Posts

-

New Fund Formed to Hunt Zombie VCs & Private Equity Funds

These zombie stories just won’t die.

Last week Kirchner Group and Crestline Partners announced a joint effort to give limited partners (LPs) liquidity:

There is an estimated $100 billion in private equity assets managed by funds past their investment periods, according to industry estimates. Many of these so-called “zombie funds†have serious issues of alignment between the general partner and limited partners. As a result, an increasing number of institutional investors are looking for creative and effective ways to restructure these funds and rationalize their private equity portfolios.

Meet the Bobs of Private Equity

The announcement goes on to explain its areas of focus, which include supporting or replacing general partners, managing or even restructuring troubled funds, providing portfolio follow-on capital and even company level follow-on investment, and finding other opportunities for exits to give LPs liquidity and maximize value.

According to PEhub Kirchner Group has already has some success with this model:

Kirchner Group has made a name for itself as a specialist in zombie deals. It took over management of the Brantley Partners V LP from Brantley Partners and renamed it Emerald Partners V LP fund, which it continues to run.

What’s In Store for Venture Capital?

VC investing is a subcategory of private equity, accounting for $30B invested by venture capitalists in portfolio companies in 2012, according to the North American Venture Capital Association. This is roughly 10% of the private equity industry’s annual global investment, so I suspect the lowest hanging fruit for this kind of restructuring are among huge private equity firms but I certainly wouldn’t rule out some restructuring of larger zombie VC funds.

We are at the beginning of an industry transformation for traditional venture capital that has been a long time coming, and the chronicling of this shift began with the May 2012 report from the Kauffman Foundation, one of the largest investors in venture capital firms and an entrepreneurship think tank, on venture capital as an asset class. According to their findings:

Venture capital (VC) has delivered poor returns for more than a decade. VC returns haven’t significantly outperformed the public market since the late 1990s, and, since 1997, less cash has been returned to investors than has been invested in VC. Speculation among industry insiders is that the VC model is broken, despite occasional high-profile successes like Groupon, Zynga, LinkedIn, and Facebook in recent years.

You can read the full report here.

We will be watching to see which LPs take this route to liquidity for their venture capital portfolio, and looking to determine what those restructuring deals and partnership changes could mean for the entrepreneurs within their portfolio companies.

-

Startup Index: Y Combinator Companies Have More Than 2x the Momentum of 500 Startups, 3x Techstars

How to Read the Startup Momentum Index

Momentum measures a quantity of motion, measured as a product of its mass and velocity. In case we want to measure the momentum of a startup (the “bodyâ€) where mass is the company’s share of web traffic (as measured by Alexa rank) and velocity is the growth trajectory of several different signals (social, inbound links, page rank, etc). It is weighted toward sustained growth, versus small spurts of growth from press coverage or a burst of paid traffic or Twitter/Facebook followers. Larger companies (by traffic) who see a decline in growth across these signals will be the hardest hit, so the worst place to be on this list is in the approaching 0 momentum points.Earlier this week we released the April 2013 Startup Index, which tracks over 1,000 companies in the investor portfolios we’ve indexed with at least 4 weeks of data. Now let’s take a look at the 3 most talked about early stage investment programs and compare the momentum of their portfolio companies.

While the percentage of active companies in each portfolios differs by just a few percentage points, the total momentum points vary widely. For example the top 500 Startups company Virool (which is was also part of YC S12) has 27.69 momentum points in April, but in the YC portfolio there are 10 companies which have more momentum than this. Similarly the top TechStars company Digital Ocean has 18 momentum points, but 500 startups has 5 companies with more momentum in this and Y Combinator has 17 that rank higher.

On average Y Combinator companies had 2.4x greater momentum than 500 Startups and 3.1x greater momentum than Techstars companies in April.These differences seem to line up with differing investment philosophies. While Paul Graham of Y Combinator is focused on “Black Swan Farming” for the one home run company in each batch, Dave McClure of 500 Startups is building a portfolio around companies hitting solid singles and doubles, while Techstars takes a geographically diversified approach. As we continue to collect data it will be interesting to see if greater momentum results in more exits.

April Startup Moment Index: Y Combinator, 500 Startups & Tech Stars

Full Disclosure: both Y Combinator and 500 Startups are investors in Referly, where I am founder and CEO.

Photo credit: New York Daily News

-

Judge and Prepare to Be Judged

Much of the feel good media coverage of startups today is so superficial and manufactured it can hardly be called news. Investigative journalism covering tech startups is extremely rare, and when it does happen it’s written in a snarky fashion full of speculation, rather than research and data.

That’s why for the past month I’ve been indexing startups and tracking their momentum using dozen of signals from public data sets. The analysis reveals up-and-coming companies who deserve more attention, and also highlights companies that are not growing or have headed into decline.

Go to any bar, any coffee shop, any coworking space. They’re talking about which startups are going to make it and which are going to die. Investors, employees, friends, family… if you’re working at or running a startup you know people are already piecing together an impression of how your company is doing based on what you say, don’t say, do, tweet, blog, etc.

Go to any bar, any coffee shop, any coworking space. They’re talking about which startups are going to make it and which are going to die. Investors, employees, friends, family… if you’re working at or running a startup you know people are already piecing together an impression of how your company is doing based on what you say, don’t say, do, tweet, blog, etc. As incomplete as the picture may be, people pick up the signals you and your company are sending out into the world no matter how good you are at putting on The Show.

Delay is the Deadliest Form of Denial

Think your B2B startup shouldn’t be expected to ever have meaningful web traffic? Twilio is #13,158 in global web traffic and Zendesk is #650, so don’t even try that line on me. Companies that build brand awareness, regardless of their industry, are the ones who win. The success of your company is a function of your unit economics multiplied by your ability to get someone to pay you. Before they can pay you they have to know you exist. This is why the most successful B2B tech companies invest heavily in doing world class online marketing, and if you are competing with them you will eventually have to as well.

There are very few B2B SaaS startups that have business models enabling them to succeed with less than 100 customers (e.g. Palantir). Startups in the consumer space will need *at least* TENS OF MILLIONS of people to be aware of your products for you to ultimately succeed. Consumer startups need to achieve massive scale in order to monetize through advertising, or sell themselves to another company who will handle monetization for them (like Facebook).

Unsung Heroes

What excites me most is uncovering companies that are doing really well but flying under the radar. So keep reading, and be among the first to know.

What excites me most is uncovering companies that are doing really well but flying under the radar. So keep reading, and be among the first to know.Let’s give them something to talk about.

-

April 2013 Startup Index: 1,183 Companies – 71% Are Growing

Through the startups indexes I’ve been creating in the past month I’ve developed a database of over 1,000 companies with dozens of signals each. This list includes ALL the startups in my database, across all the portfolios that have been indexed so far, ranked by momentum. Of the 1,183 startups in the index 71% (844) exhibited positive growth in the month of April across the signals we are tracking.

Through the startups indexes I’ve been creating in the past month I’ve developed a database of over 1,000 companies with dozens of signals each. This list includes ALL the startups in my database, across all the portfolios that have been indexed so far, ranked by momentum. Of the 1,183 startups in the index 71% (844) exhibited positive growth in the month of April across the signals we are tracking.Why I’m Writing These Posts

Many commenters and friends have asked why I’m doing this and not working on my startup. In case it wasn’t obvious, this is our startup and these posts are our MVP. I’d like to publicly acknowledge the tremendous effort by my team that make this possible. Kevin Morrill, our CTO and cofounder, who has taken a process managed in dozens on unwieldly spreadsheets and a ridiculous number of browser tabs and automated it with code. Andy Sparks, our Technology Editor, has undertaken the incredible schlep work of hand building new indices and researching startups, cleaning, curating and organizing our data.

How to Read This List

Momentum measures a quantity of motion, measured as a product of its mass and velocity. In case we want to measure the momentum of a startup (the “body”) where mass is the company’s share of web traffic (as measured by Alexa rank) and velocity is the growth trajectory of several different signals. Unlike previous indexes growth trajectory is now heavily weighted toward sustained growth, versus small spurts of growth from press coverage or a burst of paid traffic or Twitter/Facebook followers.The Bigger They Come, the Harder They Fall

You will find companies in the top portion of the list that you’ve probably never heard of, and companies near the bottom who are big names you recognize right away. Because of this, you might be tempted to immediately discredit the entire index – but let’s walk through a few examples first so you can see what we are measuring. Since this measures momentum, the bigger the company the more it is impacted when it fails to grow.

#2 – Coinbase, a service for storing and selling Bitcoin e-currency, has been gaining a lot of momentum alongside the popularity of trading the online currency – averaging 11% growth week-over-week in web traffic by our estimates. This growth also shows in Coinbase’s social media following. They grew Facebook Likes 35% from 452 to 614 during April. On Twitter they grew from 1375 followers to 1876, a 36% growth rate. We’ll be watching to see if Coinbase can sustain this growth in May.

#1179 – StumbleUpon, the popular social content discovery service, appears just 6 positions from the bottom of the list and upon closer inspection we see this is because the mass of the company has declined as it dropped from 176 to 179 in Alexa rank during April. Based on our analysis this drop is representative of a loss of around 10,000 unique visitors per day, and a look at the companies Alexa graph reveals their traffic has been in steady decline for over a year.

Also of note in this list are some of the younger startups that have already shot to the top. YC Winter 13 companies such as Strikingly, Teespring and Thalmic Labs made an impressive showing.

Biggest Winners & Losers

Keep scrolling and you will find the entire list of startups, but for those of you who don’t like scrolling through 1000+ rows in a spreadsheet I’ve got the highlights for you.

20 Startup Who Gained the Most Momentum

- BuzzFeed

- News Blur

- Coinbase

- Dropbox

- Codecademy

- Disqus

- Rap Genius

- Weebly

- ROBLOX

- Priceonomics

- Strikingly

- Teespring

- Creative Market

- Aereo

- Virool

- BuildZoom

- Thalmic Labs

- Bitnami

- Perfect Audience

- Tapas Media

20 Startup Who Lost the Most Momentum

- ChirpMe

- Causes

- Payvment

- Udemy

- StumbleUpon

- Lockitron

- Svbtle

- Crowdbooster

- Grubwithus

- Kaleidoscope

- Oh Life

- SplashUp

- Tumult

- LaunchRock

- Ecomom

- FamilyLeaf

- Imgfave

- LeanMarket

- OpenX

- Iconfinder

The April 2013 Startup Index

-

Ken Lerer’s NowThis Media Raises $4.8M

According to a regularly filing NowThis Media has raised $4M in additional funding. The company previously raised $5M under the name DailyPlanet Nework in April 2012 and its founder Ken Lerer is famously the cofounder and former Chairman of Huffington Post.

According to a regularly filing NowThis Media has raised $4M in additional funding. The company previously raised $5M under the name DailyPlanet Nework in April 2012 and its founder Ken Lerer is famously the cofounder and former Chairman of Huffington Post.The company runs the social news site NowThis News, which appears to be staffed with a huge number of experienced writers and journalists. I was surprised I had never heard of the site before, but according to Alexa it has not yet broken into the top 100,000 websites worldwide. Lerer will be on stage today at TechCrunch Disrupt today in New York, so it is possible those attending will learn more about his plans.

To give you a sense of how much traffic that is, see this comparison. DanielleMorrill.com does roughly 100k visits per month. The site is primarily a video network though, so it is possible that driving the traffic to the property itself is less important than doing distribution deals like this one announced with The Atlantic in March.

-

The Fancy Raises $15M More, Tweets They Had 98K Signups Yesterday

In December 2012 The Fancy quietly filed a funding event for $6M, which appears to have gone unreported by the press. Today in a regulatory filing they revised that amount to $15M, bringing total reported funding to just shy of $60 Million.

In December 2012 The Fancy quietly filed a funding event for $6M, which appears to have gone unreported by the press. Today in a regulatory filing they revised that amount to $15M, bringing total reported funding to just shy of $60 Million.This investment comes on the heels of $26.4M raised in October 2012 from American Express and a slew of well-known names including Jack Dorsey and Chris Hughes.

Yesterday the company claimed on Twitter that just shy of 100K signups in a single day:

Hello to the 98,365 of you who joined registered with us today twitter.com/thefancy/statu…

— Fancy (@thefancy) April 30, 2013

And it looks like they’ve been keeping track of their growth rate publicly for awhile now:

Hello to each and every one of the 81,317 new people who signed up with us today!

— Fancy (@thefancy) April 25, 2013

hello to all 70,000 new people who signed up today for fancy.. a new record for us!

— Fancy (@thefancy) April 24, 2013

to the 57,000 users who signed up yesterday… welcome!

— Fancy (@thefancy) April 14, 2013

Hello to the 51,000 new fancy users who signed up today!

— Fancy (@thefancy) March 29, 2013

We had over 7 million unique visitors across all platforms last month!

— Fancy (@thefancy) February 1, 2013

And a little bit of revenue data, too:

Thank you all for spending over $133,000 with us yesterday!

— Fancy (@thefancy) November 27, 2012

thank you all for spending over $100,000 with us today. big milestone for us

— Fancy (@thefancy) November 24, 2012

According to Alexa The Fancy has seen a steady increase in it’s share of global web traffic with a sizable bump measured at +46% in the past 7 days:

-

Scooped! What Snapchat Will Be Talking About on the Colbert Report Tonight

At a taping of the Colbert Report, which will air at 11:30pm Eastern Time tonight, the founders of Snapchat sat down for an interview. Don’t want to wait to hear what happens? You’re in luck, a source who attended the taping has the scoop.

At a taping of the Colbert Report, which will air at 11:30pm Eastern Time tonight, the founders of Snapchat sat down for an interview. Don’t want to wait to hear what happens? You’re in luck, a source who attended the taping has the scoop.The popular image sharing service, which is sending more than 150 Million snaps a day (that 150% more per day than when they announced their funding in early February), received the most laughs when Colbert asked:

“do you make a profit yet? Or does that disappear after 10 seconds too?”

Colbert also equated starting an app in college to starting a band and referred to the code used to delete snaps from their servers as the “mopsquad”.

He wrapped up by taking a snap of the audience and saying “there you go, you guys are immortal. ..for 4 seconds.”

Snapchat is backed by Benchmark Capital and announced a $13.5 M Series A round of financing in February, and has the topic of much discussion and concern, while some say it’s just a bad business. Time will tell whether naysayers get to say “told you so” or quietly eat humble pie. Who knows, this could be Instagram all over again… but who is the lucky suitor this time?

I used to think snapchat was stupid.. Now I do it way more than texting..

— Snapchat Problems (@SnapchatProbbz) March 4, 2013

Snapchat >>> txting

— P-O Archambault (@ArchyGreat_94) May 1, 2013

I’d love to hear who you think is the most likely acquirer for Snapchat in the comments!

Image Source: USC Life on Tumblr

-

VC Chamath Palihapitiya Attempts to Shame Entrepreneurs Once Again

In an interview at TechCrunch Disrupt yesterday venture capitalist Chamath Palihapitiya said the tech world at large should be ashamed for being “at an absolute minimum in terms of things that are being started”. Venture capitalists telling founders they should feel badly about the work they pour every waking moment into isn’t exactly endearing, and several readers reached out anonymously to express their dismay at the hyperbole and hypocrisy of this statement. It turns out this blatant cry for attention might not be good for deal flow either.My Take: Palihapitiya’s perceived dearth of high quality startups should hardly be taken as an indictment of the broader tech sector, and is more likely a reflection founder’s hesitation to work with him following the Airbnb email debacle.

In an interview at TechCrunch Disrupt yesterday venture capitalist Chamath Palihapitiya said the tech world at large should be ashamed for being “at an absolute minimum in terms of things that are being started”. Venture capitalists telling founders they should feel badly about the work they pour every waking moment into isn’t exactly endearing, and several readers reached out anonymously to express their dismay at the hyperbole and hypocrisy of this statement. It turns out this blatant cry for attention might not be good for deal flow either.My Take: Palihapitiya’s perceived dearth of high quality startups should hardly be taken as an indictment of the broader tech sector, and is more likely a reflection founder’s hesitation to work with him following the Airbnb email debacle.This is not the first time Palihapitiya has attempted to publicly shame founders. In a leaked email from October 2011 (allegedly forwarded by an assistant, later denied) he railed against Brian Chesky’s decision to give founders the option to take money off the table, but not offering employees the same deal. While the intent to get liquidity for early employees is commendable, the tone of the message and the fact that it was leaked publicly amounted to a public shaming and undermining of Airbnb’s CEO. Certainly not the kind of behavior founders should expect or tolerate from investors in general, and in their own company (in Airbnb’s case) at all.

According to Crunchbase, AngelList and other publicly available investment data he has yet to make a new co-investment in the same round with Andreessen Horowitz, who lead the round with Airbnb, or any Y Combinator companies (of which Airbnb is an alum). While no investor would ever share who ends up on their “blacklist”, it will be interesting to see if this pattern continues to hold up over time.

Actions, Not Words

When an investor calls out the industry for a lack of quality, the natural reaction is to look to his portfolio for the diamonds in the rough he has discovered. I was surprised to learn that Palihapitiya was one of largest investors in tragically mismanaged startup Ecomom, where his wife Brigette Lau served on the Board of Directors.

But perhaps the rest of the portfolio of his allegedly $275M fund (regulatory filings have not yet be updated to reflect the actual amount closed) has fared better. Let’s take a look at his personal investments and Social + Capital portfolio and, assuming his current investments were excluded from his sweeping derision of tech startups, get a sense of which companies made the cut:

Photo Credit: TechCrunch

-

Mobile Labs Raises $2.9 Million for Enterprise Software Testing

According to an SEC filing today, Atlanta-based enterprise software testing company Mobile Labs has raised $2,962,729 from undisclosed investors in an equity financing.

According to an SEC filing today, Atlanta-based enterprise software testing company Mobile Labs has raised $2,962,729 from undisclosed investors in an equity financing.The company was founded in 2011 and is lead by President & CEO Don Addington. Advisory board members include Neil Edwards, who is President of PangoUSA in New York. According to the Mobile Labs LinkedIn page, has grown to 12 employees.

The company provides secure 24/7 testing for enterprise mobile applications on private internal cloud infrastructure while managing applications, devices, users and test plans in the enterprise test lab. While many testing tools exist for consumer apps, Mobile Labs appears to be focused on the closed environment and unique needs of larger organizations.

Earlier today Mobile Labs was named as a finalist for the CTIA E-Tech Awards in the Enterprise Solution – Mobile Cloud category, with final awards to be announced later this month. In an official announcement CEO Don Addington said:

“Recognition as a CTIA E-Tech Awards Finalist is a testament to the hard work and dedication of the entire team at Mobile Labs,†commented Don Addington, CEO, Mobile Labs. “deviceConnect provides IT with an easy-to-use interface to manage all of their mobile testing assets and 24×7 remote access with a secure, private cloud. With deviceConnect even the most confidential enterprise app data can be tested with no concern for data breaches via accidental access over a public cloud.â€

I will update this post as I learn more about who the investors are.

-

Hunter Walk & Satya Patel

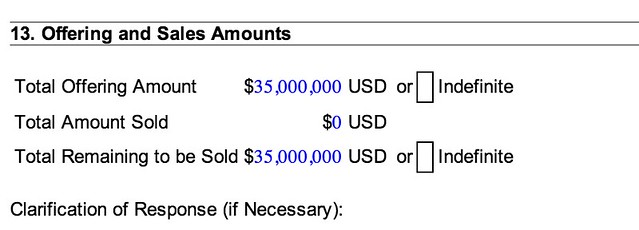

CloseRaising $35M for Homebrew Ventures First Fund It was reported in early February that the two product managers, hailing from Google (Walk) and Twitter (Patel) would raise a $25M first fund. It appears fundraising has gone so well that the two

It was reported in early February that the two product managers, hailing from Google (Walk) and Twitter (Patel) would raise a $25M first fund. It appears fundraising has gone so well that the two have closedare raising and additional $10M, bringing the total to $35M according to their Form D filing posted on Friday.Hunter Walk was formerly a product manager for YouTube at Google, and has been an angel investor for awhile now with investments in Schematic Labs, GreenGoose, Karma, Seesaw, Lever, Tugboat Yards, and Path 101 according to his AngelList profile. He also has a profile for his infant daughter on the site but notes he “will not be entertaining M&A offers until she’s at least 18”.

Satya Patel was formerly VP of product at Twitter and is also ex-Google and ex-Battery Ventures where he was a partner, so I am going to guess he brings a bit more of the post-investment VC know-how to the partnership. He is also an active angel investor with investments in Viddy, Wealthfront, STELLAService, BoostCTR, Clever, DNA Games, Blockboard, Adku, AdNectar, Loosecubes, BlueKai, eduFire, YieldMo, Safetyweb, ProsperWorks, Adisn, Umami, Brightedge, J.hilburn, FashionStake, and Slime Sandwich.

Both have been added to the List of Popular VC & Angel Blogs.

Image credit: Giant Fire Breathing Robot

Correction, I originally said they’ve closed the round but the filing actually indicates $0 raised so far, with the option to take up to $35M.

While they’ve probably got some soft commitments (these filings are generally a lagging indicator), no word yet on the fund being closed and ready to start making investments. The founders are also unable to discuss current fundraising activity public due to SEC regulations that don’t allow public solicitation for private investment by the company. The good news: if you’re an accredited investor you might still be able to invest. The fact that they’ve set a total raise amount that is higher than originally announced might indicate prospects for raising are looking good. Time will tell. (HT: Ryan Lawler)