-

I’ve Got Big Plans Heading Into 2022

Wow, another year in the books! I came into December ready to be done with “school” (Hudson) and feeling pretty spent after a year full of endings and beginnings, including riotously intense periods of effort and intentional idling and reclaiming of time. I’ve established boundaries and simplified my work down to ~20 hours per week, and I’m loving the time freedom.

In 2021 I continued to stretch my working identity beyond startups founder and employee, dipping my toe deeper into public service with a Governor-appointed board position and also making a move toward professional coaching as an ongoing vocation.

I also made the transition back to startup founder after a 4 year break that saw me take a year of sabbatical, lead an internal startup (which was spun out and backed by GV), and join the senior management team of a multi-billion dollar startup with a lot more experience and perspective than last time around (Twilio). During that time, I had my first opportunity to report to a professional CMO and got an up close and personal look at the largest Sales & Marketing machine I’ve had the opportunity to contribute to so far.

For this new startup, I have identified my sweet spot as reporting to the CEO, instead of being one. I’ve grown a lot as a leader through all my experiences, and I’m so excited to bring this next iteration of myself as founder to Firstparty alongside Jonathan. For my next act, I’m going to stretch into the CTO role for the first time.

I could not have completed these milestones without the love, help and support of my husband, my friends, my boss, my colleagues, my investing partners, my learning group, and my community both online and IRL.

I’ve also had the privilege of retaining a wonderful supporting staff (housekeeper, gardener, personal assistant) and a suite of software solutions (Calendly, Reclaim.ai, Zoom, Linear, Sanebox, Audible) who make the day-to-day of living and working a-sync and fully remote across two businesses possible. Thank you!

2021 Milestones

- Turned 36

- 4 years living in Denver

- Started my startup CEO coaching business

- Joined the board of Colorado Statewide Internet Portal Authority (SIPA)

- Wrapped up my time at Gitlab shortly before the IPO

- Started a new developer tools startup with a long-time friend, where I am cofounder and CTO

- Completed the Hudson Coach Certification program

- Kevin and I got our first super car!

- Finished reading 107 books

2021 Lamborghini Huracán EVO Spyder in Blu Cepheus

2022 Forecast

- Get pregnant (I’ve changed my tune about having kids)

- Spend more time with my nephews and nieces and extended family

- House remodel Part 1

- Run the coaching business (Objective: reach $100K annual revenue)

- Run the startup (Objective: Product Market Fit)

- Finish reading 200 books (I have 352 in “Currently Readingâ€)

- Start NO new businesses in 2022

On Having Kids

TL;DR We’re going to attempt to make some little humans to nurture and love. Their existence will bring more meaning, joy, play, adventure, novelty, and entropy into our lives. I can’t wait!

In June 2019 I wrote a post about my decision to be child-free, and now just over 2 years later, after a second dog and during an ongoing global pandemic, I changed my mind. As usual, the process was a combination of effort and good fortune. Here’s a brief rundown:

I got a lot closer to my husband during the pandemic, after 10+ years of hectic startup life. Looking back its wild to remember that I returned from my honeymoon in 2007 and dove straight into my first startup job. Even after a year of sabbatical in 2018, only the pandemic really slowed me down enough to let myself invest deeply in our the long term vision for our relationship and life together. I love you Kevin.

Working at GitLab radically changed my understand of what work/life integration could look like, and modeled for me a different vision of my professional future. It inspired me with a real-life example of the kind of workplace I will create for others as a business owner. Fundamentally the emphasis is on results delivered, not hours worked.

I got a lot more dialed into what brings meaning and joy to my life. Turns out, its more than startups! I’m finding though my work as a coach and public servant that I derive a great deal of meaning and enjoyment from bringing my passion for leadership and talent development to new contexts. I’m much more comfortable with interdependence, ambiguity, and patience for waiting at the “middle places†in life.

I accepted my own finite lifetime as a real thing, and started living accordingly. Accepting this fact enabled me recognize that the choice to have kids or not is a one-way door decision, and could potentially be a source of deep regret for me in the future. I used to think I would regret having kids, because I saw it as trading off my ambitions and time. Now that my ambitions have been (and continue to be) realized, and I have a system for managing my time and boundaries, I’ve effectively mitigated those downside risks. I’ve also accepted that living a life with no regrets is simply not possible, and set that perfectionism aside.

I made a life-changing amount of money, and I’m going to use it make parenting easier wherever possible. This is an incredible privilege, and I plan to deploy it against whatever barriers we come up against.

I’m sure I left something out, and it really feels like this short post hardly begins to express the thought and care that has gone into changing our minds. Ultimately, this is a deeply personal choice, which I expect will completely change my life and rock my world, in ways that I can read about but are clearly something one has to experience first-hand to really understand. I look forward to being humbled, greatly.

-

Taking Inventory of 2020

It’s the day before Thanksgiving, which is traditionally when I start to work on my annual reflection and goal setting process. New Year’s Eve is my favorite holiday, because it is on of the few that encourages introspection completely devoid of religion or other dogma. We make it meaningful in our own personal ways, and for me the punctuation gives a much needed sense of time passing to a life that rarely unfolds linearly.

Over the years, I’ve refined my annual process while also letting it take up more time of the year. This let’s me do my tasks at a more lazy and luxurious pace. I also take a lot of time off this time of year, which is fairly easy with Thanksgiving and Christmas going on. I think I have perhaps 9 or 10 more business days I need to attend to in 2020.

In line with the Thanksgiving holiday, my process begins by taking inventory of the year. Overall, my purpose is to become a more complex Human being through experiences, choices, and actions that I take in response to my environment and to my goals.

Thematically, 2020 definitely shifted my decisions about where to focus. I had expected it to be a year of deepening friendships and making new ones in Denver, joining a club or two to take up some sports I loved as a kid but rarely do anymore (Swimming, tennis, horseback riding), joining a local choir, trying more new restaurants in the burgeoning food scene. Sadly, many of those things became difficult to do in March with the pandemic, but instead I filled my life with other adventures like cooking, meditation, and of course epic road trips all over the United States.

As my friend Jonathan assessed when we were talking about my guilt around feeling like I’d had a pretty good 2020 all in all, despite the pandemic, “you’re good at making yourself happy†and I agree. Sometimes I think it took being very unhappy for awhile after I sold my company to really figure this out, but actually I think I knew how to make myself happy when I was a kid… I just needed to remember how.

To take inventory, I find it helpful to flip back through my calendar, journal, camera roll, GoodReads, and fitness tracking on my phone and build a chronological list of the year. I like to include anything I know I had strong feelings about, positive or negative.

January

- Started my A Ticker A Day stocks newsletter

- Lot’s of Seahawks football on TV

- Taco was spayed, and had a rough recovery that kind of scared me

- Photographed the orchids at Denver Botanic Gardens with Kevin

- My friend Michelle came to visit from San Francisco, and we went to Steamboat Springs so I could learn to ski for the first time ever!

- Got serious about prepping for a potential lockdown, thanks to my friends (and investment in) ThePrepared.com

- Finished 7 books

February

- 9 days in Hawaii with my parents

- Helicopter tour of Oahu

- Tour of Kahumana organic farm and dinner there

- Deep sea fishing we caught a 60 pound ahi tuna (and I was sea sick — rare for me — because we were out in a storm most of the time)

- Outdoor massage and stargazing session with an astronomer

- More snow!

- Hosted game night at home with friends

- Las Vegas with friends for a birthday celebration

- Experienced the amazing hammam spa at the Cosmopolitan!

- Finally saw the Beatles Love show and it lived up to the hype

- 1 year anniversary working at GitLab

- Started transitioning leadership of Meltano (internal startup)

- Finished 6 books

March

- March 5th – first 2 Covid-19 cases are reported in Colorado

- Last manicure/pedicure before lockdown

- Last dinner out before lockdown, at Barolo Grill — we were sitting at the bar when everyone heard about Tom Hanks getting sick, and it all became truly real that this was happening

- March 16th — Lockdown begins in Colorado

- Started a 6 month tour of duty as interim Senior Director of Corporate Marketing at GitLab, while its leader was on parental leave

- Started reporting to a CMO for the first time in my career

- More snow!

- First “Zoom Shabbatâ€

- Kickoff for CovidLine Colorado volunteer engineering project to get free and anonymous telemedicine and Covid-19 testing to Coloradans during the initial surge (which was anticipated to peak April 14th)

- More snow!

- Finished 3 books

April

- Frantically working to get CovidLine launched, but we do with radio interviews and locals news and a lot of government red tape

- First “Zoom double dateâ€

- More snow!

- My birthday, still in lockdown

- F-16s fly over Denver and the Front Range in honor of first responders

- First “Zoom happy hourâ€

- Massive burrito prep cooking adventure (and blog post)

- April 27th — Lockdown ends, “Safer at Home†order remains (Masks, distancing, reduced office space capacity, no indoor dining etc.)

- Finished 4 books

May

- Recurring extended family Sunday Zoom calls begin (20-30 people)

- First “Birthday Party Zoomâ€

- First “Zoom brunchâ€

- Kevin’s birthday

- Celebrated 1 full year of Taco in our lives!

- Formation of my 2nd team at work, Growth Marketing (which would become my permanent team after the interim role ended) — I’m leading the largest indirect org size (~50) I’ve had since peak Mattermark (~70) and enjoying it

- First “Zoom poker nightâ€

- Dyed my hair hot pink (again)

- Built my raised beds and started planting the summer crop (tomatoes, peppers, herbs, lettuce, blueberries, strawberries, chard, squash)

- Watched the SpaceX launch live

- First time scheduling a Peloton ride at the same time as a friend

- Finished 3 books

- Hit a new high month for average daily steps: 11,609

June

- More planting!

- Kicked off our internal Minorities in Tech mentorship at work

- First “Zoom wine tastingâ€

- Led my first virtual offsite with my Corporate Marketing team

- First outdoor restaurant meal in the time of Covid, at The Wolf’s Tailor

- First BYO outdoor socially distanced dinner at someone else’s house

- Received a sourdough starter!

- Kicked off planning for our Enterprise site about.gitlab.com/enterprise

- Finished 10 books

July

- Our friend Max came to visit from San Francisco

- New water heater installed!

- Celebrate our 1st full year in our house

- Trip to Grand Lake, CO to stay at Anya and Andy’s cabin in RMNP (which very sadly burned down in the East Troublesome Fire)

- First time seeing a moose in the wild

- Kevin did his first astrophotography with the lens I got him for Xmas

- First haircut all year!

- Led my first virtual team building day for my Growth Marketing team

- Finished 3 books

August

- 2 week road trip to Jackson Hole, WY and Ennis, MO to spend time with my parents (who met us in the middle from the Seattle, WA area)

- First time fly fishing — and I caught some fish!

- First time in Grand Teton and Yellowstone National Park

- Wildfires start getting really bad in Colorado

- Started transitioning out of my interim leadership role

- First virtual YC Alumni Demo Day

- Celebrated our 13th wedding anniversary with a long weekend in Vail and an awesome hike in White River National with our new boots

- Harvesting the garden begins

- Finished 4 books

September

- Camped with our friends John and Carlotta near Nederland, CO

- Slept in a camper van for the first time!

- Sept 6th — Harvest goes intense, as it is expected to freeze, and we have to hit the road to California in a few days

- Sept 9th — First snow of the season! (It’s still technically Summer)

- Taught the Mattermark case study at Harvard Business School (via Zoom) for the last time

- Packed up the dogs and started driving West

- Saw our friends Sarah and Patrick for dinner in Salt Lake City, UT

- Stayed the night in Truckee, and sang a socially distanced rendition of â€Sweet Caroline†with a bunch of strangers at the Ritz Carlton

- Arrived in California amidst the wildfire smoke, and stayed in Sonoma for 2 weeks in the most amazing quarantine pod house with many dear friends. It was great to see Samiur, Tess, Andy, Kate, Carrie, Fawaz, Joseph, Brett, Lindsey, Jes, Max,. We cooked, swam, and there was even a piñata.

- Got to meet our dear friends newest baby, and see their new home

- Went to The French Laundry for the first time!

- Massive pastry hauls from Bouchon and Model Bakery

- Wine tastings at Quintessa and VJB

- Got a rooftop cargo box for the car

- Decided to combine this road trip with another we had planned to Arizona, instead of going home, and headed South to Pasadena

- Arrived at our beautiful Joshua Tree, CA Airbnb for 10 days

- Met up with Colorado friends Tyler and Kat for a hike to an oasis at 29 Palms, and got to reconnect after many months apart

- Finished 3 books

- Hit a new high for average monthly active calories per day: 939 cal

October

- The most gorgeous super moon I’ve ever seen

- Friends Jonathan and Regan drove from Scottsdale to stay with us in Joshua Tree. Much cooking, cigars, and relaxing ensued

- Hot tubbing in the middle of the desert at sunset

- Drove to Scottsdale with Jonathan and Regan, and checked into an Airbnb for an entire month with a fenced yard and a pool

- Led my first virtual offsite for my Growth Marketing team

- Oona pizza oven delivered! SO MANY PIZZAS

- Seahawks are back on TV

- Saw D’Laina and her niece for dinner at Fellow Osteria

- The Local Donut, Cafe Monarch, and FnB

- Andy and Kate arrived in Scottsdale from San Francisco to complete our quarantine pod, and there were many puppy butt wiggles of joy

- We took a couple days away from the house (a staycation from our vacation LOL) to stay at the Four Seasons at Troon with the dogs, and we got in an awesome hike to the top of Pinnacle Peak.

- Finished 4 books

November

- 5 days in a beautiful New Mexico Airbnb with Andy and Kate (in self-imposed lockdown) playing board games and trying to ignore the election news coverage

- Biden wins the election!

- Drove home to Colorado with Andy and Kate to settle into our quarantine pod household as the Covid-19 numbers aren’t looking good and we are only awaiting federal aid to do another lockdown

- Happy to be back after 10 weeks on the road!

- Finished 1 books (so far)…

- On pace for a new high month for average daily steps: 13,003

-

How Switching to Remote Work Can Double a Worker’s Effective Hourly Rate

I’ve been re-reading financial independence classic “Your Money or Your Life†and it struck me that the exercise where you calculate you “effective hourly wage†after including all work-related expenses (commute, clothes, etc.) is probably one that many people could benefit from doing during this pandemic. I say this because many people during COVID-19, who have been fortunate enough to keep their jobs, have been forced into remote work situations. As a result they’re not commuting each day, eating lunch out of the house, dressing up in work appropriate attire, or doing many of the other things that would normally be required.

In order to do this analysis I’ve created some assumptions about the person and the life changes they are seeing:

- Lives in California, at tax rate of 30% of gross salary

- Makes $100K annual salary, before taxes

- Spouse does not work

- Works 40 hours per week

- Has 2 weeks of paid vacation and 2 weeks of sick days

- Used to commute 45 minutes each way, 5 days a week (6.5 hours total)

- Commuted by car with $400/month payment, using 1 $50 tank of gas per week

- Paid $100/month for car insurance

- Spent $15/day for lunch + $5/day afternoon coffee at the corner deli/cafe

- Spent $300/week for after school care for 2 kids from 3 – 6pm

- Spends $2K/year for work-related clothes and any dry cleaning

- Spends $50 each week on after work food/drinks with colleagues

Calculating the Effective Hourly Rate

The simple math to calculate our hourly pay says we take $100K and divide it by 48 working weeks, and then divide that by 40 hours per week = $52.08/hour

This simple math is misleading, because it doesn’t take into account all the unpaid time and unreimbursed expenses that are involved in the lifestyle of a commuting worker. To create a more accurate picture, we can calculate as follows:

$100K salary – 30% Taxes ($30K) – Yearly Expenses ($14.4K afterschool care + $4.8K car payment + $2.4K gas + $4.8K on food + $1.2K car insurance +$2K clothes / dry cleaning + $2.4K after work food/drink) = $38K effective annual income

Now divide this by 1,920 working hours (48 weeks at 40 hours per week) = $19.79/hour

And we still haven’t added in the 312 unpaid hours spent on commuting, bringing us to $42.8K divided by (1,920 working hours +312 commuting hours) = $17.03/hour effective hourly rate

This is how the math works out, and why someone who has finally broken through to making that elusive status symbol of “six figures†can still be struggling to get by with less than $20/hour of effective real hourly wages after taxes and work-related expenses.

Given the general recommendation to spend 30-50% of gross salary on housing, this person might feel spending $30K – $50K on rent/mortgage ($2,500 – $4,200 per month) makes sense, especially for a family of 4 needing a 3 bedroom place within a 45 minute drive to the office. At the low end of housing cost, this leaves ~$1,000/month to cover all discretionary spending (food, Internet, cell phones, healthcare,home and car repairs, etc) and on the high end the family is now spending more than they make simply to put a roof over their heads. It is likely that the spouse, if there is one, will have to take on at least part time work to make this situation sustainable.

How the Numbers Change for Remote Workers

Now let’s look at the effective hourly wage for the remote worker who does not commute or own a car, needs no after school care for the kids, does not by specialized clothes for the office costuming, and saves $10/day by needing just $5 for their lunch meal and afternoon coffee at home. They are also reimbursed by the company for their high speed Internet service, and their calculation looks like this:

$100K salary – 30% Taxes ($30K) – Yearly Expenses ($1.2K on food) + Reimbursements ($1.2K high speed Internet) = $70K effective annual income

They also do not commute, so we don’t have to add in those extra hours spent on the road. $70K divided by (40 hours x 48 weeks) = $36.46/hour effective hourly rate

Wow. From $17.03/hour to $36.46/hour. The switch to working remote has more than doubled this person’s effective hourly rate.

Obviously your mileage may vary, and you might include or exclude different variables for your own calculation, but it is clear the move to remote work confers major benefits on workers.

This post doesn’t even begin to dive into the benefits to companies, like not having to lease commercial real estate and manage physical spaces, but that is widely covered elsewhere. If you’re considering making remote work a permanent part of your life, possibly combined with a move to a lower cost of living place with more favorable tax rates, this is something to keep in mind.

-

Personal Projects I’m Enjoying

Despite living in an unpredictable world filled with death during the COVID pandemic, I’ve been finding a lot of joy lately in my personal projects.

On the public facing side of things, I have:

- Led a team of volunteer software engineers to help Clinica Colorado launch CovidLine, a Twilio-based IVR and call routing solution that provides multi-lingual symptom screening and free telehealth doctor visits for the uninsured and undocumented in Colorado.

- Started a public equity investing newsletter where I publicly share my decision-making process, which includes a mission to evaluate every company underlying the Vanguard Total Stock Market Index Fund (VTSAX) one company at a time.

- Started a free online cooking class newsletter focused on making the foods I’m passionate about accessible to anyone who wants to try.

On the home front, my inner life development continues and if you follow me on social media you might be getting glimpses of some of these projects:

- Self-reliance, prepping, and cultivating some homesteading skills including growing some of my own pizza toppings. (I was even quoted at the end of this long-form piece on “Silicon Valley Preppers†in the New York Times featuring my friends at ThePrepared.com)

- Journaling and reading extensively around grief. As I processed the end of Mattermark over the past couple year, I’ve realized that loss brought up a lot of old wounds that didn’t receive the attention and tenderness they needed to heal. I’m working to give that to myself now, accept my anger at the sense of abandonment I felt at the time, and reframe those stories as the broader tragedies they were (a teen suicide, a friend’s drug overdose and subsequent months in a coma) without centering on myself and my pain.

- Upping my impeccability level when it comes to all manner of cyclical and entropic life processes like chores, household management, personal finance, self care, hygiene and exercise. They all involve compounding and require long-term thinking, and I have room for improvement in connecting my day-to-day actions with my longer term vision for my life.

- Staying in touch with friends through texts, calls, Zoom double dates and other channels, but also working harder to notice the truth of how close we really are (or aren’t), accepting that, and modifying my expectations and engagement model accordingly. I have found a mobile app called Fabriq extremely helpful for this.

- Continuing to read extensively, though I am significantly behind track for my goal of finishing 200 books this year with 30 completed so far.

And of course, my journey as a home chef continues…

8†4 Layer Yellow Cake with Chocolate Frosting

Piperade based pasta or pizza sauce (Thomas Keller’s recipe)

Pizza crust made with sourdough starter

Homemade Kansas Style BBQ sauce

Dehydrated limes and oranges for cocktail garnish – Hemingway Daquiri

Grandma’s cinnamon rolls – from my Clark Family cookbook

With cream cheese frosting of course

Roasting meat in the sous vide, finishing with the SearzAll

For more food pics, make sure to follow me on Instagram!

-

Your $15 Lunch Habit Could Be Costing You $400K of Retirement Savings

The average 60-something today has ~$195K in their 401(k) retirement account. What if you could make one lifestyle change, which would cost you about 2 hours of meal prep every 40 days (~18 hours per year), and would in turn bring your $15/lunch* habit into < $2 per meal? If you invested the savings each year for 32 years (assuming you’re 35 like me, and retirement age is 67) at an average return of 5% compounding each year, you’d have ~$400,000 in additional retirement money at the end of that time.

See the math in this spreadsheet

I realize this isn’t the only reason to do meal prep, but it’s a pretty strong argument for making incremental changes to any habit of convenience. You can do similar calculations for other categories of discretionary spending, like ordering a $5 latte at coffee shops versus making coffee at home, using ride-sharing versus public transportation and walking, and many more habits which are ultimately optional choices we each make about how to spend. For me, looking at these analyses (even when I splurge and choose the more expensive option) really drives home the power of habits to shape outcomes. On such a long timeline it can be difficult to keep what matters most in focus.

Even if you don’t put the money into investments, with the benefit of compounding returns to get you to the full $400K, this is still $160K of direct savings that can be re-allocated to other things you value you more in life than what you ate for lunch today.

This kind of frugal thinking is a cornerstone of the book “Your Money or Your Life”, and whether you’re interested in financial independence or just stuck at home with some time on your hands, these burritos are delicious.

Making Delicious < $2 Steak Burritos

For this recipe, I’ll propose one meal plan so you know exactly what the ingredients are, what the nutrition facts are, and how to put it all together. From here, you can adjust the flavors and macros using vegetables, spices, or a different/more protein for a variety of options, while still staying below the $2 mark.

View the shopping list as a spreadsheet in Google Sheets

I’ve also done a bit of research to break down the nutrition facts of the underlying ingredients in this recipe, to give you a sense of how this performs on macros (fat, carbs, protein) as part of a balanced diet:

Bringing It All Together

Saturday night before bed: Coat the steak in salt, pepper and spices (paprika, cumin and oregano is good mix) and place in a slow cooker on low for 10 hours (or sous vide at 135 degrees Fahrenheit) overnight.

Sunday morning after breakfast: Remove the steak from the slow cooker or sous vide and shred with two forks or dice into small pieces and set aside to cool. Dice the white onions. Get out the other ingredients and set up an assembly line of on the kitchen table, starting with your pop-up foil.

Place two sheets of foil on the table side-by-side overlapping a couple inches. Lay a tortilla on the foil and apply a thin coat of olive oil (so it won’t stick to the foil when reheated later) and flip over, oil side down on the foil.

Put your driest ingredients in first, to avoid sogginess. The green chili salsa should be the last thing you put in.

Roll it up, and freeze it right away!

Reheating the Burritos

We’ve wrapped them in foil, so the microwave isn’t an option unless you completely unwrap. For the best flavor, remove a burrito from the freezer and put it into the fridge the night before to thaw or remove it from the freezer in the morning and put it out on the counter to thaw. Preheat the oven to 350 Fahrenheit, and bake for ~1 hour.

The spices and salsa should make the burrito flavorful and moist enough on its own (the raw onions and black beans will steam in the oven), but if you want to make the meal feel a bit fancier garnish with hot sauce, sour cream, limes, salsa, diced jalapeños or even an egg over-easy. Enjoy!

P.S. Going Beyond Burritos

Am I seriously suggesting you eat a burrito for lunch every day for the next 32 years? Well, yes… but also no. One of the biggest challenges to saving money is that frugality is often boring and low status. You might get made fun of for brining a bag lunch to work, but the odds that you will be hanging out with the people you work with in retirement (or even 2 years from now) is low. How much do you actually care?

There are lots of lunch meals you can enjoy for $2 or less that will give you the macros you need. One of my favorites is good old PB&J.

Check out my previous spreadsheet trying to construct < $10 day meal plan that felt yummy and not restrictive here for more ideas.

Not everyone spends $15 on lunch, but I am basing this off of my own spending while living and working in downtown San Francisco. Some example lunch menus include SOMA Eats, Uno Dos Tacos, and Deli Board.

-

Results of Sam Altman’s 2015 “Bubble Talk” Bet

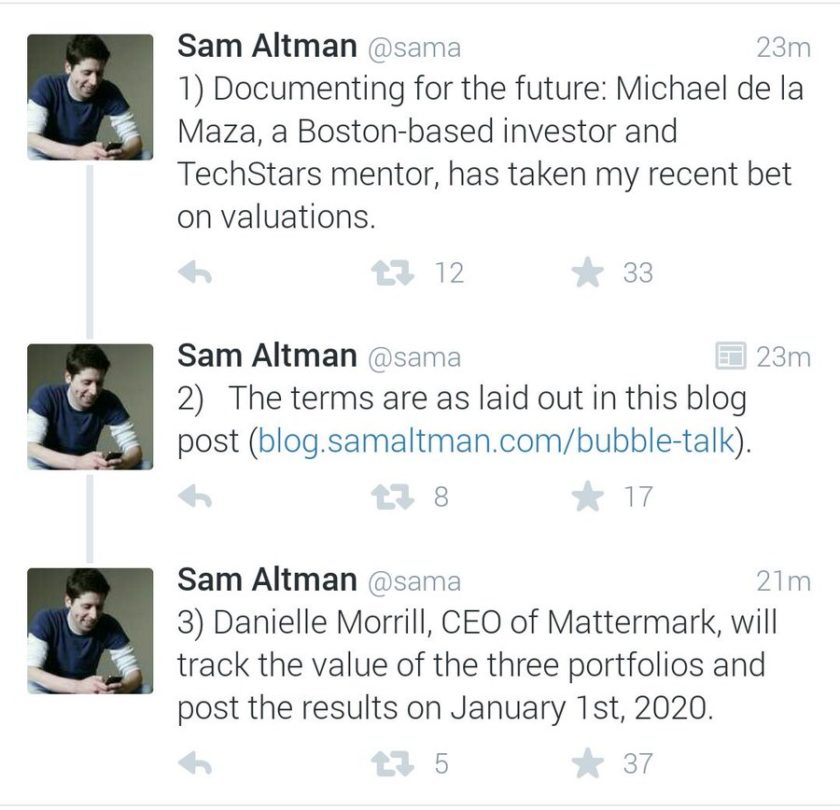

In 2015, Sam Altman wrote a post titled “Bubble Talk” which lamented the “boring reading” of ongoing press coverage of a bubble in tech valuations, and laid out 3 scenarios he believed would be true by January 1, 2020. To win, Sam has to be right on all three propositions laid out in the post and reviewed in detail below. Sam also invited a VC to take the other side of the bet and Michael de la Maza obliged. The loser will donate $100,000 to a charity of the winner’s choice.

Proposition 1: On January 1st, 2020, the top 6 US companies at http://fortune.com/2015/01/22/the-age-of-unicorns/ (Uber, Palantir, Airbnb, Dropbox, Pinterest, and SpaceX) s will be worth at least $200B in aggregate (from just over $100B in 2015).

Outcome: Not true. The group is collectively worth $30-40B less than $200B, based on publicly reported valuations of private companies and market caps of publicly traded companies.

- Uber = $50.73B Market Cap on Jan. 1, 2020

- Pinterest = $10.41B Market Cap on Jan. 1, 2020

- Dropbox = $7.44B Market Cap on Jan. 1, 2020

- SpaceX = $33.3B private valuation as of May 31, 2019

- Palantir = $20-30B private valuation as of September 2019

- Airbnb = $35B private valuation as of March 2019

Proposition 2: On January 1st, 2020, Stripe, Zenefits, Instacart, Mixpanel, Teespring, Optimizely, Coinbase, Docker, and Weebly will be worth at least $27B in aggregate (from just under $9B in 2015).

Outcome: True.

- Stripe alone is valued at $35B as of September 2019

Proposition 3: The current YC Winter 2015 batch—currently worth something that rounds down to $0—will be worth at least $3B on Jan 1st, 2020.

Outcome: True.

- GitLab* = $2.75B private valuation as of September 2019

- Razorpay = $450M private valuation as of June 2019

- Atomwise = $150M private valuation as of March 2018

- Chariot = acquired by Ford for $65M

*Disclosure: I work for GitLab.

-

Post-Startup Life: Reflecting on My First 18 Months Living in Denver

In December 2017 my husband, myself, and the remaining cadre of Mattermarkers who remained moved to Denver as renters and “short-timers”. Given how we started out, I didn’t put odds on staying long. We started out fresh from California in the middle of winter, as part of an acquisition capping off a long M&A process that had left me pretty burned out. We hadn’t planned to move, but it was what we needed to do to close the deal so we did it. Alighting on a new city in the midst of the holiday season, we didn’t have our support network built up over the past 10 years (basically my entire adult life) in the Bay Area, let alone the right clothes to weather the initial shock of change.

After spending years building something that’s no longer yours, especially if as in my case you have nothing (at least economically) to show for it, can raise questions about whether it was worth building at all. I spent 5.5 years, from early 2012 to mid 2018, on the Referly/Mattermark/FullContact rollercoaster with an average annual salary of $120K and net negative personal savings rate. In the sale of Mattermark, the purchase price did not clear the amount invested by preferred shareholders and common stock (including all the founders and employees) was wiped out. There was no success fee for completing the deal, just my honor and self esteem + a job offer at the acquirer with a relocation bonus.

I’m not complaining (and doing the deal was ultimately my choice and the best option available to the company), just laying it out in a bit more detail because sometimes I think people try to leave things vague to create an aura of mystery when founders have these types of exits. Despite all the work I’d done to separate my identity from my role as startup CEO, I felt quite shitty about this outcome… and it took a lot longer to work through those feelings than I could have predicted.

Where Am I?

Initially, we lived out of an Airbnb in Washington Park with our 4 month old puppy (Emo) while scouting for a pet-friendly rental in the neighborhood, but ultimately ended up finding a brand new duplex in Cherry Creek North renting for less than our portion of our former 3 bedroom apartment with roommates in San Francisco.

Moving into this tony old neighborhood of Denver was funny, mostly because we constantly felt like the youngest people around. After starting to feel “old” among our eternally 20-something tech startup peers in San Francisco, the average age of 65 was refreshing. Older Denverites of relatively good health are super active with their dogs, their gardens, and myriad outdoor sports and we met a lot of friendly people very quickly. Even at -1F (New Years Day) we relished the walkability of our 16-block shopping district and the mostly sunny climate with 2-4 inches of snow every week or two.

I started learning about the neighborhood’s history, and discovered it was founded as the township of Harman in the 1880s by Edwin P. Harman and his wife Lou, and annexed to Denver in 1896. As neighborhood folkore goes, Edwin was a decorated Confederate veteran and former lawyer and judge who became disillusioned with post-bellum life in Mississippi and decided to head West. I love that the original town hall still stands, always has the best flowers in summer, and has been tastefully renovated to host fancy community events. The city of Denver was founded in 1858, and Colorado did not become our 38th state until 1876, so this was all happening in a very short window of frontier history.

Beyond the local history, I also started to familiarize myself with the surrounding natural environment (Red Rocks, Front Range, Loveland Pass, Aspen, Durango, Mesa Verde and so much more… I took a week-long solo road trip through the Southwest), plants, animals (prairie dogs!), birds, bugs (cicadas!), weather (tornado warnings!). At first, I was still too burned out to do much socially, so I held off on engaging with the startup community or making an effort to find new friends beyond whatever happened naturally through day-to-day life. Through my responses to the warmth and outreach of others, I felt myself become nicer, less hard, less guarded. I started hosting small get togethers at our house. I was still pretty overwhelmed with my inner monologue, and didn’t really know how to explain myself if asked, “so who are you? what do you do?” but angel investment opportunities started to come my way, impressive local female founders.

Little did I know, time passing was working its subtle magic on me. Simply by existing, I was working through a lot of things during my experiment with retirement, which I branded as “professional sabbatical” since I didn’t know if it was going to be permanent. I felt myself becoming more stable and comfortable with my identity not being tied to my work.

How Am I Going to Pay for This?

I wrapped up the Mattermark transition in May 2018 and decided to use some of my savings to take the rest of the year off. To satisfy my need for an incremental spreadsheet to constantly iterate on, and because I finally had the time, I took over the “CFO of household” role from my husband for the first time in our 11 year marriage.

After an initial audit, which included calculating our net worth and IRR for the first time since 2012, I began thinking through how to diversify away from concentrated positions in startups and public stocks, and replenishing our retirement savings (Kevin had cashed out his 401k for a previous failed startup, so we were pretty behind where we should have been). I re-read “Your Money or Your Life” (thanks Dad for having that on the shelf when I was a teenager!) and began to engage with the FIRE movement (Financial Independence Retire Early) community to find more people like me.

When I say “people like me” I mean people for whom working or not is a choice, because they’ve accumulated the wealth required to deliver economic freedom. Living the lifestyle I want (which is not particularly frugal) entirely off the compounding returns of my investments, even at a fairly conservative growth rate on the principal, is an option for me now.

Can These Numbers Really Be Right?

Being young and in a position to never work again (at the 4% withdrawal rate, with some tweaks to my spending habits) sounds great and is literally the millennial dream if you spend much time on Instagram. I’m incredibly grateful that the stock I received for my work at Twilio ended up generating my wealth, but it’s also terrifying in the sense that it is all new and feels like it could disappear tomorrow.

After making my detailed spreadsheet it was undeniable: at a relatively conservative compounding growth rate, I could stop working and cover my expenses with my investment income and I would have more money than I’d ever need to spend in my life. It was very disorienting to have my net worth climb from something I hadn’t worked on since 2012, while my current efforts were amounting to nothing in economic terms.

I wondered if the math could really be right, and checked it a ton of times. I found it difficult to figure out who to discuss these questions with, since its taboo to talk about money in general, and retirement in your 30s specifically can trigger all sorts of reactions. Most of us have been fed the idea that retirement means we work until 65 and then take it easy playing golf, going on vacations, and buying a beach house, and never questioned that. As I reached out for advice I was surprised to find many people who are high earners but have very little savings. For them, talking to me about my plans brought up a lot of uncomfortable comparisons about life choices. I’ve included a list of resources at the bottom of this post for anyone who is curious to learn more about thinking through questions like this.

What Do I Do With All This Time?

Being on sabbatical gave me a taste of what retirement would look like for me right now: I had few friends or hobbies, no kids, and no long term goals or vision for my life. I had put pretty much all of this off while working on my startup, and then had moved away from my established community, habits and routines. I struggled to explain myself outside of my work, and even the creative things I had become good at didn’t ring true and I struggled to say, “I’m a writer” or “I’m an analyst” or “I’m an investor” or even “I’m an inventor” even though any of these answers is right. All this meant meaning-making was extremely difficult each day, and I started to wonder, “what do I do with all this time? is this all there is in life?”

For anyone who has ever suffered a bout of depression, these thoughts are warning signs. For me, I immediately began to build out lists of things I wanted to do, and fill my days with activities to stave off these thoughts. I spent a lot of time and money getting my hair done, working out, cooking, traveling extensively, and reading even more extensively. Each day I would write down everything I had done that day, and recite it to my husband. Thanks to a lot of time spent doing mindfulness training over the past few years, within a few months saw all this manic movement without purpose for what it was: a way to paper over my anxiety about my direction in life.

This is loosely written in chronological order, but for any reader who has made it this far I want to reassure you *I regressed many times* and it is still happening. It is not a linear path from not feeling okay about your life to feeling okay again, and I still have mornings where I wake up in a funk that takes me hours to shake off.

Why So Much Focus on Money?

Economic freedom is a powerful thing, and I growing up in the household of an entrepreneur I lived by the ebb and flow of the business and its income. When I started working as a stablehand at 13, for my Dad as an analyst at 15, at McDonald’s at 16, as a receptionist at the tennis club, as a tennis instructor for the Parks & Rec Department, as a barista, as a freelance website consultant… each move was a step toward freedom from the strings that came attached to my parent’s money, a step away from the financial precariousness that shaded my childhood.

Money isn’t something I hate, but I’m also wary of loving it. I don’t think it is a good idea to love tools you didn’t make yourself, or at least to love anything that is as fungible as money. What I love is freedom to live the way I want to live, do the things I want to do and also NOT do other things, and to be able to adapt to the world quickly and face the reality and consequences of my own choices. I’ve done several significant of “off script” things in my life including skipping the 4-year college checkbox, getting married really young, starting my own companies, and deciding to be childfree. There are many more that are too personal to share here.

Because of my tendency to do things that are at odds with what society tells us to do, I have assigned an additional level of responsibility to myself economically to always be able to protect myself from the potential fallout of being “weird” or different. Regardless of the fact that I enjoy a long marriage, I feel it is extremely important that I don’t need to rely on anyone else for money (or the protection it provides) and that I not subject my partner to a situation where he is carrying out the role of “Good Provider”.

So to simplify all this, I am focused on having money because it confers economic power, and economic power can be used to purchase freedom. Having the Freedom to live my life as I choose is my highest value.

But What About… You Know, Denver?

Denver’s great, but I can hardly claim to know it yet! It has been an excellent cocoon for me as I figure out what I’m doing with my life. The next chapter likely involves getting much more involved in the local community, doing a ton more outdoor stuff, finally learning to ski (lifelong snowboarder but I broke my ribs when I was early on at Referly without healthcare… long story) and so much more.

It took me at least 3 years to start feeling really at home in San Francisco, so I am expecting the pace for this will be about the same here. If you want to see the cool places I’m exploring, eating, hanging out etc. check out my Instagram – it’s public now so everyone can follow along as our puppies grow up!

Consciously Choosing Goals for Life in 2019

Given how much I love my freedom to live as I choose, you’ll probably not be surprised to hear that I am very into thinking through just what I should do with all this freedom I’ve earned. As 2018 came to a close I did my yearly exercise of writing down goals for the coming year. I chose 3 themes:

- Establish Creative Work Routine

- I would like to be writing and painting (~4 hours per day), and I also want to explore startup ideas.

- Grow BuriedReads.com

- Launch paid associate-as-a-service newsletter

- Start coding on personal CRM project

- Continue XFactor partner role + angel investing

- Improve Physical Fitness & Appearance

- I would like to have a slender, healthy, attractive body.

- I would like to be comfortable on the floor with the dog, falling asleep, and doing athletic activities.

- Prioritize Making Memories

- I would like to have a year filled with memorable experiences that honor my values, including outdoor exploration, live music, eating and drinking out and other fun stuff.

What you might notice is that nowhere in here did I say “I want to get a job”, “I want to get another dog” or “I want to buy a house”. Arguably, the three biggest decisions I’ve made in 2019 weren’t on my list. Thematically, I’d say the dog aligns with physical fitness and the job aligns with creative routine. But the house? The house is awesome, both emotionally and as an investment, and is totally the right choice. But it also reveals something about a hidden theme, perhaps the “why” behind these other themes.

The bigger theme is that I want to build a life. I am actually motivated to build my life up again, even though one lesson I’ve learned is the impermanence of it all. I found it a painful lesson to discover that sometimes good things (like startups you love or lifestyles in cities you love) do come to an end. I’ve realized that it doesn’t make the world a dark, bad, or hostile place and it doesn’t mean I’ve lost my freedom. Perhaps this is 1999 or 2006 in terms of market cycle, but this time I have so many more resources, and so much evidence that I can weather whatever storm comes.

Lead by Mary Oliver (listen to this poem read aloud)

Here is a story to break your heart. Are you willing? This winter the loons came to our harbor and died, one by one, of nothing we could see. A friend told me of one on the shore that lifted its head and opened the elegant beak and cried out in the long, sweet savoring of its life which, if you have heard it, you know is a sacred thing, and for which, if you have not heard it, you had better hurry to where they still sing. And, believe me, tell no one just where that is. The next morning this loon, speckled and iridescent and with a plan to fly home to some hidden lake, was dead on the shore. I tell you this to break your heart, by which I mean only that it break open and never close again to the rest of the world

Best Resources to learn more about FIRE (Financial Independence Retire Early):

There are a TON of resources for FIRE now that the movement is spreading, but these are the ones I found the most valuable.

Resources:

Playing with FIRE — Retirement Calendar

Books:

“Reboot: Leadership and the Art of Growing Up” by Jerry Colonna

“Your Money or Your Life” by Vicki Robin and Joe Dominguez (this is the original source of the movement, written in 1992!)

“Early Retirement Extreme: A Philosophical and Practical Guide to Financial Independence” by Jacob Lund Fisker

“The Millionaire Next Door: The Surprising Secrets of America’s Wealthy” by Thomas J. Stanley and William D. Danko

Blogs: Mr. Money Mustache (+ he has a coworking space here in Colorado!)

Podcasts:

Reddit: r/financialindependence and r/FATfire

- Establish Creative Work Routine

-

Building Your Life is the Creative Thing You’re Doing Right Now

I caught up with a long-time friend this week, someone who has known me since I was 19, since before I was “in techâ€, since before I had my first job worthy of going on my LinkedIn profile. He’s a writer and a filmmaker now, and I love to talk to him about ideas I have for stories and hear about his parallel world to software — he’s creating movies, commercials, storyboards, and other artifacts while I’m creating software, specs, spreadsheets, and so on.

But this week, I described my writing as “not real writing†because I’m not publishing much of it. In fact, I’m slowly and regularly erasing my tweets, which used to be such a fun outlet for self expression, when they get older than one week. I’ve considered making all these blog posts private, or just removing this website from the Internet, but talked myself out of it. In life, I’ve folded myself into a little cocoon to let something new germinate. I’m not sure what that is yet.

“I’m not really doing anything creative,†I told him. “I’ve become a reader, not a writer. A consumer of tech, not a producer.†But he wouldn’t let me diminish myself like that and said so. “Why do you think it isn’t ‘real writing’? What’s wrong with being a reader, or a consumer?â€

It’s hard to be confident as I slowly emerge from my cocoon. I feel so raw, so vulnerable and soft, so easily reached right to my core. Whatever I was using to protect myself, to keep myself above reproach, isn’t there anymore.

I also feel like the work I’m doing right now, building software, somehow doesn’t “count” as creative because it isn’t something I’ve founded (even though it is remarkably similar to past projects like UnicornDB and GitSheet, which is why I chose to join the team even before my sabbatical was officially over). I know this isn’t true, and not even rational, but it’s part of my inner monologue that I’m working through.

Sitting in the couch with my dogs this morning, reading The Paris Review and sipping my coffee, I was suddenly reminded of a CEO coaching session where I admitted my compulsive need to make things… even on the weekend. When I was still CEO, this often took the form of cooking elaborate meals, but I also have a long string of projects including paintings, short stories, poetry, journal entries, all sorts of investment analysis and theory backtesting that came from this compulsion. When I compare my creative productivity now to what it was then, I would say the person I am today is super lazy! It’s intentional, but sometimes I still judge myself harshly.

After selling the company and moving to Denver, I have been working on a lot of personal projects but with a more long-range and less manic and compulsive nature. A major part of my journey has been learning to sit still, to waste time, to make a little room to be with my inner voice and not just jump as the first “you should†it throws out to me. You should cook. You should clean. You should take the car to the car wash. You should start a startup. You should take piano lessons. Should… should… should.

It’s not that these aren’t good ideas. In fact, I’d like to do all those things. But there’s an issue of motive that I didn’t examine for a long time. Why should I? What drives me to choose to spend time this way versus that, and will that motivation sustain me long enough to see it through? In part I wonder this because of how tired I got at the end of Mattermark. Partly that’s because M&A is a brutal process that is far less about building new things than selling what you’ve already created. But partly I did get tired, and from April 2013 to April 2017 is only 4 years… which makes me question my endurance. I know startups take longer than that, I knew it going in, and yet I just could not find the motivation to take it further.

“Your life is the creative thing you’re building now, your beautiful house you just bought, training your young dogs, the year of the burger, your personal project to read the Western canon of literature… it sounds like like you’ve gone from CEO to philosopher.â€

I smiled at this, and tried not to think about how much less epic it seemed than building a billion dollar company. Where did I pick up this need for the epic anyway, was it a borrowed belief that didn’t get much consideration or something actually important to me now?

But then this morning I woke up and checked my sleep quality with my new Oura Ring, plus the AutoSleep app, plus Gyroscope… all to plan how active I’ll be today, what I’ll need to eat and what kind of workout I’ll do. It sounds so trivial, but stringing together days of good sleep, good diet, and good exercise is one of the things I’m finally taking care of in life. And this is something that millions of people (billions, though most don’t have the privilege of these tools yet) struggle with every day.

And for the first time I’m starting to think about maybe all these people building all these products are building them for me. The founders of these products/companies may have varying aspirations, but I am the **user** now instead of the system (to borrow from Tron) and these things that are being to sold me to make my life better are pretty incredible. Some of them are crap, or at least a waste of money for what they deliver, but I’m not really interested in spending time complaining about them on my blog.

I’ve become heavily invested in understanding how to use these tools to construct the modern Good Life. I’ve also taken the time to survey a lot of the timelessly good things, like books and travel destinations, and made an intentional plan (curriculum?) for incorporating them into my life.

I’m writing this down mostly to capture it for myself, for when I forget and want to start another startup simply to gratify my ego or silence my anxiety. I remember how meaningful my life felt as I worked on my startup and look forward to feeling that degree of meaning again, from daily life.

-

I Will Be Mentoring at TechStars Denver This Summer

Super excited to share that I will be a mentor for the @techstars Sustainability Program in partnership with The Nature Conservancy (@nature_org) in Denver this summer! Excited to work with Managing Director Zach Nies (former CTO of Rally Software) and Program Director @Hannah Davis.

I am deeply interested in water rights, and looking forward to using this opportunity to learning about other categories of conservancy as a business through my involvement in the program.

-

Deciding to Be Child Free

This post was originally a tweetstorm from June 20th, 2019. I delete and archive my tweets older than 7 days (using an app called Jumbo), and want to retain thoughts shared below. These tweets have sparked a widespread discussion, with more than 1.8K likes, hundreds of retweets and comments, and about 400K total impressions. It has been lightly edited for spelling, grammar, and punctuation.

I finally decided to be child free, after nearly 12 years of marriage. Would it help anyone out there for me to share my long and thoughtful process?

A few people said yes, so I guess I’ll just share here. For starters, I got married at 22, so there was zero time pressure to have kids then. Ended up getting pregnant and having an abortion in the first year of marriage, which woke me up to reality of this choice.

Super grateful to Planned Parenthood, and I am a donor and customer (for my birth control) to this very day.

So then my career took off, and it was easy to put off thinking about kids. And then San Francisco was astronomically expensive, and then I was a founder and it seemed impossible to imagine… so I put it off, I had an IUD, no period, so no reminder.

So I was just kind of happily 20-something and then 30. Btw the pressure from my parents was non-existent, after some gently questions in my first couple years being married. I realize now how lucky I’ve been, after reading r/childfree on Reddit for 5 minutes.

Then my younger sister had her first son just over a year ago, and I realized the time to think through this and start working on a more conscious decision had come. So I started reading parenting books, so so SO many parenting books.

And I also began processing a lot of my own experiences as a child, my issues with my parents (most of us have some) and then… we sold Mattermark. I was totally free to write whatever new chapter of my life.

Which was scary af but also awesome in the true meaning of the world. Full of awe. But also a void of meaning… and this is where it was so tempting to have a kid, to give my life meaning in the face of this yawning void of an unknown future.

So I didn’t, because that seemed like a really unfair reason to make a new human.

But that scared me because I started to wonder if everyone was secretly doing this whole due diligence process, not talking about it, and coming to some conclusion that I just could not figure out.

So I started something different, taking an inventory of the things I liked and didn’t like about my life, my self, my relationships, and anything else I could come up with. And I started to map out the underlying things that enable and hinder those things.

And I realized that I have a lot of things that I haven’t given enough time to over the past 10 years (like making art, writing fiction, traveling in non-Western culture) that I want to prioritize now.

I also got really into the American Time Use Study (I’m a data nerd) ans camr to the conclusion that I would not be able to maintain the time allocations to reading 100+ books per year, working out 3-5 times a week, cooking most of my own meals and meditating 20-50 minutes per day.

And I know this is probably where some people will mention I’m selfish. But I am starting to think that is okay, that I can chose anything. If I didn’t write this, you’d never know or care about my choice and my little life over here. And that got me thinking…

Self help books make people think there is “one right way†to do X. Parent, exercise, eat, date, fuck. But the reality is that you only have to care about that if you’re caught up on being “goodâ€. I’m so tired of performing the good role. I’m going to chose something different.

I don’t know what to call it. “Happy†seems like what the Instagram quotes would say… but that’s not quite the right word

So this is the amazing thing, to me at least. At the end I just am choosing the risk of missing out on one experience, in favor of the other experience I am having now. When we are kids we can pick endless choose your own adventure options, but eventually doors start to close

Can i still have kids at 40, 50, 60? Yes. The technologies are incredible from drugs to surrogacy (remember I read like 50 books!) but also adoption. That’s not the point. For me, I needed to come to an answer so I could plan the next phase of my life.

I never felt super angsty about this choice, but I realize now I have had the immense privilege of a mostly secular family without much judgment, and wonderful friends who have never acted like “oh you must not like kids†and they never kept theirs away from me.

So yeah, that’s my story of my choice. I enjoy nurturing many people (mostly adults, a few kiddos) and a couple dogs, and those who know me in that role know it is a passion of mine. I hope this helps a few other people feel more seen. Btw, child free is a choice men face too.

So if you read this and it got you thinking, thank you!

P.S. some of you asked about my husbands role in this, and he was supportive of the exploration but put zero pressure on me to have kids. This was more about my inner journey to peace with my choice, and he helped me imagine how life together would be good either way.

I also want to acknowledge my friends with kids who have heard me think this through and been so real and loving with me, the respect you showed my process is so incredible and I am so grateful.