stuff you should talk about in this meeting is how many customers you have, how you got them, what they’re saying, and how you plan to get more.

If you’re already launched, you should know everything you can about your users. Where do new users come from? What is your growth like? (Bring a printout of a graph.) What’s the conversion rate? What makes new users try you? Why do the reluctant ones hold back? What are the top things users want? What has surprised you about user behavior?” – Official YC Interview Prep Guide

Also, listen to Marina and the Diamonds and dance around the house when you need to de-stress:

-

Strikingly, BuildZoom and Bitnami Lead Hottest Y Combinator Winter 2013 Startups

Tomorrow marks 1 month since Y Combinator Demo Day for the Winter 2013 class of startups, and since I’ve been tracking their progress for awhile now I have a pretty good sense of who has seen sustained interest, growing traffic, and increased audience through social media. The weeks after Demo Day were a strange time, in some ways anti-climactic as companies leave the YC nest but also exciting as they begin to close in on funding rounds which will be announced in the coming months.

Tomorrow marks 1 month since Y Combinator Demo Day for the Winter 2013 class of startups, and since I’ve been tracking their progress for awhile now I have a pretty good sense of who has seen sustained interest, growing traffic, and increased audience through social media. The weeks after Demo Day were a strange time, in some ways anti-climactic as companies leave the YC nest but also exciting as they begin to close in on funding rounds which will be announced in the coming months.On 3/25, 4/7, 4/15 and 4/21 we measured of several data points for each company. For this ranking we use Alexa rank (traffic) scaled to product unique visitors, Twitter followers, Facebook followers, and LinkedIn followers to assess who has been gaining the most visibility to customers and the outside world since Demo Day.

Want to analyze this data yourself? Download the raw dataset here.Of course this is no measure of revenue, but it does give a good sense of which companies have the strongest top of funnel for gaining new leads right now. I wouldn’t be surprised if the companies at the top of this list were the most competitive deals for funding, and the most in-demand for jobs.

It will be interesting to see whether this ranking holds up one year from now.

Full disclosure: I have made an angel investment in Bitnami. -

Art Is Hard

My old startup died.

I have been working on my new startup.

It’s kind of named after this band I love, but not entirely.

New name, and we’ve got a long way to go.Art Is Hard

Cut it out – your self-inflicted pain

is getting too routine

the crowds are catching on – to the self-inflicted song

Well, here we go again – the art of acting weak

Fall in love to fail – to boost your CD sales

And that CD sells – yeah, what a hit

You’ve got to repeat it

you gotta’ sink to swimIf at first you don’t succeed

you gotta recreate your misery

’cause we all know art is hard

young artists have gotta starve

Try, and fail, and try again

the comforts of repetition

Keep churning out those hits

’til it’s all the same old shitOh, a second verse!

Well, color me fatigued

I’m hiding in the leaves

in the CD jacket sleeves

tired of entertaining

some double-dipped meaning

a soft serve analogy

This drunken angry slur

in thirty-one flavors

You gotta’ sink to swim

immerse yourself in rejection

regurgitate some sorry tale

about a boy who sells his love affairs

You gotta’ fake the pain

you better make it sting

you’re gonna’ break a leg

when you get on stage

and they scream your name

“Oh, Cursive is so cool!”You gotta sink to swim

impersonate greater persons

’cause we all know art is hard

when we don’t know who we are -

Zombie VC Shakeout Continues

Earlier this month my post “Zombie VCs” raised hackles throughout the industry by naming firms who appeared to be inactive based on a lack of new investment data available in Crunchbase,

If today’s article byDan Primack of Fortune “Fewer than 100 tech VCs left?” is anything to go by, my active investors list may be far too inclusive, and the zombie VC list should probably be quite a bit longer.

According to Fortune:

New data suggests the decline has been more severe than previously thought, finding fewer than 100 active U.S. VC firms in the technology sector.

In fact, in a presentation made by venture capitalist Mark Suster to FLAG Capital it appears active investors (defined as those who have invested 1M per quarter for 4 consecutive quarters) has dropped to just 86 firms:

Fortune.com

ONLY 100 TECH VCS LEFT? @msuster SAY SO. NO LOOK AT ME, GRIMLOCK, ME ONLY ATE SOME OF THEM. buff.ly/15JXjqS

— FAKEGRIMLOCK (@FAKEGRIMLOCK) April 24, 2013

-

Weekly Traction Tracker: Who Is Hottest Among 1,100 Startups?

This post is part of a series on data-driven blogging which includes the Startup Index and Investor Index. I have quantified companies from 500 Startups, Y Combinator, TechStars, Andreessen Horowitz and First Round Capital and would love to hear your feedback on what I should measure next.

I hate subjective top X lists as much as the next guy, and since I’m tracking ~1,100 companies now I thought it would be fun to share the fastest growing folks of the past week. These are this week’s movers and shakers.

Top 20 Startups – Website Traffic Growth*

*calculated as the delta between the log of the original Alexa rank and log of the new rank. Updated to remove TutorialTab, founder has confirmed the company is no longer operational.

Top 20 Startups – Twitter Following % Growth

*the @Authy Twitter account followersappear to be primarily spam accounts, they went from 239 followers to 7736 followers in the past week – they say they did not buy followers so they might have been bot bombed.

Top 20 Startups – Facebook Likes % Growth

And my personal favorite, because getting LinkedIn followers is pretty difficult:

Top 20 Startups – LinkedIn Follower Count

And last but not least:

Top 20 Startups – % Increase Inbound Links

Other Notable Movements in the Data

On LinkedIn companies self-report which bucket company size they are in, and usually this doesn’t move much. However, Task Rabbit and Bizible both bumped up from the 2-10 employees to 11-50 employees size.

-

Everything I Am

Oh oh oho.

damn, here we go again.

Oh oh oho.

Common passed on this beat, I made it to a jam,now everything I’m not, made me everything I am.

damn, here we go again.

people talking shit, but when the shit hit the fan

everything I’m not, made me everything I am.I never be picture-perfect-Beyonce

Be light as Al B or black as Chauncey

Remember him from Blackstreet

He was as black as the street was

I’ll never be laid back as his beat was

I never could see why people’ll reach a

Fake-ass facade they couldn’t keep up

You see how I creeped up?

You see how I played a big role in Chicago like Queen Latifah?

I never rock a mink coat in the winter time like Killa Cam

Or rock some mink boots in the summertime like Will.I.am

Let me know if you feel it man

’cause everything I’m not, made me everything I amDamn, here we go again.

everybody sayin’ what’s not for him

everything I’m not, made me everything I am

damn, here we go again.

people talk shit, but when shit hits the fan

everything I’m not, made me everything I amand I’m back to tear it up

haters, start your engines

I hear ’em gearin’ up

people talk so much shit about me at barbershops

they forget to get their haircut

OK fair enough, the streets is flarin’ up

’cause they want gun-talk, or I don’t wear enough

baggy clothes, Reebok’s, or Adidas

can I add that he do spaz out at his shows

so say goodbye to the NAACP award

goodbye to the India.Arie award

they’d rather give me the nigga-please award

but I’ll just take the I-got-a-lot-of-cheese awarddamn, here we go again.

everything I’m not, made me everything I am

damn, here we go again.

people talk shit, but when shit hits the fan

everything I’m not, made me everything I amI know that people wouldn’t usually rap this

but I got the facts to back this

just last year, Chicago had over 600 caskets

man, killing’s some wack shit

oh, I forgot, ‘cept for when niggas is rappin’

do you know what it feel like when people is passin’?

he got changed over his chains, a block off Ashland

I need to talk to somebody, pastor

the church want tithe, so I can’t afford to pay

the slip on the door, cause I can’t afford to stay

my 15 seconds up, but I got more to say

That’s enough Mr. West, please no more todaydamn, here we go again.

everybody sayin’ what’s not for him

everything I’m not, made me everything I am

damn, here we go again.

people talk shit, but when shit hits the fan

everything I’m not, made me everything I am