-

Traction Tracker: 84 Y Combinator Companies With Significant Traffic Growth

What’s this music thing? I pair music with my posts, as I find it makes digesting spreadsheets a bit more fun. Enjoy!

I’ve been compiling stats about the Y Combinator, 500 Startups and Andreessen Horowitz portfolio companies to produce The Startup Index. Website traffic tells only part of a company’s story, but how it changes over time can reveal who is gaining momentum and attention online. Focusing on Alexa ranking deltas, rather than absolute numbers, also shines a light on enterprise, hardware and developer focused startups who would normally get pushed down low on any traffic-based ranking system.

I’ve been compiling stats about the Y Combinator, 500 Startups and Andreessen Horowitz portfolio companies to produce The Startup Index. Website traffic tells only part of a company’s story, but how it changes over time can reveal who is gaining momentum and attention online. Focusing on Alexa ranking deltas, rather than absolute numbers, also shines a light on enterprise, hardware and developer focused startups who would normally get pushed down low on any traffic-based ranking system.Imagine “Hot Companies” Lists Driven By Data, Not PR

Have you ever wondered how those “Top X of Y” posts are generated? Occasionally journalists will put out a request to PR people for companies that fit with a roundup post they’re working on. The PR firm will send over some logos and blurbs for a few companies that fit, and boom – you have 3-for-1 placement. But what if we used data to compile our own “Hot Startups to Watch” article by the numbers?

- 75% (84 of the 112) YC companies in the Alexa 250,000 grew their traffic since March

- Companies with traffic growth had a median delta of +4,130 positions, average delta of +11,121 positions.

- 35% (29 of the 84) of companies with traffic growth outperformed the average delta.

- 5% (4 of the 84) of companies with traffic growth are also members of the Alexa 500

Scroll below the spreadsheet for a little analysis on the top 10 companies.

Some have suggested it would be more useful to take the log of the March rank and compare it to the log of the April rank, to account for the fact that it is more difficult to go from the 10,000 position to the 1,000 position than from the 100,000 to 10,000 position in the Alexa global rank. I have created that data set as well, and the results are:

What would you do with this data? Let us know in the comments.

Quick Notes on the Top 10

You might wonder why successful companies like Weebly, Scribd, Airbnb, and Disqus are at the bottom of the list. Being listed at all means the company has grown its traffic in the last month, and made it into the prestigious top quarter million websites in the world. Ranking by delta calls attention to companies with the most upward momentum in their website traffic, relative to the other properties on the Internet. Moving from the 122 to 121st more popular website globally, as Dropbox did this month, is a big deal and could indicate an increase of hundreds of thousands of visitors.

Snipshot – I was excited to see a Winter 2006 company in the #1 spot. Some research reveals the site went up for auction on Flippa recently for $10,000 and some commenters mentioned they found the auction because Mark Zuckerbeg liked it (I’m assuming on Facebook). That might account for the traffic spike.

Get Going – Get Going is a YC company from last summer who launched their travel service a few weeks ago to let people get crazy good deals if they’re willing to let the service pick their destination. This traffic is most result of the classic “TechCrunch spike”, and it will interesting to see where things settle in a month.

AeroFS – It’s great to see a B2B company at #3 on the list, and AeroFS is helping large groups collaborate in the cloud of sensitive files. This is a classic big company problem of needing to keep confidential stuff inside the firewall, and exactly the kind of service to adopt if IT refuses to let you use Google Docs. Just last week they announced they’re out of beta on the company blog, and this feels like one of those “boring” companies that just chugs along in relative quiet and then is suddenly HUGE.

Ark – I couldn’t find any recent press or other activity to explain the increase in traffic, but according to Alexa ~50% of their traffic is going to livedash.ark.com, a service that let’s you search for anything said on national TV.

Ark – I couldn’t find any recent press or other activity to explain the increase in traffic, but according to Alexa ~50% of their traffic is going to livedash.ark.com, a service that let’s you search for anything said on national TV.Custora – The customer engagement and retention company announced they’ve landed a LivingSocial as a customer earlier this month, and they’ve also been actively updating their company blog with helpful content for customers.

AnyPerk – Announced a $1.4M round of funding from Digital Garage and others to expand their employee perk management services, and experienced a nice TechCrunch traffic bump. The website was also redesigned recently.

Firebase – James Tamplin’s company continues on a tear with the announcement that the app infrastructure service is now available to all developers.

PagerDuty – The company announced a $10.5 Million round from Andreessen Horowitz in January and have grown to 24 employees.

YouGotListings – The landlord management tool (I need this!) appears to be chugging along on minimal people and cash, with no other funding announced other than their Y Combinator / StartFund investment. I couldn’t find any recent news events, so I’d imagine most of the traffic bump comes from more active usage. They also mentioned their were revamping some features in February on the company blog.

Verbling – They launched Google Hangout powered language learning classes back in December and it looks like it’s paying off. They’ve got right now and a thriving multi-lingual following on Twitter.

Methodology Notes

Companies that have exited are not included. W13 companies are excluded from this analysis, and will debut in the April Y Combinator index later this month. I have limited the list to companies in the top 250,000 websites globally according to Alexa.

Many very successful YC companies who would be considered “stable” aren’t going to show up here if their traffic rank stayed the same or dropped a few positions over the past month. That doesn’t mean they’re not doing well, and in fact they’re likely growing as they convert more and more of their returning visitors into paying customers. The goal of this list is to identify the movers and the shakers, the up-and-comers, and the under appreciated growth of the early stage. You can check out the March 2013 Y Combinator Index for a ranked list of the entire portfolio as of March 20, 2013.

There are 94 other companies who also climbed the Alexa ranking in this period, but are not yet in the top 250,000 websites and I look forward to doing more analysis of these companies in a separate post.

-

Zombie VC Post – The Bug Report

What’s this? I usually pick a song I feel goes with the post and expresses my mood writing it. Enjoy, I hope it will enhance your reading experience.

I’d like to address some bugs from Yesterday’s Zombie VCs post, which provided a list of investors who were inactive in Series A deals in the past 6 months according to Crunchbase, a self-reported database of deals updated by startups and their investors as follow-up to a post about helping founders find active investors during the Series A crunch and avoiding taking meetings that are a waste of time.

I would like to express my appreciation to O’Reilly AlphaTech Ventures, MMC Ventures, Lightbank, Kepha Partners, Paladin Capital Group, Mercury Fund, Neu Venture Capital, Shasta Ventures, Genesis Partners, Magma Venture Partners, Kima Ventures, Greylock Ventures Israel, Softbank Capital, Carmel Ventures and Emergence Capital for reaching out to provide data and help me confirm they are currently actively doing Series A deals in recent months. Big thank you also goes to Shira Abel, who has been reaching out to Israeli VCs to get them updated and on the active list.

This index can be improved, but I will not stop publishing it monthly and even with flaws it helps entrepreneurs focus their efforts on the most active firms.

The Data Is Crap

I used data from Crunchbase, which is much less accurate than I thought it would be. I did expect some errors, but mistakenly thought the 6 month window was big enough to limit that and didn’t take the time to validate the list or contact the companies on it. I also limited the list to funds who participated in Series A deals in the past, but it turns out many of those were one-off deals from growth capital firms or follow-on from funds who primarily focus on seed. I should have taken more time to research this data, cross check with other sources, and at the very least reach out to some very obviously active firms like Shasta to find out more info before publishing.

I am still a huge advocate for Crunchbase, which I think is a treasure in the startup community, and encourage investors to update their profiles. I have also submitted a feature request to them to allow investors to update activity without revealing the companies, so we’ll see how that goes. Founders aren’t reading paid subscription data services or VC insider newsletters and I don’t think it is realistic to expect them to start.

The Methodology Needs Work

While I believe this first attempt raised some transparency around investor activity, a mea culpa is definitely necessary where methodology is concerned and I wholeheartedly agree with Fred Destin’s suggestions in ZOMBIE VCS TAKE II – HOW TO SPOT AN ACTIVE FIRM which jives well with in-depth methodology feedback I’ve received privately as well. I have included a list of corrections in the original post, and also updated active investors list for March 2013 as needed. Going forward I look forward to offering an updated active investors list, and I will be leveraging additional data sources that have been offered (thank you) and contacting companies.

Listing Inactive Investors is of Little Value to Founders

Creating a list of inactive investors isn’t very constructive, and is of little practical value of founders. What founders want to know is which investors are active, they care much less about who is inactive. I have been working through many ideas around the best ways to track fund performance which are still specific and transparent but are also credible and helpful, and I welcome your input in the comments, via email and on Twitter to help me improve this.

There were several smaller bugs as well, including:

- The title also turned out to be much more sensational than I would have expected, playing off of my previous “Zombie Startups” post

- The disclaimers about data quality were not clear enough to many readers

- The use of the “total deal participation size” number to sort the list was useless (and has since been removed, it is now alphabetical)

—

As a blogger I believe in offering insight based on experience, a data-driven perspective wherever possible, and actionable details that are useful for founders (like a list of investors who are actively doing deals) whenever possible.

I would also like to acknowledge, though I cannot name, dozens of people who have sent me tips and other info I am following up on, hopped on calls with me to explain their perspective and ideas for how to make this better and more useful for entrepreneurs and the ecosystem as a whole, opened up APIs and other data sources for additional research, and expressed their appreciation and shared personal stories. They bring a huge range of experience across the entire startup community including founders, associates, VCs with names you’d recognize, long admired heroes of venture and tech, quiet “guy behind the guy” types and everything else in between. I’m listening and working to bring their feedback into the content I create in the future. I know I will not win over people who don’t want this information made public, and quite honestly I just don’t care. This one’s for all the founders in the struggle.

Thanks to Fred Wilson for the inspiration on how to craft this post.

-

Zombie VCs

This post uses publicly available data on Crunchbase and has elicited a strong response from the tech community in general. I am making corrections as I receive them and you can scroll to the bottom of the post to see a full list of my changes. The list has been updated to read in alphabetical order, and I have posted a follow up bug report on the data and methodology.

I am going to say what most investors and many savvy entrepreneurs in Silicon Valley know but aren’t saying: just as there are zombie startups, there are zombie VCs out there and they walk among us. These are partners at venture firms who are 3-5 years into investing their fund, don’t have very strong results so far, and are struggling to raise new funds. These investors are not doing new deals, opting instead to use their remaining capital to double-down in follow on rounds with their existing portfolio, but in some cases they’re taking meetings anyway.

How to Spot a Zombie VC When Raising Your Series A

In the same way at a VC will often send you to an associate because they’re “too nice” to say no, zombies will meet with you and make you feel like you’re making progress on the fundraising path, but can ultimately wind up being a huge waste of time. Since you don’t have your own associate to pass them off on, you need to watch for the warning signs yourself and ruthlessly protect your precious time. You’re here to raise money and get back to work, not make friends.

- They haven’t made any series A investments in the past 6 months

- They haven’t invested outside their existing portfolio in the past 3 months

- They haven’t made ANY investment in the past 3 months (after a more regular pace in the past)

- They tell you they’re re-focusing on later stage deals, or raising a new fund

Once you have identified that you may be meeting with a zombie it can be frustrating, but what you need to understand is that just like Bruce Willis in the 6th Sense zombies usually don’t realize they’re dead. Politely complete the meeting and update your spreadsheet accordingly when you get home. If they contact you to set up another meeting or request that you send over your deck it is appropriate to ask them how serious they are about doing new deals before you provide more information (decks get emailed around) or offer up more of your time.

If the investor seems angry with you for asking about their (lack of) recent Series A this is a red flag.

You have every right to do your due diligence on them. On to the next one.

Doing the Diligence

In my previous post, I listed the most active Series A investors, and my advice to entrepreneurs was to start by pitching investors you know are actually doing Series A.

This is a list of funds who may be doing deals, have participated in Series A in the past, but have not publicly done a Series A in 6 months or more. The data is sourced from Crunchbase and includes investors who have previously participated in a Series A investment which was publicly announced, but not in the past 6 months. It includes active institutional investors as far back as January 1, 2012 who have participating in lifetime total deals of $20,000,000 or more (to reduce inclusion of angel funds). The list is sorted by total deal participation size, to show the most well-known investors first. Some of these investors are late stage in general, so they’re probably not great to pitch for your first round of venture funding but that doesn’t mean they’re not doing well overall.

Investors, have you been included in this list in error? Please let me know about a Series A deal you’ve done in the past 6 months (I don’t need the details, just your word) so I can get you off this list and onto the active Series A investors list. My email is morrilldanielle (at) gmail.com

Editor’s Notes: Updated to clarify that the Crunchbase data set only includes publicly announced investments.

I’m updating the list as I learn more from the community, and many investors below have been moved to the active Series A investor list.

I would like to express my appreciation to O’Reilly AlphaTech Ventures, MMC Ventures, Lightbank, Kepha Partners, Paladin Capital Group, Mercury Fund, Neu Venture Capital, Shasta Ventures, Genesis Partners, Magma Venture Partners, Kima Ventures, Greylock Ventures Israel, Softbank Capital, Carmel Ventures and Emergence Capital Partners for reaching out to provide data and help me confirm they are currently actively doing Series A deals in recent months. I have also removed late stage investors who do not typically do Series A deals, seed funds that do not do Series A, and biotech focused investors as I identify them.

Big thank you also goes to Shira Abel, who has been reaching out to Israeli VCs to get them updated and on the active list.

-

119 Investors Actively Doing Series A Deals Since March 1st

Strategy #1 for Surviving the Series A Crunch: If you must pitch, at least pitch investors who are doing Series A deals right now. It will save you time and heartache.

Despite the doom and gloom predictions about Series A Crunch there were 119 institutional investors (according to Crunchbase) who participated in a Series A round since the beginning of March 2013. I have

ranked them by historical deal involvement size, and as a rule of thumb companies nearer to the top of list list are more likely to lead Series A rounds and companies lower on the list are more likely to participate (there are tons of exceptions)updated the list, based on a great deal of helpful feedback, to show the funds alphabetically. I hope to offer more data on fund size and percent of capital deployed in the future.Hey investors, do you belong on this list? Get busy! Or, if I missed your deal let me know and I’ll update it. My email is morrilldanielle (at) gmail.com – I am actively updating this list regularly.

Active Series A Investors January 1, 2013 to Present

-

PopExpert Raises $500,000 Seed Round for Lifelong Learning Marketplace

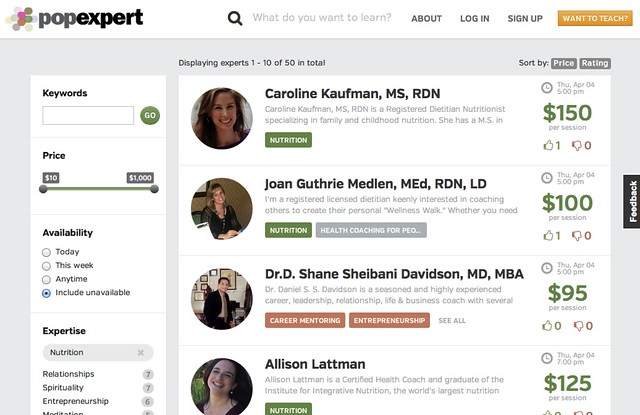

San Francisco based PopExpert has raised a seed round for its live video service, according to documents filed with the SEC. The website connects people who want to learn new skills to a broad range of experts, let’s learners search by price and availability, and handles the scheduling and payments. Yesterday they featured 3 popular guitar teachers offering lessons on their site, and have experts in other areas like nutrition, entrepreneurship, software development and many more categories.

San Francisco based PopExpert has raised a seed round for its live video service, according to documents filed with the SEC. The website connects people who want to learn new skills to a broad range of experts, let’s learners search by price and availability, and handles the scheduling and payments. Yesterday they featured 3 popular guitar teachers offering lessons on their site, and have experts in other areas like nutrition, entrepreneurship, software development and many more categories.

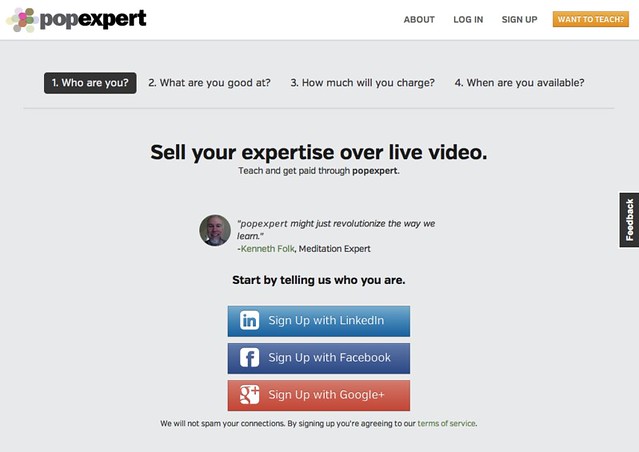

Experts can sign up to offer their services, set their own price and manage their sessions through Pop Expert – making it somewhat similar to Clarity which allows individuals to manage phone based “clarity calls” offering coaching, expertise, and advice.

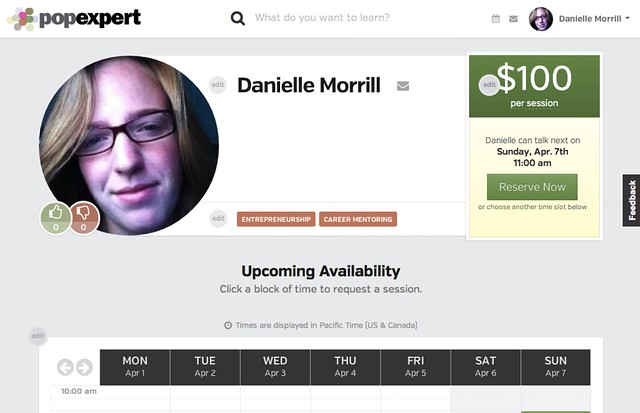

According to Facebook, I have 1 friend already using this app and it is being used by 300 others – pretty awesome traction for a company that appears to be flying a bit below the radar until now. I’ve signed up to teach so I hope you’ll come check out my profile and sign up for an available time slot.

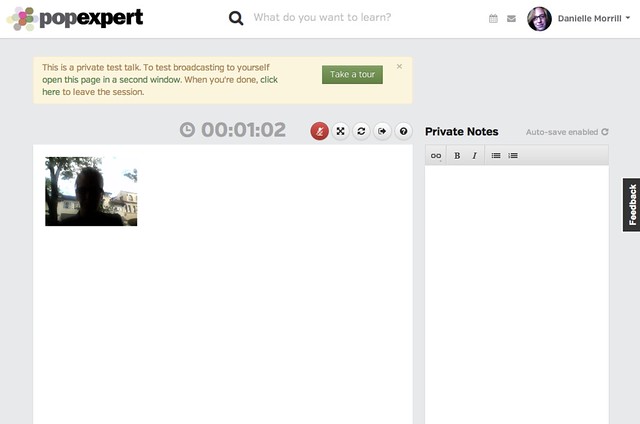

I just tested out my video connection, and I’m ready to rock.

PopExpert is cofounded by CEO Ingrid Sanders and CTO Jeremy Thomas, who share a background at The Active Network and the service is currently in private beta. You can visit their website to request an invitation.

-

Is Digg “A Thing” Again?

Ars Technica tech policy writer Timothy B. Lee tweeted this morning that news aggregation service Digg is “a thing” again, which I hope means he’s seen some meaningful traffic and distribution of one or more of his pieces through the service.

My traffic stats suggest that digg is a thing again.

— Timothy B. Lee (@binarybits) April 4, 2013

After being purchased by Betaworks last year Digg has undergone a makeover, and some bloggers lamented that this previously regular source of traffic wasn’t what it used to be. Are you seeing an uptick in traffic from Digg distribution of your stories?

-

IPO-Bound Flurry Looks to Double Headcount, Launch Real-time Bidding Platform

Flurry, the Google Analytics of mobile applications used in nearly 300,000 mobile applications, is widely rumored to be IPO-bound though no official paperwork has yet been filed. One job listing mentions that the role will include “managing policies and procedures required to ensure full IT compliance with SOX 404 and all other laws, regulations, and SEC requirements in anticipation of Flurry’s IPO”.

Flurry, the Google Analytics of mobile applications used in nearly 300,000 mobile applications, is widely rumored to be IPO-bound though no official paperwork has yet been filed. One job listing mentions that the role will include “managing policies and procedures required to ensure full IT compliance with SOX 404 and all other laws, regulations, and SEC requirements in anticipation of Flurry’s IPO”.Our sources tell us the company is on track to double their headcount this year, and the 105 person organization currently has 50 open positions they’re looking to fill including director roles in Evangelism, Partner Integration, IT, Product Management, QA and Sales.

As ambitious as this sounds, the company doubled last year and shows no signs of slowing down after hitting cash flow positive and raising another large chunk of funding at the end of 2012. Flurry provides analytics services to developers for free and uses the anonymized data they collet to help developers increase their audience with targeted in-app advertising across their ad network, tracking over 1.2 trillion anonymous aggregated user sessions per month.

Launching a Real-time Bidding Marketplace?

In early March Flurry competitor Tapjoy announced the launch of their mobile advertising platform out of beta, and with it came a real-time bidding platform. A little sleuthing (Google, actually) reveals that Flurry is currently hiring for a Realtime Bidding Manager and has posted their Terms of Service for a realtime-bidding marketplace, which describes the service as:

…the automated real-time auction service that enables you to bid on and purchase inventory for the placement of Ads in the Flurry RTB Marketplace, a virtual marketplace where you may buy inventory for yourself or on behalf of third party advertisers (“Advertisers”) from sellers. “Ads” means your text, graphic, rich media and other advertising materials. The Flurry RTB Service enables you to deliver Ads through the Service by responding to ad requests delivered through Flurry’s real-time bidding application programming interface (the “API”) with a CPM-based bid price for that impression (the “Bid”)

While the TOS page is live, it is unclear whether this service is live to customers and we have reached out to Flurry and will update this post when we hear back.

The bottom line: The launch a real-time bidding platform is the inevitable next-step in Flurry’s path to IPO. But with Gartner estimating the mobile advertising market will continue to double over the next three years, reaching more then $20 Billion by 2015, mobile advertising is hardly a winner take all market. I also wonder whether Tapjoy is considering IPO plans as well, and I’m curious whether Google has made overtures to purchase one of the two companies.

-

Startup Investment Hits 3.5 Year Low in December, Q1 M&A Slowest Since 1995

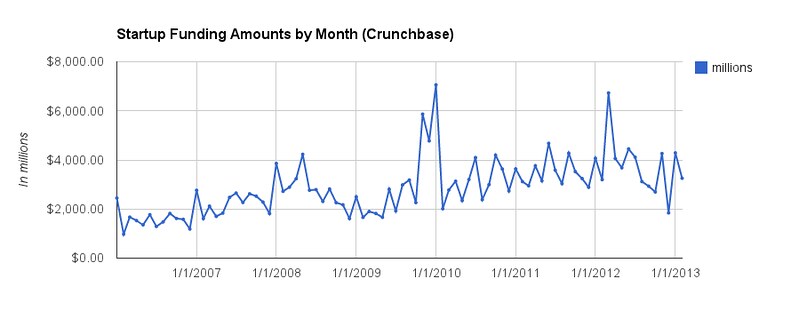

According to investments reported in the Crunchbase database, this winter investment dollars flowing to startup companies reached low point not seen since May 2009.

Even more concerning, on Monday the National Venture Capital Association reported that venture-backed IPO exits fell to a 3 year low in the first quarter of 2013, while M&A was at its lowest point since 1995.

According to the article:

The number of venture-backed IPO exits during the first quarter of 2013 fell 58 percent compared to the first quarter of last year. For the first quarter of 2013, 77 venture-backed M&A deals were reported, 10 of which had an aggregate deal value of $984.3 million, a 73 percent decrease from the first quarter of 2012. This marks the slowest quarter for number of disclosed deals since the first quarter of 1995*, when eight disclosed deals were completed.

“First quarter IPO and acquisitions activity is often subdued as year-end reporting and forward planning take priority, but this year political, taxation, and sequestration concerns weighed even more heavily on the exit market for emerging growth companies. Therefore, activity was especially slow,” said John Taylor, head of research for NVCA. “That said, public market valuations have been up recently, 2012 financial statements are being finalized now, and quality companies tell us they are starting the process toward an exit later in the year. Despite having waited for the right opportunity to move forward, the 2013 class of companies that goes public or gets acquired will have to be solid. Barring significantly adverse events, we expect stronger volume in the second and third quarters.”

*emphasis added

I’m unclear why the tech press did not report on this, and can only speculate they were too busy curating lists of April Fools Day pranks to notice. Or maybe they thought this was a bad joke from the NVCA?

-

Indexing the Andreessen Horowitz Portfolio Companies – Pinterest, Twitter and Github on Top

Over the past few weeks I’ve been indexing groups of startups, starting with the Y Combinator index and 500 Startups index. I’ve received a lot of requests for other indexes, and the company whose portfolio everyone wanted to look at was that of the Silicon Valley venture capital firm Andreessen Horowitz.

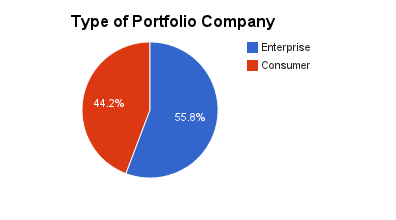

Portfolio Overview

Andreessen Horowitz has an impressive list of exited companies in 3 IPOs (Facebook, Groupon, Zynga) and 3 acquisition from high profile companies: Nicira (acquired by VMWare), Instagram (acquired by Facebook), and Skype (acquired by Microsoft).

For this post my research covers companies that have not yet exited.

Andreessen Horowitz Consumer Startup Index

Andreessen Horowitz Enterprise Startup Index

The enterprise index is entirely based on traffic at this point, since Facebook MAUs aren’t useful for this segment of companies. We are working on collecting more useful revenue / unit economics data for ranking these companies and know this does not accurately reflect their progress. For example Apptio is in the #31 spot but is preparing for a possible IPO.

Methodology

The index takes into account website traffic ranking globally, as provided by Alexa, along with a weighted average of Facebook monthly active users (MAUs). While traffic is only one part of the story, how it changes over time can provide a useful proxy for evaluating how the company’s reach and attention received from others. There are many other indicators of a companies health that I will take into consideration in future indexes, but for now this is presented as a very simple overview of the companies. I split apart the consumer vs. enterprise companies to make it more of an apples to apples comparison.

I have also included Quantcast rankings, as many people seem to think they are more credible. Overall I found their data set had too many gaps to be useful, although we may weigh it into the average in the future.

Editor’s Note: This is the first index of this portfolio so it does not show each company’s change in rankings over time. I will show that in the next index of this portfolio, one month from now.

Missing Companies

These companies are taken from the AH website, Crunchbase, AngelList and other public announcements. If I missed something please let me know in the comments or email me at danielle (at) refer.ly

-

The Stable Song – Gregory Alan Isakov

remember when our songs where just like prayers.

like gospel hymns that you called in the air.

come down come down sweet reverance,

unto my simple house and ring…

and ring.ring like silver, ring like gold

ring out those ghosts on the ohio

ring like clear day wedding bells

were we the belly of the beast or the sword that fell…we’ll never tell.come to me clear and cold on some sea

watch the world spinning waves..like some machinenow i’ve been crazy couldn’t you tell

i threw stones at the stars, but the whole sky fell

now i’m covered up in straw, belly up on the table

well and sang and drank, and passed in the stable.that tall grass grows high and brown,

well i dragged you straight in the muddy ground

and you sent me back to where i roam

well i cursed and i cried, but now i know…now i knowand i ran back to that hollow again

the moon was just a sliver back then

and i ached for my heart like some tin man

when it came oh it beat and it boiled and it rang..its ringingring like crazy, ring like hell

turn me back into that wild haired gale

ring like silver, ring like gold

turn these diamonds straight back into coal.