-

Mattermark Wasn’t a Pivot

We completely started over, here’s what happened.

After shutting down our previous product I was depressed, disillusioned with consumer tech, and definitely had blood in my mouth. I took the huge chip on my shoulder on a mission: for 30 days I would write a post every day, starting with our own post-mortem.

I wanted to talk about things no one else was saying in Silicon Valley, like which VCs were wasting founders’ time, or how much revenue Tumblr actually had leading up to being acquired by Yahoo. I scored a couple“scooplets†and seriously considered never going out in public again. Maybe I’d just sit in my apartment and write until my pageviews surpassed those of TechCrunch. Lots of attention, very little social pressure. In retrospect it was a pretty dark time.

I read every single blog post Michael Arrington ever wrote. Whatever you think of Arrington, this guy is without a doubt the most important thing that has ever happened to media coverage of startups — because he made calls. He’d actually pick a company and say “I think this is going to big, here’s whyâ€. And then he’d take other startups and tear them to shreds with public product feedback. It was so much more than a PR machine.

Maybe I’d be the next Michael Arrington, I mused.

In order to make calls, I realized that I needed to take a much broader view of startups. I needed to know about new products much earlier and I needed to be trying things out every day. If I wanted to say something was going to be big I needed to measure it and compare it to other companies… so I started making spreadsheets. Lots and lots of spreadsheets.

At first they were completely manual. What was the Alexa rank of the company? How about Twitter followers? Facebook page likes? Did they have an app ranked in the App Store? What did Google trends think? To write a single story ranking just 100 companies it took me 20 hours to collect all the data I needed, and as soon as I collected it, it was stale again.

These spreadsheets needed to be code.

So we began to produce the spreadsheets at scale, and write crawlers, and consume APIs, and create processes to do quality assurance on the data. We had nothing else to do, we’d shut down Referly and weren’t paying ourselves until we launched something new. We had no idea what to launch.

Eventually (and this is all happening in a super-compressed 8 week period from mid-March to mid-May of 2013) our investors asked us what we were up to. I think it was April.

We drove down to Sand Hill Road and showed them our “story generatorâ€. They asked if they could use it, we asked for a little bit more money so we could hire another engineer to help us. They said yes. Holy shit, we’re back!

Our initial plan of attack was to work on the project, which we hadn’t even named yet, through the summer and launch it in September after VCs came back from their fabled month of vacation in August. But then Leena Rao published “The Quantitative VCâ€, and closed the article with:

Bloomberg and Thomson Reuters have made multi-billion dollar businesses from charging premium prices to data-hungry public investors. With an increasing appetite for data on Sand Hill road, will the same happen in the VC world? For now, most VCs will continue to rely on what’s publicly available, perhaps until a clever startup packages something better.

I emailed Leena about 10 seconds later, and we launched Mattermark after just 6 weeks of coding (and blogging). I pitched our launch story on Friday, to go live on a Monday. In the 48 hours in between we had to actually build a website other people could use, which was mostly just things like the signup and login flow, a settings page, a front page and some terms of service. Fortunately the app itself was stable and already being used heavily by a couple dozen people… but it was still a scramble.

The reaction was far greater than I could ever have imagined, and it began to wake me up from that haze of not knowing what would come next. With a product to build and real customers to manage, my writing began to drop off. But with hundreds of requests for access I knew we needed to keep feeding the community growth and decided to launch an email newsletter to keep people engaged while we worked out the kinks.

The pressure of blogging publicly had started to stress me out, so communicating with a semi-private focused audience was a welcome change. I wanted to challenge myself to keep producing content on schedule and what began as a weekly missive became a daily letter.

In the process I’ve learned a lot about email marketing and building a community and I think any company looking to build long-term relationships with customers and the customer ecosystem should consider this strategy.

So what about Mattermark today?

Fast forward 8 months and we’ve built our newsletter readership to more than 10,000 subscribers. My dreams of being the next TechCrunch/Arrington have shifted toward building the best sourcing and research tools for investors, corporate dev, biz dev, sales and marketing professionals who are looking to do deals with startups.

We are proud to have more than a hundred paying customers, and in October we reached ramen profitability. Since then we’ve plowed all our earnings back into building the business faster, and the team has grown from just us 3 cofounders to 9 fantastic people who I am grateful to have on board to achieve our mission of bringing visibility to startup dealmaking. We even moved out of our apartment to a real office a few weeks ago!

This weekend I’m re-reading the 146 email newsletters I’ve written since we began, and reflecting on these early days of Mattermark because I can sense they will become a blur amidst the pace of growth ahead of us. Don’t get me wrong, it was painful and embarrassing to restart from nothing a year ago, but looking back now I am so happy we made the decision to pull the plug and try something else. Thank you to everyone who helped us along the way.

On the evening of June 8th, eight months ago today, I penned my first email newsletter to a readership of 802 people. The email was Mattermark Weekly Issue #1 and if you’re curious, you can read it here. This weekend, I’m looking back.

I look forward to publishing and iterating on Mattermark Daily for many years to come. Subscribe to my newsletter, written daily with love

-

Measuring Startup & VC Performance – Everyday is Another Chance to Turn It All Around

Today I wrote about some potential methods for benchmarking startup investors, and on a call with a client this afternoon I was asked how I handle the inevitable pushback from investors who aren’t in the top 10 of the list. This the same question I regularly face regarding our approach to assigning scores to startups and the pushback I receive there is similar. My answer right now is simple: this is not predictive.While this frustrating from a data science perspective, not to mention as an investor (who doesn’t want to predict the next Facebook or Twitter!?) it is heartening as a founder — because every day is another chance to turn it all around.

When we look at metrics, whether they’re “soft” KPIs like web traffic or hard ones like cash flow, it is a reflection of the past. It might be an indicator of the future but we don’t have enough data to backtest and prove that yet. It takes much less energy to make something in motion go faster than does to get it started moving in the first place, so I think a company that has momentum this week is more likely to have momentum next week. Still the most I think we could predict right now is which startups will be competitive for their next round of funding.

The future isn’t promised, in either the positive or negative sense. In financial advising and investing the phrase my Dad always reminded me of went like this: “past performance does not guarantee future results”. Nowhere is this more true than in startups. While we’re busy working on making our measurements, algorithms, and data collection a better reflection of each fund’s reality I hope investors are dropping notes to their companies with helpful value add to bring the bottom to the middle, the middle to the top, and the top to their ultimate outcomes.

-

Focus

Wow. My last post was in August.

I’m proud to say I’m still doing the same thing. As with most of my journals, I don’t usually write much when things are going exceptionally well in my life. For more writing on startups definitely check out the blog on Mattermark and subscribe to our newsletter.

-

Embracing the Incrementality Mentality

We’ve all heard that line about the 10 year “overnight” successes.

A friend* recently told me a key metric of his company was growing 4% week-over-week. Actually, he related with some dismay that it was only growing at 4%, and he was looking to build another product to make their company more attractive for raising the next round of funding.

I was shocked.

The base number that this 4% growth is accumulating on top of is in the billions, without much marketing or distribution yet. They found a problem many people had, solved it elegantly, and then forgot to tell those people about it.

Instead of doubling down on something that was working, going big and blowing it out of the water, they went chasing after another adjacent product without real market validation, significant platform risk, and delusions of grandeur. All to raise a Series A.

I’ve seen this story play out before, and it doesn’t end well.

Double Digit Growth Addiction

Paul Graham’s essay on Growth is extremely important reading for early stage startup founders, and this guideline in particular is quite useful:

A good growth rate during YC is 5-7% a week. If you can hit 10% a week you’re doing exceptionally well. If you can only manage 1%, it’s a sign you haven’t yet figured out what you’re doing.

Important context for this advice, which I believe is often missed, is that the majority of companies in YC launch during the tail end of the program.

If your startup has some success in the years following graduation from the incubator, you’ll discover the painful truth: it’s incredibly difficult to grow 10% week-over-week once your TechCrunch spike is gone, you’re 3 months out from demo day, and you’re still not doing marketing because [enter excuse here].

Gone are the days of the lovely hockey stick graph you proudly showed investors from the Demo Day stage. It’s been six months now and their money is in the bank, but the rush of winning those signatures has long passed. You feel like every update you send them is a bit anti-climatic. “Grew 14% this month,” you write, and paste in a graph with bars as blue as you feel.

The 6 Month Crisis

For startups who are funded, it’s easy for founders to tell themselves that fundraising isn’t the most important thing but a lot harder to feel it, know it, and truly believe it. Often raising a round is the first external-facing “win” you’ve experienced in months. It becomes a new emotional local maximum, and six months after raising you might find yourself looking for the next burst of excitement and validation to match it.

Long gone are the double digit numbers, because the base you’re growing from is much bigger now. You can’t hand crank this machine you’ve built anymore. You need people to help you feed it. There aren’t enough hours in the day. You’re a generalist but now you need specialists.

Things have changed, and that’s okay.

Building a company is quite different from starting one. The shine of being a “startup” wears off, and it’s time to be a business. As soon as you’ve found some product market fit your job shifts from finding the market to capturing it. If you don’t make this mental switch, and keep fighting for the new hotness, you’ll be like so many companies with too many ideas and too little execution. You’ll die.

Incrementality

Most wins you’ll have are incremental, so subtle that you might not even realize you’re winning. When seasoned CEOs say the harder road lies ahead as you toast champagne to a milestone like a financing round closed, big contract signed, crucial hire started, key acquisition completed etc… they know the truth.

All that vision, all that ambition, all those grand dreams of the future… they felt so close as you pitched your big vision but as you wallow in the weeds and details of really nailing each sales call, each deployment, each planning session, each new hire… all that feels so far away. In some ways, you might feel held back.

It’s so tempting to dabble. Now that you have money in the bank, a team around you, and some traction you feel you could build anything. You can see your market more clearly than anyone else on Earth, and you’re intimately aware of the problems your customers face. You want to solve all of them. You want to be their hero.

Just stop.

Your ego is going to hate you for this, and it will fight you.

Stop.

The Longest Road

Building a startup is about fighting all the temptation that lies out there for a maker. You can prototype anything, maybe you also have some visibility and platform to speak from, it’s easy to think you can dabble in anything that could be a big market opportunity. The “Crossing the Chasm” strategy of tackling and winning a beach-head, which sounded so right and so daunting 6 months ago, is now happening. You haven’t won yet but like a soldier who yearns for home you’re looking to the future and, if you allow it, that distraction can become so acute you’ll die in a daze on the battlefield. You might not even know you’re dead.

Investors, advisors and other people will also start seeing the future more clearly – because you did a great job painting the picture for them. They’ll try to get you to talk about what’s next, they’ll add more temptation to focus on the next battle when you haven’t yet won this one.

Don’t let them.

Win.

*details have been changed to protect the anonymous

-

First Week Using the Jawbone UP Wristband

I received a Jawbone UP wristband last week as a gift, and it is the first quantified self device I’ve used.

Before the UP I would sporadically track my exercise and food with the My Fitness Pal iPhone app, but the UP wristband has taken it to another level with mostly passive monitoring of my activity. The only things I can optionally add in myself are my food and my mood.

As a woman in her late twenties and a startup person I’m generally more focused on my career and spending time with my friends and family than on my health, and so it comes as no surprise I have gained about 20 pounds in the past 18 months since setting out as a founder. In the past 2 months I have finally started taking steps to turn that trend around, and one of the unfun things I knew needed to start doing was stepping on the scale more regularly to see whether I was making progress.

I think most women (and many men) can relate to the years of emotions tied up around stepping on a scale, and as much I am a confident person overall I had the sinking feeling when the number read out on the screen doesn’t reflect how good you feel about the better decisions or the challenging activities you’ve been embarking on. Weighing yourself isn’t about confirming progress, it’s about conceding that what you did just might not have been enough to move the needle yet. Very rarely do I feel elated or anywhere near happy after stepping on the scale.

The UP band on the other hand has a completely different emotional connection. It shows me how many steps I’ve taken, how many minutes active and inactive, and how many calories I’ve burned for the day. It also tracks my sleep, showing me how much deep and light Zzz’s I got and also how many times I woke up during the night. When I plug in my UP to sync with my phone I am always excited to see what new progress I’ve made, and I know it’s within my control whether I will hit my goal of 10,000 steps a day or not.

Another really cool thing about the UP is that my husband has one too, so we can compare our sleep and notice patterns about each other. We speculate on how we might be negatively impacting each other’s patterns, which has made me a lot more conscientious about things like making sure the blinds are draw, lights off, door closed, etc. in the early morning hours when I’m up and about and he’s still sleeping (he tends to go to bed 3 hours later than me and wake up 3 hours later). With steps it’s more of a playful competition, and turns a walk to a meeting for me into a nudge to get up and walk to Starbucks or go to the gym for him.

Overall it has been a really cool experience so far, and I’m looking forward to seeing some weight loss progress eventually… but for now I am happy to just have a better understanding of what’s going on with my body, and I feel in control of where to go from here.

What a great product.

-

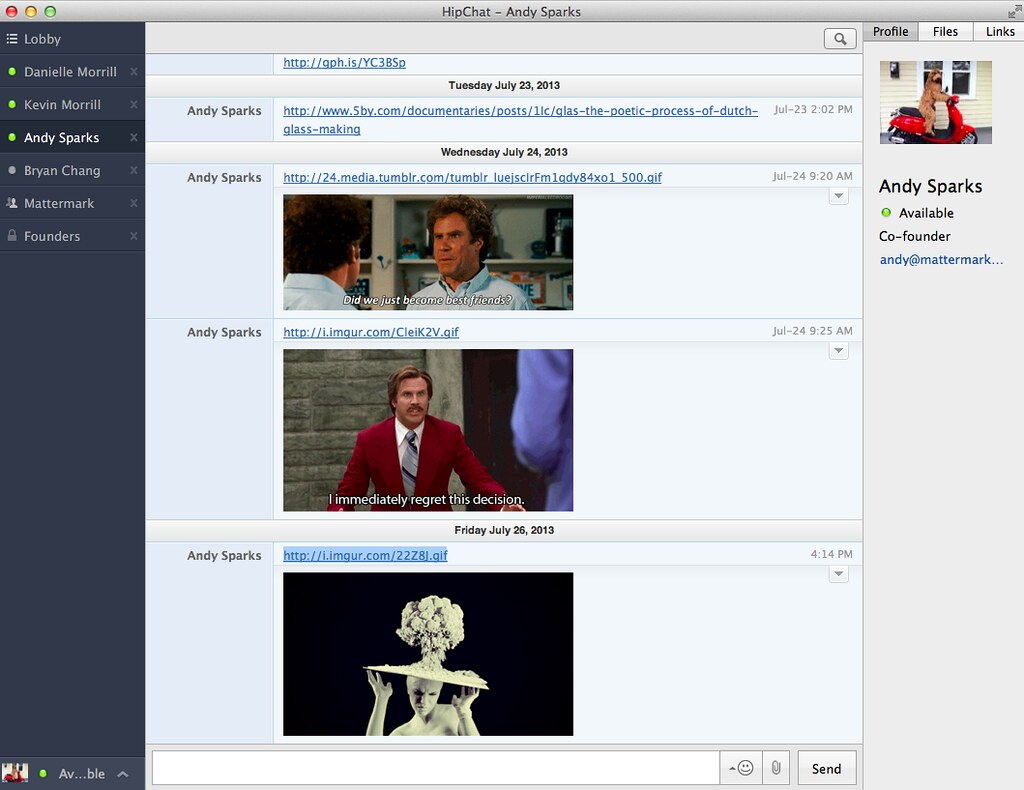

Why I Hired Andy Sparks

He has a Hipchat room that is filled with GIFs

Like this:

And this:

Or maybe:

And my personal favorite:

-

We never meant to stay here

We never meant to stay here

We were here for the goldWe got stuck here for the winter

Blinded by golden dollar signs

We built some simple structures

Temporary, not permanent

But each year we dug much deeper

And each year things got more serious

Each year our hearts grew weaker

Blinded by golden dollar signsWe never meant to stay here

We were here for the goldPut a lump of coal in my hand

Squeeze just as tight as I can

Hope for a brand new diamond

I know it’s slight but it’s all I can

I promise honey that when we get paid

We’ll pack our things and we’ll move away

A thousand miles from this frozen lake

We’ll find a place where we both can stayWe’ll find a city with a million people

Find an apartment where the rent is real low

We’ll disappear and no one will notice

How about it Darling?

We could both live downtownWe never meant to stay here

We were here for the gold

We never meant to stay here

But we’re just dumb animals with our paws in the hole, grasping goldNow we’re stuck in a small town

Out on the shield

But it lost its appeal long ago

We wake up at dawn and kiss our wives on the forehead

And we slowly make our way into the caves

Where we will forget the faces of our children and our small regrets

Like, I should have kept that lucky penny while I had the chance -

We aren’t caught up in your love affair

-

Dave McClure is Raising $10M for Asia-Focused 500 Durians LP

I don’t think I’ve ever laughed out loud reading SEC filings until today, when I saw a filing from 500 Durians. What’s Dave up to now, naming a fund after a smelly fruit? The filings confirmed my suspicions, yes this is another fund run by 500 Startups founder Dave McClure, and it will be focused on investments in Asia.

This play on words is apt, comparing the challenges and rewards of investing in Asian startups with the challenges (the smell! the spiky hard skin!) to the rewards (the fruit, which is an acquired taste). Despite the inherent difficulties in making small investments in early stage companies overseas McClure is one of the most active angels when it comes to international startups, and the most recent accelerator batch boasted the highest ratio of international to U.S. companies yet.

He is constantly on the road visiting with founders around the globe, and this strategy rumor has has gotten him into wildly successful international companies like 9GAG and IconFinder while their valuations were still low.

In an interview with Entrepreneur India McClure was asked why he chose to enter India, and said:

“I have had an affinity for Asia and particularly India, for a long time now. I had also started a company along with some Indians 20 years ago. I have generally felt very comfortable with Asia and South East Asia because of its demographics and growth. Most of Europe has not seen any growth while Asia is growing very well. I also have a number of friends from India. This makes it natural and easier for me to invest here. India is one of the biggest markets for us primarily because of the advantages: it is English-speaking, has a lot of connections with the US, and is backed by strong talent and cooperation between the two countries. I came here first in 2011, but I feel I have been here for over a decade. Since I came to India, we have made about eight investments in the country.”

Asia is a big place, and it will be interesting to see if Dave can make 500 investments on that continent alone in the coming years.

wheels up Haneda -> Beijing. fun times Tokyo, see u again soon 🙂

— Dave McClure (@davemcclure) May 26, 2013

wheels up BLR -> BOM. Mumbai here we come! #goap

— Dave McClure (@davemcclure) February 24, 2013

wheels down Bangalore, 3am local time. next: customs, luggage, hotel, sleep. #goap

— Dave McClure (@davemcclure) February 20, 2013

wheels down Gandhi Intl. good morning New Delhi 🙂 cc @gsfindia @rajeshsawhney

— Dave McClure (@davemcclure) November 26, 2012

Don’t knock the hustle.

-

SpotRight Raises $2.8M for Social Customer Intelligence

According to a regulatory filing Boulder-based startup SpotRight has raised $2,870,889. The company previously raised $1M in funding in July 2012 from Grotech Ventures, Access Venture Partners and FFP Holdings, and also raised a $1.4M Series A from the same investors under its original name Giveo in January 2011.

According to a regulatory filing Boulder-based startup SpotRight has raised $2,870,889. The company previously raised $1M in funding in July 2012 from Grotech Ventures, Access Venture Partners and FFP Holdings, and also raised a $1.4M Series A from the same investors under its original name Giveo in January 2011.SpotRight was originally launched as part of TechStars Boulder in the Summer of 2010 and merged with Spot Influence in July 2012. According to the announcement of the merger:

“As a combined company, SpotRight unveils an unparalleled platform that helps direct response marketers access social data on their customers and act on it to create real business value.”