-

Sulia Now Driving 6-Digit Traffic to Publishers, on Track to Hit 15-20 Million Uniques This Year

Thanks to Facebook, Twitter, and Tumblr, cat photos and rants from angry aunts appear in the same feeds as shared recipes and world news. Sulia is changing that by introducing subject-based “channels†where users can consume media about a single topic like technology, politics, or food. Moving away from a single crowded feed towards multiple focused feeds has the potential to be helpful to readers, publishers, and advertisers alike.

Pronounced “soo-lee-uh,†the company aggregates news in a style similar to Prismatic, but Sulia has significantly more traffic. Sulia reported a user base of 10 million users when it announced a $1.5M Series A in September of 2012 and has since, by our measures, more than doubled their traffic. Sulia’s VP of Editorial & Expert Operations, Josh Young tells me they’re on track to hit 15-20 million uniques by the end of the year.

Young emphasized that Sulia’s burgeoning traffic is now driving significant traffic to publishers – 100k monthly uniques to TMZ, 60k to Huffington Post, and 50k to ESPN to name a few. With distribution power like that, publishers would be wise to turn their attention towards getting their content on Sulia.

Sulia’s experience is comprised of individual subject-based channels, is mostly easy to use aside from an odd absence of headlines. Each channel is an endless scroll of relevant stories from publishers, like those mentioned above, and subject-area experts like Robert Scoble & Kara Swisher in Tech & Science, and Nate Silver & Anderson Cooper in Politics. In our interview this morning, Josh explained their “proprietary expertise indexâ€:

“We index Twitters lists and sort them into subject areas. Then we think of membership in those lists as a “vote†for being interesting or having expertise in that area. For example, someone who is in 4,000 lists has more expertise than someone in 300 lists. This is how we know who the top people in each field are. From there we connect these social profiles with open RSS feeds. We filter the first sentence or so of those feeds to make sure they’re relevant.â€

Twitter lists might seem like an odd place to start on the surface, but Sulia and Twitter lists have been inseparable since their inception. Initially founded in 2009 as TLists, the company helped Twitter build and manage its lists feature prior to Twitter’s redesign in September 2010. After that, the company pivoted to become Sulia.

Aside from Twitter lists, users can influence the content displayed in each channel by clicking the “trust†button on each expert or publisher for given interest channels. The more “trust†experts & publishers accumulate, the more likely the content their is to appear. Through this, Young says Sulia is building the first “trust graph,†their key to breaking through the noise on today’s crowded web. The methodology seems sound, if not at least difficult to “game.â€

Building the Business

15-20 million annual uniques and interest-segmented audiences isn’t just good for publishers though, it’s also good for advertisers. In an interview with Business Insider in November Jonathan Glick, Sulia’s CEO, explicitly stated that the motivation behind organizing content by subjects is to segment audiences for marketers & advertisers. In his words,

“One of the things that’s difficult about organizing content in the way that Twitter, and Tumblr, and Facebook do it today, which is all intermingled without a subject, is that a marketing message thrown into the middle of that feels a little bit like spam…whereas if you’re in the cooking section [of Sulia]…an ad for a new kind of canned soup makes a lot of sense.â€

With the rise of native advertising on sites like BuzzFeed it isn’t surprising that Sulia is experimenting with this format as well. Content from sponsors like Dyn, as seen below, utilize Sulia’s existing layout and story format.

Driving hundreds of thousands of hits to publishers and itself seeing unique visitors in the tens of millions with no plateau in sight, Sulia is on track to become a major player in business of online publishing, and potentially a model for advertising as well. In our interview, Young said their focus in the coming months will be refining and improving their core IP, the “trust graph†in the interest of building a more useful tool for readers, publishers, and advertisers alike.

Screenshots:

-

SpotRight Raises $2.8M for Social Customer Intelligence

According to a regulatory filing Boulder-based startup SpotRight has raised $2,870,889. The company previously raised $1M in funding in July 2012 from Grotech Ventures, Access Venture Partners and FFP Holdings, and also raised a $1.4M Series A from the same investors under its original name Giveo in January 2011.

According to a regulatory filing Boulder-based startup SpotRight has raised $2,870,889. The company previously raised $1M in funding in July 2012 from Grotech Ventures, Access Venture Partners and FFP Holdings, and also raised a $1.4M Series A from the same investors under its original name Giveo in January 2011.SpotRight was originally launched as part of TechStars Boulder in the Summer of 2010 and merged with Spot Influence in July 2012. According to the announcement of the merger:

“As a combined company, SpotRight unveils an unparalleled platform that helps direct response marketers access social data on their customers and act on it to create real business value.”

-

Wiggles of Hope: Yahoo Stock on the Rise, At Highest Point Since May 2008

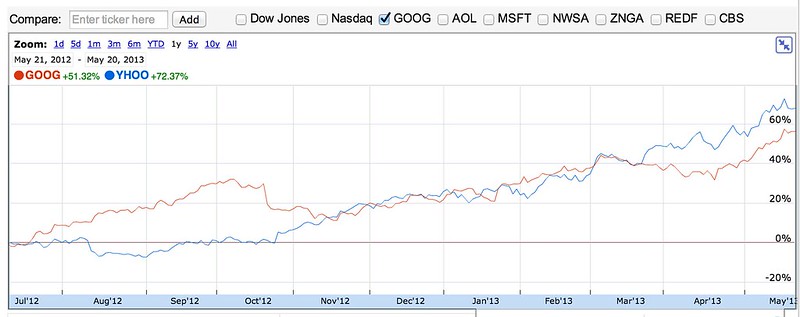

If you invested in Yahoo the day before Marissa Mayer was announced as the new CEO you’re probably pretty happy right now. The price has climbed from $15.36 per share on July 15, 2012 to close at $26.58 today – a 73% gain. For long suffering employees with underwater stock options and shareholders waiting for the price to move this undoubtedly comes as a welcome change.Yahoo’s stock price is now at it’s highest since May 2008 thanks to a steady stream of acquisitions including the purchase of the Tumblr blogging service for $1.1B today, policy changes and other positive PR for the company. While this is still a far cry from the 10 year high in late 2005, or peak price of over $100/share in 2000 prior to the dot-com crash, Mayer has done more to move the needle in her 10 month tenure than the 4 predecessors who came after Jerry Yang’s departure in 2009.

Scroll down to see Yahoo vs. Google stock price growth comparison for the past year.

Google vs. Yahoo Stock Price Growth – 1 Year Comparison

HT: Hacker News, Images via Google Finance

-

Project Decor Raises $5M for Social Home Decorating

In a regulatory filing Project Decor revealed they have raised $5M in venture capital, which includes investment from Launch Capital. The company was founded in September 2011, and previously raised $1.6M in March 2012.

In a regulatory filing Project Decor revealed they have raised $5M in venture capital, which includes investment from Launch Capital. The company was founded in September 2011, and previously raised $1.6M in March 2012.

Project Decor is cofounded by Andy Appelbaum, Cliff Sirlin, and Aaron Wallace. CEO Appelbaum is a well-known New York angel investor and cofounder of online food delivery service Seamless Web, and previously founded several companies alongside Sirlin. Project Decor aims to help people decorate their homes, and is part of a hot space lead by Houzz and Tastemaker. AngelList currently lists 88 home decor startups on their site.

For their part Project Decor seems to be amassing a following, with more than 1,300 likes on their Facebook page and over 2,000 followers on Twitter. For a social shopping service building visibility and a community will be crucial, and we’ve added them to the Startup Index as one to watch.

-

In Race to Be First on Tumblr Acquisition by Yahoo, Wall Street Journal Publishes Questionable Headline

Update, Sunday May 19, 2013 @ 6:21pm: Some readers mentioned that they thought they’d read somewhere that Tumblr’s board had already approved the sale, but with hundreds of Tumblr news stories over the past few days we were struggling to track down a link where that was actually published. Now we have that post. Jeff Bercovici wrote at Forbes yesterday that he independently confirmed “Tumblr’s board, which includes representatives from Union Square Ventures, Spark Capital and Sequoia Capital, has already voted to approve Yahoo’s offer.”

The Wall Street Journal headline this morning reads href=”http://online.wsj.com/article/SB10001424127887324787004578493130789235150.html”>”Yahoo to Buy Tumblr for $1.1 Billion”, but last I checked the purchase of a company requires the consent of both sides. The same story reads:

“It wasn’t immediately clear whether Tumblr’s board had also approved the deal.”

I realize that it is highly likely at this point that Tumblr intended to do this deal (and readers point out they probably already have a letter of intent to be sold), but how can publishing this headline be considered legit without confirmation from a source? Couldn’t this even have a material impact on $YHOO stock price in the morning? Reporting the deal as fact when it is unconfirmed seems wrong… but now even the New Yorks Times is running with the story, so it must be true right?

@daniellemorrill @nickbilton no one is talking (but they are)

— Kara Swisher (@karaswisher) May 19, 2013

I’ll take this to mean they have sources speaking on background but can’t confirm anything. AllThingsD is widely known to always have the inside scoop on what’s going on at Yahoo

Why This Matters

The biggest issue here is that WSJ is a massively reputable news source, and this headline has lead to lazy journalism on the part of many other outlets who appear to have mostly copy/pasted the existing story and conveniently missed the part where Tumblr hasn’t confirmed. The public who aren’t watching closely will simply take these headlines at face value, after all they’re busy and this is all entertainment anyway so who cares if we bend the truth right?

- Geekwire: “Yahoo buying Tumblr for $1.1B”

- AllThingsdD: “Yahoo Tumblrs for Cool: Board Approves $1.1 Billion Deal as Expected”

- SFist: “Yahoo Will Buy ‘Hipster Blogging Platform’ Tumblr For $1.1 Billion”

(the “as expected” was added after the story was published). See Kara’s first tweet with the original headline and then the second tweet with the updated one.

Yahoo Tumblrs for Cool: Board Approves $1.1 Billion Deal dthin.gs/12Mgdc2

— Kara Swisher (@karaswisher) May 19, 2013

Yahoo Tumblrs for Cool: Board Approves $1.1 Billion Deal as Expected dthin.gs/12Mgdc2

— Kara Swisher (@karaswisher) May 19, 2013

Geekwire changed their headline to “buying”, but this tweet captures the original headline:

Report: Yahoo buys Tumblr for $1.1 billion goo.gl/fb/yCM0w

— GeekWire (@geekwire) May 19, 2013

-

The $3B+ Exit Tumblr Could Have Had

It’s all over the news, Yahoo! is in talks to acquire Tumblr. The popular blogging platform, which was founded in New York in 2007, has just a few months of cash left and hasn’t successfully monetized their platform fast enough to cover costs.

It’s all over the news, Yahoo! is in talks to acquire Tumblr. The popular blogging platform, which was founded in New York in 2007, has just a few months of cash left and hasn’t successfully monetized their platform fast enough to cover costs.

To date investors have put $125M into the company, most recently infusing it with $85M more in September 2011 at a valuation of over $800M.

According to Forbes Tumblr is targeting $100M revenue in 2013 but, according to sources I spoke to who are familiar with the company, actual Q1 revenue growth was flat and Tumblr is on track to do only $15M in revenue this year.The company started selling ads in May 2012 and revenue was reported at $13M for the year. Tumblr’s source of advertising revenue is the logged in user “dashboard†where sponsored posts are displayed in the sidebar via Tumblr Radar, while recommended posts are injected directly into the feed by Tumblr Spotlight..

Tumblr claims 120M+ daily impressions on Tumblr Radar, which equals 3.6B+ monthly impressions. Assuming $10 – 20 RPM (revenue per thousand impressions), which is within the normal range for premium brand advertising, the total revenue opportunity for Q1 was $108 – 216M. Based on this calculation, at an annual run rate of $15M ($3.75M quarterly revenue) Tumblr is selling 1-4% of its total monthly inventory. If you think about this operationally it sounds reasonable, as the company is just beginning to ramp its ad sales.This analysis rests on the assumption that Tumblr advertising will command premium brand advertising prices. If not, RPMs in the $3 – $9 would be more realistic and you could reduce all the values in these calculations accordingly.

Tumblr claims 120M+ daily impressions on Tumblr Radar, which equals 3.6B+ monthly impressions. Assuming $10 – 20 RPM (revenue per thousand impressions), which is within the normal range for premium brand advertising, the total revenue opportunity for Q1 was $108 – 216M. Based on this calculation, at an annual run rate of $15M ($3.75M quarterly revenue) Tumblr is selling 1-4% of its total monthly inventory. If you think about this operationally it sounds reasonable, as the company is just beginning to ramp its ad sales.This analysis rests on the assumption that Tumblr advertising will command premium brand advertising prices. If not, RPMs in the $3 – $9 would be more realistic and you could reduce all the values in these calculations accordingly.Tumblr may also be enticing early advertisers by selling inventory for a fraction of the price it eventually hopes to charge. At $1 RPM $3.75M in revenue would have paid for 30% of the available impressions, and in order to sell 100% of its inventory in Q1 Tumblr’s average RPM would have had to drop to $0.35. Compared to Reddit advertising, which offers $0.75 CPM, and sub-$1 rates for Tumblr CPMs sound plausible.

Red Flags

There were signals of a possible revenue ramp miss in the first quarter of 2013 with the resignation of Rick Webb, who was brought on board just 10 months earlier to focus on revenue growth and work closely with Tumblr CEO David Karp. He is the latest in a string of senior executive departures characterized by Beta Beat as a “leadership vaccuumâ€.

There were signals of a possible revenue ramp miss in the first quarter of 2013 with the resignation of Rick Webb, who was brought on board just 10 months earlier to focus on revenue growth and work closely with Tumblr CEO David Karp. He is the latest in a string of senior executive departures characterized by Beta Beat as a “leadership vaccuumâ€.The shutdown of Tumblr Storyboard in early April was another worrying signal. The project was touted as a “journalism experiment†but was more likely an experiment in figuring out how to work with brands to create effective content marketing on Tumblr’s advertising platform. The production value of the content and high profile editorial team likely cost the company millions but ultimately it “didn’t work†according to Karp.

The Initial Offer

The initial offer from Yahoo! is $1.1B in cash, but according to TechCrunch it may not be accepted:

“Tumblr employees feel that Yahoo’s $1.1 billion offer is “too low†and view it as “only a first offer,†according to sources close to acquisition talks.” – TechCrunch

Employees’ opinions aside, the lack of cash on hand and lack of trust in leadership to hit revenue milestones are likely having a negative impact on Tumblr’s negotiating position, which is probably contributing to what some consider a “lowball” offer.

When it comes to setting the price, rumors that and Facebook and Microsoft are waiting in the wings to make an offer could produce a competitive bidding situation that will make up for the valuation gap left behind by questionable business results.Setting the Purchase Price

In an acquisition the purchase the price is usually set as a multiple of existing revenue or expected near-term revenue. For media companies a 10x multiple on revenue is quite steep Edit: but does happen (AOL paid $315M for Huffington Post, which exited with $30M in revenue), and with only $15M of revenue in 2013 that would put a Tumblr acquisition price tag at just $150M.

In an acquisition the purchase the price is usually set as a multiple of existing revenue or expected near-term revenue. For media companies a 10x multiple on revenue is quite steep Edit: but does happen (AOL paid $315M for Huffington Post, which exited with $30M in revenue), and with only $15M of revenue in 2013 that would put a Tumblr acquisition price tag at just $150M. My first reaction was that Yahoo! or whoever else was involved in the acquisition talks was about to massively over pay. But Yahoo! isn’t stupid, so what’s going on here? Clearly this is about expected value, not actual revenue. If Tumblr were to hit their own stated $100M revenue target a 10x outcome would be $1B – but employees are saying this is a lowball offer. Why?

Looking at our numbers from earlier, at $10 – 20 RPM and 3.6B dashboard impressions a month (and growing) the annual revenue potential for Tumblr ranges $432M – $1.44B.

Viewing the $1.1B offer from Yahoo! through this lense, it is 2.5 multiple of the low end of the expected revenue range. An acquisition at the high end of the range with a 2.5x multiplier would be $3.6B, and realistically if the company was crushing it on ad sales the multiple could be even higher.Why sell a company with such a substantial revenue opportunity on the low end of the range?

Pencils Down, Time’s Up

While employees hold onto the hope that the company will be valued on it’s ability to drive billions in revenue, the reality is that Tumblr didn’t pull it off in time. The vast majority of that potential was not realized in time.

While employees hold onto the hope that the company will be valued on it’s ability to drive billions in revenue, the reality is that Tumblr didn’t pull it off in time. The vast majority of that potential was not realized in time.It wouldn’t be a problem that Tumblr is lagging in revenue production if the board felt the odds of the company capturing this expected value were good, and that was probably the thinking when they invested $85M in 2011.

Two years later it looks like the CEO who famously quipped to the L.A. Times “we’re pretty opposed to advertising, it really turns our stomachs” may have hesitated to monetize too long, and investor patience seems to have run out.The path to keep the company independent would probably involve finding a replacement CEO, or at the very least hiring a COO to be Tumblr’s own version of Sheryl Sandberg and drive the company aggressively toward revenue. It would also mean raising a boatload more cash at significant dilution to everyone involved, cutting expenses, and buckling down to operate like a serious business generating meaningful ad sales revenues in the next 18 months.

Outcomes

In choosing to sell the company and hand Tumblr over to a professional management team with a track record for monetization through media properties, the board is implying that they do not feel putting more money into the company would enable the management team to achieve a better outcome in a reasonable amount of time. Investors who participated at the $800M valuation are probably welcoming the prospect of a $1.1B exit in cash – assuming some liquidation preferences were put in place they’ll get their customary 2x-3x late stage return, and the deal won’t negatively impact their respective fund’s overall IRR.

Selling now may also allow David Karp to remain in a leadership position at Yahoo! where he can continue his work to revolutionize advertising – maybe even leading Yahoo! to a more competitive position vs. Google for brand advertising and giving them a reason to drop the underperforming partnership with Microsoft in the long term. And if things don’t work out with Karp Yahoo! doesn’t seem to have any problem firing acquired founders who no longer fit with the company’s plans.

In the end Tumblr won’t see a bigger exit because they didn’t prove they could monetize their massive traffic before time (and money) ran out.

This article was quoted in: New York Post, Valleywag, and Mashable

-

FrogDice, Whoozat, Skyword, AbilTo, Privlo, EnglishHelper, Variable Technologies & Intradiem Raise New Funding

Every day dozens of companies file their funding rounds with the SEC, but often these stories go uncovered by the mainstream tech press until they receive a pitch. These filings are public, and often quite interesting if you’re willing to dig into the names of the directors to see what’s cooking. Many of these companies are based outside of Silicon Valley and don’t build consumer tech – placing it outside of the editorial focus of many tech publications.Check out the companies whose funding has come across the wire so far today:

Kentucky-Based Frogdice Games Raises $576K for Online RPGS, Virtual Worlds, and Casual Games [Source: SEC Filing] The company has been around since 1996, and is lead by Michael Hartman. Titles include Coin ‘n Carry, Threshold RPG, Primordiax, Tower of Elements, and Dungeon of Elements. Investors in the round were not disclosed.

Kentucky-Based Frogdice Games Raises $576K for Online RPGS, Virtual Worlds, and Casual Games [Source: SEC Filing] The company has been around since 1996, and is lead by Michael Hartman. Titles include Coin ‘n Carry, Threshold RPG, Primordiax, Tower of Elements, and Dungeon of Elements. Investors in the round were not disclosed. Chicago-Based Whoozat Raises $750K to Connect Social Affinity Groups. [Source: SEC Filing] The company is founded by Curt Conklin and investors in this round include Brill Street + Co founder Nancy Lerner Frej and former Ameritrade COO and Nebraska Senate nominee Peter Ricketts. The website currently says coming soon Summer 2013.

Chicago-Based Whoozat Raises $750K to Connect Social Affinity Groups. [Source: SEC Filing] The company is founded by Curt Conklin and investors in this round include Brill Street + Co founder Nancy Lerner Frej and former Ameritrade COO and Nebraska Senate nominee Peter Ricketts. The website currently says coming soon Summer 2013. Skyword Raises $6.7M in Venture Funding. [Source: SEC Filing]

Skyword Raises $6.7M in Venture Funding. [Source: SEC Filing]

Skyword was formerly Gather.com (their site now times out and Twitter account has been deleted), which raised over $27M from 2004 to 2010, and the core leadership team remains the same. Between the two companies they have taken over $40M in investment. AbilTo Raises $1.5M from Liam Donohue at 406 Ventures to Build Behavioral Health Programs for Adults Making Life Transitions. [Source: SEC Filing] The company is based in New York and founded by Michael Laskoff. The company announced a $3M Series A earlier this week lead by 406 Ventures, and the $1.5M in this filing is their portion of the capital committed.

AbilTo Raises $1.5M from Liam Donohue at 406 Ventures to Build Behavioral Health Programs for Adults Making Life Transitions. [Source: SEC Filing] The company is based in New York and founded by Michael Laskoff. The company announced a $3M Series A earlier this week lead by 406 Ventures, and the $1.5M in this filing is their portion of the capital committed. Privlo, the Public Marketplace for Real Estate Loans, Raises $2.1M from QED Investors. [Source: SEC Filing]

Privlo, the Public Marketplace for Real Estate Loans, Raises $2.1M from QED Investors. [Source: SEC Filing] English Helper Raises $750K More in Seed Funding, Bringing Total Funding to $1.3M for the Language Learning Startup. [Source: SEC Filing]

English Helper Raises $750K More in Seed Funding, Bringing Total Funding to $1.3M for the Language Learning Startup. [Source: SEC Filing] Variable Technologies, Creators of the Node Sensor Platform, Raised $2M. [Source: SEC Filing] To learn more check out this article in BusinessWeek, explaining how George Yu is building a sensor to measure anything.

Variable Technologies, Creators of the Node Sensor Platform, Raised $2M. [Source: SEC Filing] To learn more check out this article in BusinessWeek, explaining how George Yu is building a sensor to measure anything. -

Past Performance is No Guarantee of Future Results

Past performance does not guarantee future results for startups, venture capitalists, accelerator programs, the media, individual founders, or any other part of the startup ecosystem. On the mission to see into the future, there is a tendency to over value the information and lessons of the past. With 20/20 hindsight it seems obvious that things would turn out the way they have. Cell phones? Computers? “If I had been alive back in the 1950s I so would have called that,” you say. Television? Telephone? Automobiles? “Obviously I would have been first in line to get mine!”

On the mission to see into the future, there is a tendency to over value the information and lessons of the past. With 20/20 hindsight it seems obvious that things would turn out the way they have. Cell phones? Computers? “If I had been alive back in the 1950s I so would have called that,” you say. Television? Telephone? Automobiles? “Obviously I would have been first in line to get mine!”

But would you have? Really? Massive changes in how we build things, operate our companies and think about technology have often taken place gradually, and met plenty of resistance along the way. Even visionaries miss great things all the time, just look at the Bessemer Venture Partners anti-portfolio, read Dustin Curtis’ “What a Stupid Idea” reflecting on early looks at Pinterest and Vine, or the long list of VCs who didn’t invest in Facebook early on but then made a late stage play to add the Facebook logo in their portfolio.

Echoes From the Past

Limited partners (LPs) complain that their venture capital investments haven’t had returns that were as good as in the 90s. Venture capitalists complain that companies founded today aren’t as innovative as they used to be or that valuations are higher than they used to be. And the press? Writers who have never been anything remotely close to entrepreneurs will continue to bitch about everything.

“Company ABC would never do that” – says who, Company ABC is like 4 years old? “I’m not a sales guy” – you’re a 22 year old computer science graduate, you’re not really anything yet! “Startups who tried that in the 90s totally bombed” – yeah well it is 2013 now, might be time for another go. “I wish we could invest, but founders who fit our profile have computer science degrees” – your profile is 20 years old, the Internet has gotten a lot more programmable since you were in school.

Fighting for the Future

Listening to these complaints and excuses for not doing something (e.g. changing strategy, trying sales, trying a model that previously failed, investing despite lack of founder credentials) is like hearing parents complain that the kids’ music is too loud, and rock was so much better in their day. And the worst part is that they try to dress all this up as some version of “pattern matching”, which is the one of those terms you can throw out to make people nod and stop arguing with you. One of these days I’d like to jump up from the boardroom table and shout, “screw your pattern matching, I saw the results and I don’t believe you!” just to see what happens.

Boardroom fantasies aside, people who are really great at pattern matching don’t get distracted by inessential details like what founders are wearing on 2nd street this week, what kind of parties they throw, the alma mater of the software engineering team, what Dave McClure said at a conference, or even whether the company is raising at a $5M or $12M pre-money valuation out of Y Combinator this batch. These are things that might matter for a moment in time, but quickly fade into the past. What matters most is trying to understand how a combination of past knowledge combined with present action will ultimately generate a favorable result.

Fight for the future, or get out of the way.

P.S. I’m not claiming I am some great visionary, but I’ve been placing some bets so we’ll see in 10 years or so.

Image credit: Bioepherma

-

New 500 Startups Batch Announced. Who Has the Most Momentum?

500 Startups announced the non-stealth participants in their current batch today in a TechCrunch article, and while they’ve kindly put them in alphabetical order… you probably know by now that’s not how I roll.

500 Startups announced the non-stealth participants in their current batch today in a TechCrunch article, and while they’ve kindly put them in alphabetical order… you probably know by now that’s not how I roll.I’ve been tracking many of these companies for awhile now and will certainly start tracking those I missed. It will be interesting to see how this rank and momentum scores at the beginning of the program compare to the end of the program.

Are you a future investor, employee or customer for these companies? Get on it.

My advise to the startups looking to increase their score? Every day we hustlin’ #500strong

Full Disclosure: I am a 500 Startups mentor. I haven’t written a full ethics statement for this blog but this is my rule of thumb: no free equity/options. I make investments from time to time, you can see them on my AngelList profile.

-

New York Startup Index: 500+ Companies Ranked by Momentum

This is the Startup Index series, an ongoing effort to measure the momentum of startup companies using external signals. It is calculated based on weighted factors such as web traffic, social media share of voice, inbound links, etc. I usually add some music, to make cruising a spreadsheet a little more fun. Enjoy!

The Startup Index is inspired by the Seattle 2.0 Index, which Marcelo Calbucci produced each month to create a leaderboard for local startups and it is now the basis for the Geekwire 200 in Seattle. But why stop at Seattle? There are many so many startup communities around the world, and today I’ve applied our algorithm to 533 startups from New York that we’re currently tracking. Check them out, see who’s on top and how they’ve been trending this past week, and as always let me know if there are companies I’ve missed and I’ll get them added.