-

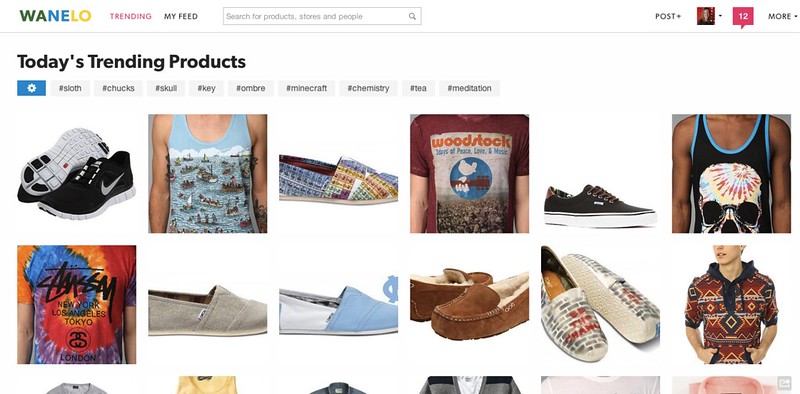

Social Shopping Site Wanelo Launches New Vertical For Men, Rises to #7 in Lifestyle Apps

Update: It’s a bit unclear whether this is a new vertical or simply an easier way to see men’s products that have actually been in Wanelo all along. The Wanelo blog has a series called Manelo Monday’s featuring menswear-focused users which indicates they’ve been around longer than we thought. We have reached out to Wanelo for comment.

—

CEO Deena Varshavskaya announced today that Wanelo has rolled out their popular “shopping entertainment” service, which was previously gear towards hip Pinterest-loving women, for men as well.

CEO Deena Varshavskaya announced today that Wanelo has rolled out their popular “shopping entertainment” service, which was previously gear towards hip Pinterest-loving women, for men as well.

The service curates the best shopping from popular sites like Pinterest, but ensures you can buy everything you find – a common frustration for otherwise satisfied Pinterest users.

The Wanelo Shopping iPhone has quickly risen in the Lifestyle category, and currently holds the #7 spot in the category as well as the #93 spot for free apps overall according to AppData.com. The company also made headlines last week for raising their Series A at a $100M+ valuation.

Check out Wanelo for men

We have reached out to Wanelo for comment and will update when we hear back.

-

Introducing Tokkr – April Fools!

A few weeks ago I announced that Referly would be pivoting, and that we would no longer offer cash rewards for purchases generated on the platform after March 31st. Yesterday, we paid out our last rewards and today I am excited to announce that we have decided to turn our focus to a side project we’ve been excited about for sometime: Tokkr.com

I just stood up the web server this morning!

Those who know me understand that I tend to be a bit type A, but I am hoping this project will give me some time to chill out and achieve a bit more work/life balance. Even cooler, it will be powered by our Reefer.ly commerce platform so we can reuse a lot of the sweet code we’ve already written – so instead of hiring and managing engineers we can take off for Thailand and post tons of amazing pictures of us growth hacking.

What is Tokkr?

And for that matter, how does Reefer.ly work? Well from the names of our two products it should be obvious that we are creating a high end, bespoke, hand curated service for people who want to get high. Tokkr will be a consumer site where people can share their favorite experiences, photos, quotes, all in a social, beautiful way. Think of it as Pinterest meets Potspace, or maybe Quora meets Weed Forums.

We’re not totally sure yet since we’ve written one line of HTML and derped around with httpd conf for a few hours for no good reason, but we went through YC so obviously we’ve got what it takes to figure this baby out. In fact PG has some great insights on weed trees, weeding out people, and not dying that I found very relevant.

You can enter your email here to get updates and find out when we officially launch. Anyone who signs up today will get 50% off all products on Reefer.ly and Tokkr for LIFE!

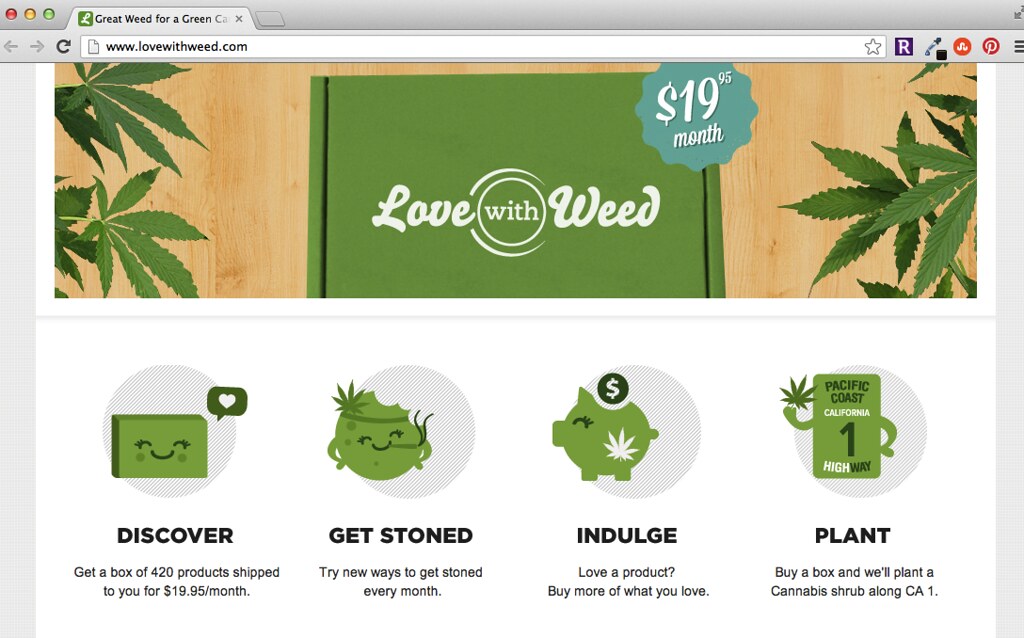

Our First Partner

We has such a great time working with Love with Food, who were our first paying API customer on Refer.ly, and we are excited to share that they have launched Love with Weed this morning to much fanfare. The site looks gorgeous and we can’t think of a better gift to give your friends.

Onward!

UPDATE: We forgot to mention our awesome friends at Pusher will be powering realtime updates. (Full disclosure: Pusher cofounder Damien Tanner is an investor).

-

AngelList Receives SEC No-Action Letter Two Days After FundersClub

Updated at 1:53pm PST with comments from AngelList CEO Naval Ravikant.

On March 26th The Funders Club received a no-action letter from the Securities and Exchange Commission stating that it will not recommend enforcement action against the year-old private equity investment platform, making it the first government sanctioned online VC.

What has not yet been reported is that AngelList, a competing service used by early stage companies to receive introductions to investors and take some online investment, received its own no-action letter just two days later on March 28th (embedded below). While being first makes for great PR, FundersClub can expect AngelList will be the first of many competitors to emerge now that its business model has been validated.

The letter to AngelList also mentions a currently unformed business entity with an identical model to that of The Funders Club:

AngelList Advisors LLC (“AngelList Advisors”) intends to form a limited liability

company and register as an investment adviser either with the Commission or one or more states.

AngelList Advisors will be a wholly-owned subsidiary of AngelList or its affiliate. AngelList

Advisors proposes to establish a new angel investing platform (or part ofits existing website)

that will assist AngelList Advisors and accredited investors (“Investors”) in identifying

companies that seek capital and in which one or more so-called “angel investors”3 intend to

invest (each such company, a “Portfolio Company”). If Angel List Advisors identifies and

approves ofboth a Portfolio Company and an angel investor (referred to hereinafter as a “Lead

Angel”), then AngelList Advisors will form a separate investment vehicle (“Investment

Vehicle”) for the sole purpose ofinvesting in that Portfolio Company. You state that the

Investment Vehicle will likely be structured as a limited liability company or limited partnership,

and will be responsible for all organizational costs and expenses associated with its formation

and the investment in the Portfolio Company.4 You also state that AngelList Advisors will

provide the initial capital required to pay such organizational costs and expenses.UPDATE – 1:53PM PST: I have just spoken with AngelList CEO Naval Ravikant, and he has confirmed they have received this letter from the SEC. According to Ravikant, their funding vehicle has been enabled for 28 companies to date and generated $2M in funding in the past month. He also says AngelList on the whole now generates around $10 Million in investment commitments monthly to the larger community of startups receiving introductions on the platform.

He also told us they expect to make money on other services not related to investing, such as Angel List talent which according to Ravikant, “has growing 2-3x in the past month with 1600 mutual matches of about 600 candidates, with 3300 companies recruiting and a reported 5% close rate. AngelList hired their last 3 engineering team members on their own platform”. Giving the hiring challenges in Silicon Valley, this could be huge. Currently AngelList does not charge for talent placements or listing.

“We didn’t really announce this since a lot of it seems like behind-the-scenes inside baseball. It lets us know the legal boundaries of what’s possible in the space and will inform our future products, but right now we’re happy with the SecondMarket partnership – SM vets investors for sophistication, companies for background, and provides Broker-Dealer level protection and compliance.

The /Invest[sic] feature on AngelList is working well so far. We do curate the opportunities to those with a high-quality lead investor, and to date we’ve announced 7 fundings, 14 are closed or in closing, 18 are currently open for Accrediteds, adding about one per day. We’ve received over $6M in commitments in the last Quarter in 915 separate transactions. We have 12,000 Accrediteds on AngelList, and via our SecondMarket Partnership, can reach another 20,000.

Unlike others in the space, we don’t think we can pick the winners – rather, it’s a more open approach for any company with a high-quality lead investor. We also don’t view it as a money-maker for AngelList – more of a community service. We also think it makes sense to augment it with our base service of introducing high-quality companies to sophisticated investors (VCs, Seed Funds, Professional Angels) – we currently drive 500-700 of those introductions per week, and drive about $10M / month there.”

AngelList SEC No-Action Letter from March 28, 2013

Www.sec.Gov Divisions Marketreg Mr-noaction 2013 Angellist-15a1

FundersClub SEC No-Action Letter from March 26, 2013

Www.sec.Gov Divisions Marketreg Mr-noaction 2013 Funders-club-032613-15a1

-

Purity Ring “Grammy”

-

Facebook Actions Are Coming to Status Updates

Update: A source close to the company has confirmed this new functionality is available as option in the Facebook status composer. For now this works on the web and m-touch for some users, but not yet on mobile. I think this might be the visual sharing reported by TechCrunch in January this year, but I don’t have the functionality in my own Facebook account so it is hard to tell.

—–

When I saw this status update in my Facebook news feed I did a double take. Can you spot what’s different about it?

I clicked through on the word “coffee” and was taken to the coffee interest page.

It turns out TechCrunch wrote about the introduction of Facebook actions over a year ago. As the article explains:

The new app actions are basically a conceptual expansion of actions posted by apps like Spotify and the Washington Post, and use verbs and nouns that go beyond the non custom actions like “listen†“watch†and “read†to “bought,—spot,—pose,—want,—love†and “become an expert.â€

While these actions were announced as available from within apps, this is the first time I’ve seen it used in my news feed outside of app-generated actions such as “liked” (Facebook) or “listened to” (Spotify) or “pinned” (Pinterest), and I’m not even sure it was generated with an app – it appears like a written status message with no application source.

I tried to update my status to mention the “coffee” interest page and see if it would automatically prompt me to select an action, but no luck.

While initially I was just curious to figure out what Facebook might be doing, it’s clear that being able to organize the actions we’re taking in life like drinking coffee right now could help Facebook better target advertising. I’m sure Starbucks would be interested to know that I drink coffee every day.

-

Numbers in Action

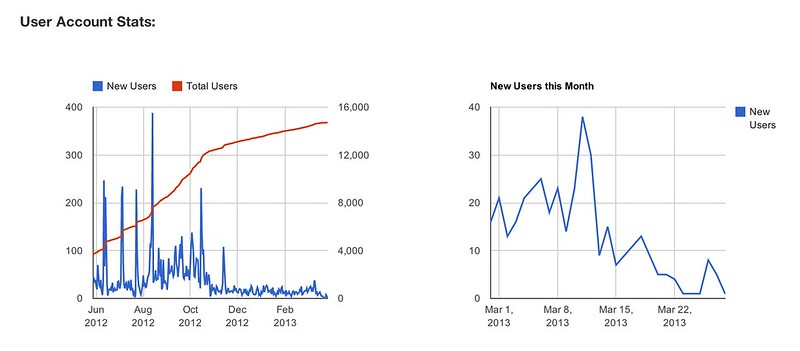

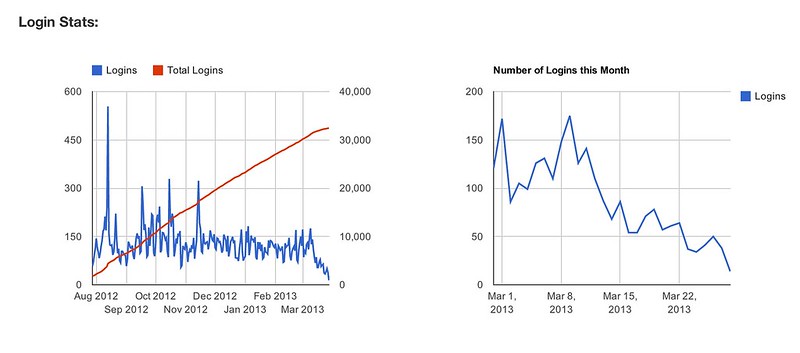

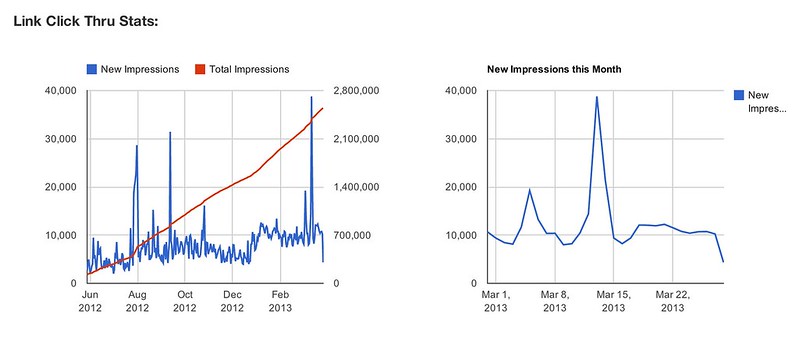

If you haven’t heard, Referly is switching gears to avoid becoming a “Zombie Startup”, and we’ve already posted a high level summary of our metrics on the front page of our site. This post is part of my ongoing retrospective, which is helping me get some closure while we incubate our next direction as a company.

Until 3 weeks ago I woke up early every day, eager to check our internal dashboard, Amazon Associates and Skimlinks and update a couple spreadsheets, set a goal or two for the day to keep us on track, and send an update email to the team with any adjustments to the week’s plans. There’s nothing I love more than operating the day-to-day. It was a joy to plow full steam ahead with our team of 8 content, engineering, and outreach folks. Seeing these numbers drop over the past few weeks has been painful, so after I post this it will be the last time I visit these operational tools for awhile, and probably my last post about Referly until we share what we’re doing next. Memento mori

I offer these metrics to you without analysis… and look forward to answering your questions and providing more insight in the comments depending on what you’re interested in.

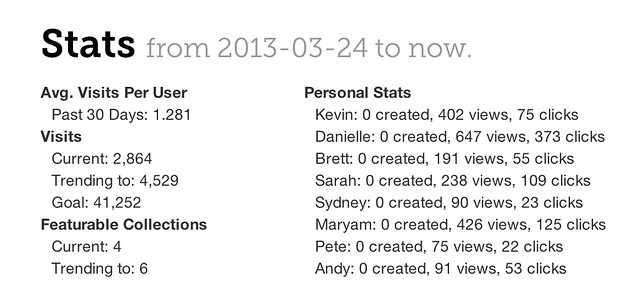

Weekly Pace & Contributur Stats At A Glance

Each week we’d set goals for the week in our Monday team meeting. At our peak, we produced nearly 100,000 pageviews in a single week. The “X Created” stands for collections created. Engineers were asked to created 7 per week (and they were awesome!), everyone else on the growth team (myself, Andy, and our wonderfully creative interns) created 20-40 depending on our goals and the seasonal campaigns going on.

These show 0 created for everyone because this is a snapshot from today, but normally this would show the number of feature-worthy collections created (has cover photo, title, description, at least 3 pieces of content).

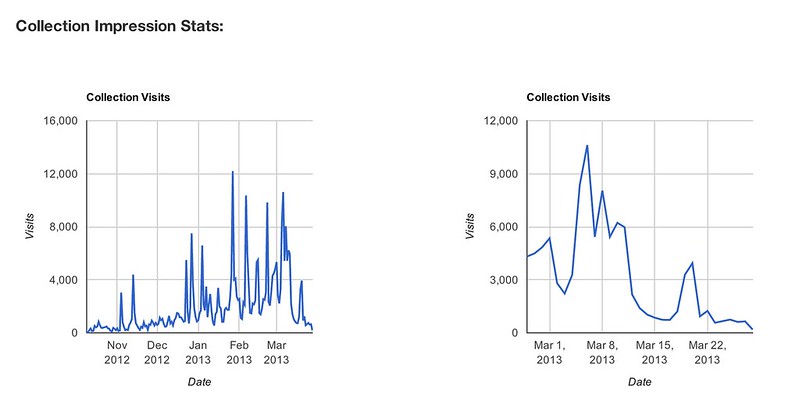

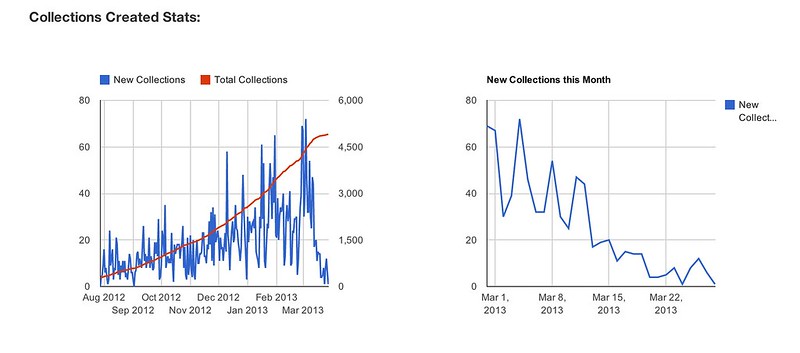

Daily & Monthly Stats

For each metric the graph on the left shows daily stats for all time, and the graph on the the right shows daily stats for the current month (so you can see more detail).

That’s it.

Show Me the Money

You might be wondering why we didn’t share a graph for revenue or gross merchandise sold. This is intentional. I believe that whatever you measure and share is what people will focus on. Having a dashboard for individual revenues earned, or each aggregate revenue, would distract us from our number one priority: creating awesome content people would love reading and sharing. While I tracked this data and shared it with the team periodically it was never the focus of their attention. I set out content generation and traffic goals based on the ultimate revenue goal, but revenue wasn’t something the content team worried about from day-to-day.

Sometimes I wonder whether we would be pivoting now if every person in the company had been focused on maximizing revenue in every piece of content they produced from day one. While I think we might have earned marginally more money in the short term, I think the quality of our content would have been much lower overall and ultimately we wouldn’t have been able to attract the right readership or community of content producers.

To Be Continued…

Over the past year I’ve shared more about Referly than I ever expected to, and I hope seeing these metrics gives you (especially other founders) a sense of what things look like under the covers of a company that is growing, hitting goals and getting PR. Personally, I have learned so much about how to operationalize a technology-enabled media business that consistently puts out content that drives meaningful traffic and keeps people coming back. While we are no longer paying rewards, people from our community of more than 25,000 writers are still logging in and producing new content every day with our awesome edit-in-place CMS. You can absolutely sign up to use Referly as it is today (this link can’t be found on the site, just a little perk for my readers!), and you’ll be among the first to hear what’s next.

—

Do you need to create a business dashboard for your company? This one of my favorite things to do as a company mentor/advisor, and right now I am looking for opportunities to try different approaches and use some of my spreadsheets and other graphing and analytics packages. If you are interested, and willing to pay for my time (in money or beers or coffees) please get in touch at morrilldanielle (at) gmail.

-

YC Entrepreneurs Rewarded With a Yawn

My site was having hosting issues this morning but I really wanted to get this “morning after” post out, reflecting on the reactions to Y Combinator Demo Day yesterday among friends, investors and the press. You can read the full article on my Distribution Hacks blog “YC Demo Day, the Morning After”.

—–

Apparently, this year it’s particularly in vogue to express a certain ennui about the batch of Y Combinator startups that presented at Demo Day.

As I checked in with investors and friends who attended the event, the overwhelming response was that there were tons of solid companies but nothing “amazing†or “10xâ€.

Even the tech press can’t seem to get behind one single company…

-

Meet the 9 Female Founders of Y Combinator’s Winter 2013 Class

This post is part of my continuous coverage of Y Combinator Demo Day for the Winter 2013 Class. You can see all publicly launched companies from today’s presentations here.

—

It’s always exciting to see more female founders, and the Winter 2013 YC batch brings us some awesome new faces (and some familiar ones). These are only founders from publicly launched companies – feel free to contact me at morrilldanielle (at) gmail if I’ve missed something. Enjoy!

Editor’s Note: Updated to include Iolanthe Chronis from Swish.

Iolanthe Chronis – Cofounder & CEO at Swish

Prior to founding Swish in August 2012 she held roles at Kayak, BetterOffline and Microsoft.

Iolanthe received her Masters of Engineering, EECS in 2010 from MIT and also holds a B.S., EECS, Physics from MIT.

Rosanna Yau – Design Cofounder at Backerkit

Rosanna graduated from the California College of the Arts Design MFA program in Interaction Design, and from the University of California Davis Design program with a BS in Visual Communications. In addition to life as a busy cofounder she also is a lecturer for a Community Arts course at CCA. Check out her portfolio and follow her on Twitter.

Photo credit: Mashable

Cindy Wu – Microryza

Cindy is a transplant from Seattle, where she was previously a Research Scientist and Engineer @UW Bioengineering. Microryza was built to serve herself and her colleagues who struggled to fund their own projects even as PhDs. Now they’re enabling anyone to become a modern day patron of science.

She is also a published scientific researcher and received her B.S. Cellular, Molecular, and Developmental Biology in 2011. Follow her on Twitter.

Photo Credit: WeFunder

Grace Garey – Watsi

Grace heads up marketing for Watsi, and previously has experience in the non-profit space working for Kiva, Sandbox Suites, Walter H. Capps Center for the Study of Ethics, Religion, and Public Life, and International Rescue Committee.

She is a Capps Congressional Fellow, studied abroad at the University of Ghana in Legon for 6 months in 2009, and lived abroad in India with the Swami Vivekananda Youth Movement in 2012.

Erica Brescia – Cofounder & COO at Bitnami

Erica joined BitRock as VP of Business Development in 2005 and served in that role for nearly 3 years before becoming CEO. According to her Linked in profile she is still CEO of BitRock and founded Bitnami in 2011.

Prior to BitRock she spent 3 years as a manager at T-Mobile. She has a BS in Finance from the University of Southern California.

Photo Credit: About.me

Kelly Lau-Kee – Cofounder & Chief Product Officer of PayTango

Kelly was previously at Google as a UX design intern for YouTube and is currently Senior at Carnegie Mellon University double majoring in Human Computer Interaction and Industrial Design. Her academic honors include the Presidential Scholarship and Inc. Magazine, America’s Coolest College Startups 2013.

Photo Credit: PayTango

Kendall Herbst – StyleUp

Formerly an editor at Conde Naste for well-known fashion publications like Lucky, InStyle, and New York Magazine she’s now striking out to disrupt the magazine industry.

Kendall also is currently an MBA student at the MIT Sloan School of Management.

Vanessa Torrivilla – Design Cofounder at Goldbely

Prior to Goldbely Vanessa headed up UX and Visual Design at Blip.tv, and was a Senior Interactive Designer for Gilt Groupe. As is the team’s “Food Wench” (don’t get all up in arms, this is a pirate reference which makes more sense when you see their awesome map-themed about page about being “explorers of food”) Vanessa handles UI/UX and all things creative at Goldbely.

As a self-described “metal head” I hope that includes rocking out with some excellent tunes! Follow her on Twitter and check out her Dribbble portfolio.

Photo Credit: Goldbely

Fei Deyle – CEO & Cofounder of Lollipuff

Fei is an electrical engineer turned fashion blogger turned CEO, and admittedly quite the fashionista. In fact, she is the lead blogger for her own site under the pseudo-name Bebefuzz. She is a trusted online brand authenticator, and previously worked a senior sales person in the power industry.

Photo Credit: Lollipuff

Michelle Crosby – Wevorce

Wevorce makes going through a divorce less financially and emotionally painful for everyone involved. Michelle gives a great interview about her passion, personal story, and vision for the future:

Wevorce introduction from wevorce on Vimeo.

-

Watsi and the Future of Patronage

This post is part of my continuous coverage of Y Combinator Demo Day for the Winter 2013 Class. You can see all publicly launched companies from today’s presenters here, Watsi is currently ranked #7.

—

While Watsi will probably not take in capital on traditional VC terms, I hope they can capture the imagination of some folks in the audience and gain new donors.

.png?1332528504) Today Watsi, a non-profit for funding medical treatments, is presenting on stage at Y Combinator Demo Day by cofounders Chase Adam, Jesse Cooke, and Grace Garey. The company made quite a splash back in January when they were announced as the first non-profit to receive funding from YC.

Today Watsi, a non-profit for funding medical treatments, is presenting on stage at Y Combinator Demo Day by cofounders Chase Adam, Jesse Cooke, and Grace Garey. The company made quite a splash back in January when they were announced as the first non-profit to receive funding from YC.Hilarious by @paulg “There’s one company here today that’s a nonprofit. An intentional nonprofit!”

— Sundeep Peechu (@speechu) March 26, 2013

I am admittedly a bit of a curmudgeon when it comes to donating to charity, but after seeing Watsi present yesterday and reading this post “The Bacon Wrapped Economy” about the end of cultural patronage as we know it, it got me to thinking. Maybe this is exactly the kind of platform people like me can get behind.

The East Bay Express paints a bleak picture the future for philanthopy, suggesting that our outcomes-focused giving will fail to build the kinds of institutions that have perserved American culture for the past 300 years.

And according to Medak and other members of the art world, it’s not just the donors themselves who are changing; it’s the entire ethos — and that may mark a change in a system that’s been more or less the same since the Renaissance. “A lot of those philanthropic dollars are now going to programs with measurable outcomes,” Medak said. “This shift toward a more transactional relationship in philanthropy, where you give something and expect to get something concrete back, has continued to escalate. The entrepreneurial infatuation we have now — and I don’t mean that in a loaded way — comes with a notion that the things we’re investing in should have a potential to [make] returns. It’s antithetical to the kind of philanthropy that has built institutions in this country.” Medak didn’t mention the logical, eventual corollary to this — that an end to institution-building philanthropy can also mean an end to the institutions themselves — but it doesn’t feel entirely far off.

I’m not so bearish. In fact, I wonder if the Internet can finally bring the meaning and accountability that has been lacking for young donors who won’t be building a hospital in their name, but simply want to feel they’ve made an impact on an issue they care about.

Old Money, Old Mindset?

The post goes on to explain that most patronage typically comes from older generations who have had a lifetime to accumulate their wealth. I can hardly complain – visiting the local museums, structures, monuments, artwork and other results of this philanthropy is a pleasure. I would never make the argument that this is an either/or situation where all funds should move away from arts and toward solving the world’s problems.

However, I think charitable giving needs to be aligned with the values of the people donating money, and it’s possible that those values have shifted for a younger generation toward institutions that solve real world problems.

In the case of Watsi, the public is clearly in support of a new institution that works to support those in need of medical attention around the world. Operating like a startup and providing an unbelievable amount of transparency is mostly a marketing gimmick today, but long term it could reset the expectations for a new generation of givers.

Today’s Demo Day at the Computer History Museum attracts high net worth individuals, investors and professionals looking to put their charitable giving to work, so while Watsi will probably not take in capital on traditional VC terms I hope they can capture the imagination of some folks in the audience and gain meaningful new donorship.

Wish them luck today, and take a moment to make a donation to Oumar, a 19 month old child whose life is threatened by meningitis and chronic epilepsy. He needs just $1370 to save his life, and 100% of your donation goes directly to his treatment.

Wish them luck today, and take a moment to make a donation to Oumar, a 19 month old child whose life is threatened by meningitis and chronic epilepsy. He needs just $1370 to save his life, and 100% of your donation goes directly to his treatment.It’s been 2 years since @chaseadam17 imagined Watsi.org. Today we’re pitching at @ycombinator‘s Demo Day twitter.com/watsi/status/3…

— Watsi (@watsi) March 26, 2013

-

YC Demo Day Winter 2013 Batch – Quick Reference Index

Today is Y Combinator Demo Day, and I’ve compiled a list of Y Combinator startups from the current batch who have officially launched (27 of 47) and ranked them using the same methodology as this month’s YC Index. It is extremely early days for these companies, this can give you a sense of who is getting attention and seeing early growth and we will use this as a benchmark for them in the index going forward. I will update this post as new companies are launched throughout the day.

The companies highlighted in orange would have made it into the top 100 of the Y Combinator Index released for March. All companies will be included in the April index.

I post this with the caveat that web traffic rarely tells the full story for any company. We have done our best to also factor in Facebook monthly active users and mobile app rankings, but for enterprise and developer tools companies the amount of website traffic they receive can be disproportionately low compared to how much money they make.

Update: Now includes PayTango, which launched last night.

Data sources include TechCrunch, Crunchbase, AngelList and YClist.